Income Protection for Accountants

Ah, accountants, the sort you wouldn’t want to corner you at a party because, well, yawn.

All those debits and credits swimming around your brain have replaced the chit-chat leaving only tax rebates and allowable income small talk, right?

You know I’m only messin!

After all, I peddle life insurance for a living, so accountancy is a relative blast. I make you look like a veritable rock star at a party.

We have loads of accountants as clients and they’re sound as a pound.

Accountants, I tip my hat to you, you wonderful bunch of money savers.

Without you, I’d be slogging away come tax season, holed up in my cave, throwing papers around like a loon.

From what I’ve heard, you, accountants, are a respected bunch and earn a pretty penny to boot.

But what, if you found yourself unable to work for some ungodly reason and that money dried up?

Maybe you’ve fallen sick, knackered your back from years of stooping over a desk, or encountered too many clients (like me) who have stressed you to the eyeballs.

Surely something out there can help with a little bit of income continuance when you’re off sick?

That’s where our superhero comes in to save the day.

Duh, duh, duh, duh. (That’s my superhero entrance theme tune if you hadn’t worked it out).

What is Salary Protection For Accountants?

Like the rest of us, you have financial obligations – mortgage, life insurance, rent, utility bills. Need I go on?

But your life can instantly go from rolling in the dough to pinching the pennies. Unfortunately, you won’t see it coming until you’re on your back, bleeding your savings like a stuck pig.

I know you’re a money-savvy individual. I mean, you’re an accountant. Money is your job, so you probably have ample rainy day funds.

However, I’d like you to flip this on its head and turn that rainy day fund into a sunshine fund.

I’m dreaming of margaritas on a beach in Barbados.

Divert some of those monthly savings into an income protection policy to insure against the rainy days that may lie ahead.

Let’s say you earn €100k (fair play, those years of slogging through the ACCA were worth it) but you fall ill and can’t do a tap for three years. That could leave a massive hole in your savings fund or completely empty it.

On the other hand, your income protection will keep chugging out a replacement income until you get back to work. Think of it as a neverending savings fund. And you won’t even have to pay for it! As soon as you claim, the insurer will suspend your premiums.

Lookit, I’m an insurance guy, it’s my duty to advise you on all sorts of insurance, but income protection is the one I hang my hat on.

Think of it as your big brother.

Paying for it will piss you off. At times, you’ll think it’s not worth the hassle, but income protection will stand up and protect you when you need it most, just like your big bro.

Why Do Accountants Need Income Protection?

If I haven’t made you think that protecting your regular income is beyond important, that’s cool.

Some people are risk-takers, and some aren’t. You obviously fall into the former category, ya mad yoke. Click away now!

But, if you’re still reading, I take it you are somewhat interested.

Let’s crack on.

From personal experience dealing with income protection claims, I know the future is a fickle beast.

It couldn’t give two shits what you think or what you want. If it decides to throw a cancer bomb in your path when you least expect it, what can you do only be ready?

When clients contact me to make an income protection claim, the first thing they says is, “I never thought it would happen to me.”Quickly followed by “thank God, Vishnu, Shiva, Allah and Odin that I have income protection!”

What does Income/Salary Protection Do?

Salary protection will provide you and your family with a replacement income if you can’t work due to illness, injury or disability.

Unlike serious illness cover, salary protection even pays out if you can’t work due to musculoskeletal (back, hip, neck, knee, ligaments etc.) or mental health issues (stress, anxiety, depression)

Even you brave self-employed accounting folk can join the party. In fairness, you need it more than accountants who work in the private sector, considering you have no employer to pay you extended holiday pay or whatnot. And if you pay Class S PRSI, you won’t even get state illness benefit, so your income will drop to a big fat ZERO as soon as you can’t work.

If you’re already living paycheque to paycheque, what would happen if that sweet income stream stopped because you couldn’t work?

How Much Long Term Disability Cover for Accountants Cost?

Ah, I couldn’t possibly tell you that.

No, really, I’d need more info to get you the best possible deal for your income protection.

Complete this income protection questionnaire, and I’ll be back in a jiffy with options to suit your budget.

Or a quick call, a couple of q’s, and we’ll be well on our way.

As an accountant looking for income protection, you’re already in a rather enviable position.

One major factor affecting the cost of income protection is what ‘class’ your particular occupation falls into.

Starting with the lowest risk of Class 1, right through to Class 4 for your higher-risk jobs.

And accountants fall smack bang into that rather juicy class 1, so that’s a good start.

Another way to control the cost of your salary protection premium is with the deferral period.

Deferral periods are the weeks between being out of work and when your income protection kicks into action.

Most insurers offer 4, 8, 13, 26, or 52-week periods.

So, you’ll pay more for your salary protection policy to kick in after just four weeks of being out of work and far less if you’re happy to wait a year for your policy to start paying out.

It’s all starting to sound pretty good, am I right?

You’re still wondering about the cost, aren’t you? Oh, you accountants and your lust for numbers, OK, here’s an indicative quote for you:

Quote Type: Income Protection

First Person: Non-Smoker, born on 09/03/1982

Cover Amount: €50,000 per year until age 65.

Occupation Class: Accountant (Class 1)

Deferred Period: 26 weeks

Monthly premium: €99

After tax relief: €59

€60 per month nett to insure €50,000 income per year. Not bad numbers.

Tax relief, eh??

I thought that would intrigue you.

Yep, you can claim tax relief on your income protection premiums at your marginal rate or if your company pays your premium, it can claim tax relief and there is no BIK for you.

Over to you

The above was a simplified explanation of income protection for accountants; too much jargon can become very boring, quickly.

Here’s our in-depth FAQ.

If you are serious, you should get in touch if you’re ready to future proof your lifestyle.

Why?

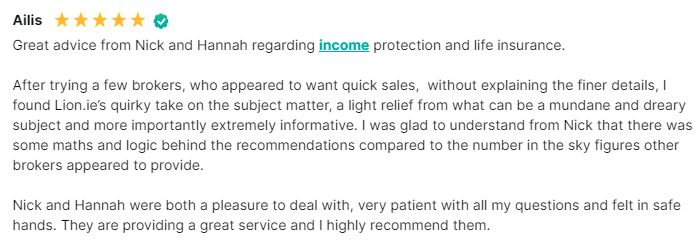

Well, we’re the best.

That’s not big-headed of me, just the truth.

We’re protection experts; I know this stuff inside out. We’re not a jack of all trades “financial advisor”, so we won’t try to hawk a pension, mortgage, or some hare-brained investment.

Protection is all we do.

If you’d like our help, we can walk this yellow brick road hand in hand like some beautiful version of Dorothy and the Scarecrow.

We’ll even let you be Dorothy.

Talk soon

Nick

PS: Here’s our income protection questionnaire again for a no-obligation recommendation and quotes.