In An Era Of Premium And Provider Price Increases, State Employee Health Plans Target Key Cost Drivers

By Sabrina Corlette and Karen Davenport

After several years of below-average increases, premiums in employer-sponsored health insurance are poised for rate hikes this year. With this open enrollment season, workers will soon know what premium increases mean for their take-home pay and out-of-pocket costs, as at least some employers pass increased costs on to their employees.

There are more than 15 million state and local government employees—those who work for state executive, judicial, or legislative branch agencies, school districts, public universities and hospitals, or local municipalities—and they too will feel the pinch of increased health care costs. Yet, in many ways, the agencies that purchase health insurance for these public employees are uniquely situated to tackle rising health care costs. They are often the largest commercial purchaser of health care services in their state and therefore have market power to exert pressure on insurance companies and providers. Furthermore, given their size, their efforts to shift health plan and provider behaviors and encourage greater efficiencies can have ripple effects for other commercial purchasers. For these reasons, many state lawmakers have seen these health plans as a testing ground for health policy innovations. The Center on Health Insurance Reforms’ (CHIR’s) recent survey of state employee health plans (SEHPs) probed the key challenges facing these major health care purchasers and identified promising cost-control strategies.

Prices Represent Primary SEHP Cost Drivers

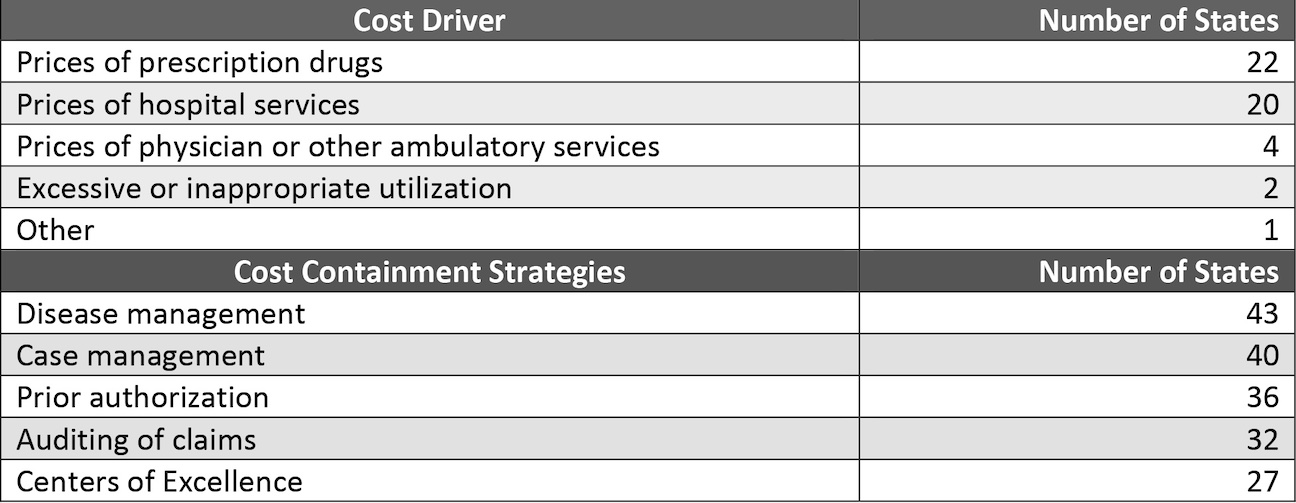

In the CHIR’s 2023 survey, SEHP administrators identified prescription drug prices and prices for hospital services as the primary drivers of cost growth. This finding is consistent with other surveys of private-sector employers. Only a few SEHP administrators cited other factors, such as excessive or inappropriate use of health care services (exhibit 1). Yet, when it comes to their cost-containment strategies, most SEHPs prioritize curbs on enrollee use over controls on price growth. This is likely because strategies that target provider prices can elicit resistance from both providers and plan enrollees and can be administratively challenging to implement—both sources of “friction” that plan administrators seek to minimize. This friction may help explain why, when asked to identify cost-control initiatives they have implemented over the past five years, SEHPs commonly reported new disease management and case management programs and prior authorization requirements. These approaches can mean employees with chronic conditions or acute health care needs pay more out of pocket or are denied coverage for appropriate care.

Exhibit 1: Single highest cost driver identified in 2022 and top five cost-containment strategies implemented over the past five years

Source: Authors’ analysis of survey responses from 50 state employee health plan administrators. Notes: Forty-eight states responded to the question about cost drivers. Forty-six states responded to the question on cost containment strategies, and states could identify multiple initiatives.

Source: Authors’ analysis of survey responses from 50 state employee health plan administrators. Notes: Forty-eight states responded to the question about cost drivers. Forty-six states responded to the question on cost containment strategies, and states could identify multiple initiatives.

Promising Strategies: Reference Pricing, Tiered Network Plans, And Multipayer Purchasing Initiatives

While the majority of specific SEHP cost-control strategies in our survey focused on reducing use of health care services, roughly half the states also indicated that they have taken some steps to reduce hospital and ambulatory services prices. And although no single strategy targeting these cost drivers emerged as a clear favorite in our survey, follow-up interviews with SEHP administrators surfaced promising results for reference pricing, tiered network plans, and multipayer purchasing initiatives.

Reference Pricing

Nine states in our survey reported pegging provider payments to a reference price, such as a percentage of Medicare’s payment for a specific service. Such programs have garnered attention from policy makers since the Montana SEHP’s reference pricing initiative saved the state $47.8 million in hospital costs between state fiscal years 2017 and 2019. More recently, an audit of 2021 claims data for the Oregon state health plan’s program revealed that the state had saved more than $112.7 million, more than initially projected.

In interviews, two SEHP administrators with similar reference pricing programs reported realizing significant savings with this easy-to-implement approach. “We manage to save about $40 million per year,” noted an administrator in a state that sets its prices based on Medicare rates. The administrator also reflected that although their reimbursement levels are not as high as other commercial payers, they enjoy high provider participation—99.3 percent of hospitals and 80.0 percent of physicians in the state participate in their network—which they attribute to the plan’s significant size and market presence.

Tiered Network Plans

Tiered network plans represent another popular cost-control strategy, with 14 SEHPs in the survey reporting that they offer a tiered network option to their employees. Research on the cost impact of tiered networks in private health insurance plans suggests that the use of such networks can result in modest but meaningful reductions in spending. For example, one analysis found that total spending per member per quarter for enrollees in a tiered network plan fell by 5 percent.

In these arrangements, the health plan divides providers into tiers based on their performance against quality measures and spending targets; employees pay lower cost sharing to see providers in the top performance tier. SEHP administrators appreciate the lower costs—about 8 percent, according to one state—that tiered network plans offer compared to a traditional broad and undifferentiated provider network. In interviews, administrators also noted that plan enrollees accept tiered cost sharing more readily than a narrow network that excludes high-price, but popular, health systems.

Multipayer Initiatives

When health care purchasers and payers collaborate and align their purchasing strategies, it can help overcome a market dynamic in which consolidated, “must-have” provider systems demand ever-higher prices for their services. In our survey, only five states reported that they are collaborating with another purchaser on cost-containment initiatives. California, New Mexico, and Washington State have coordinated with another public purchaser, such as Medicaid or the state-based Marketplace, while Colorado and Maine have worked with private-sector purchasers. Specific examples include a SEHP working on common standards for health plan performance with the Marketplace and Medicaid agencies, another SEHP working across payers to develop a new delivery model for rural hospitals in the state, and a third SEHP that hopes to leverage multipurchaser alignment in price negotiations with large hospital systems. “If all three agencies are working together on the same things, we’re going to have an enormous impact,” predicted the SEHP administrator working on common plan performance standards. This administrator further observed that their efforts to align across programs ease providers’ administrative and reporting burdens.

Takeaway

The growth in average family premiums in employer-sponsored insurance has steadily outpaced inflation and workers’ earnings. Family premiums are now almost $24,000 per year. Many employers have tried to shift more of these costs onto workers and their families through higher deductibles, with the result that 43 percent of people with employer-sponsored coverage say it is very or somewhat difficult to afford their health care, and more than one-third of them struggle with medical debt. At the same time, many US employers recognize that health care is an employee benefit critical to recruiting and retaining a skilled and productive workforce. Standing alone, however, most lack the capacity and size to demand the payment and system changes necessary to check the growth in health care costs. State employee health plans, however, often have significant market power, if they choose to use it.

Our survey finds that, while many SEHPs continue to focus on reducing health care use, a number of SEHP administrators are demonstrating that it is possible to design and implement strategies that reduce provider price inflation while also minimizing pushback from important internal and external stakeholders. To the extent that some of these strategies change provider behavior or engage other health care purchasers, improvements in quality or cost savings can have ripple effects across the market for commercial insurance. As these efforts garner more experience and data, other SEHPs, as well as private-sector purchasers and policy makers, can learn, and potentially benefit from, these initiatives.

This post is part of the ongoing Health Affairs Forefront series, Provider Prices in the Commercial Sector, supported by Arnold Ventures.

Sabrina Corlette and Karen Davenport, “In An Era Of Premium And Provider Price Increases, State Employee Health Plans Target Key Cost Drivers,” Health Affairs Forefront, November 16, 2023, https://www.healthaffairs.org/content/forefront/era-premium-and-provider-price-increases-state-employee-health-plans-target-key-cost. Copyright © 2023 Health Affairs by Project HOPE – The People-to-People Health Foundation, Inc.