Immigrating to Australia to Join the Now 24 Million other Aussies

Russell Cain Updated: 28 January 2020

After years of arriving early to work and staying late, youâve finally been promoted. Your new position allows you more freedom, creativity and the opportunity to travel. Youâre immigrating to one of the best countries in the world, Australia.

Because of its high quality of life, Australia has been ranked the second-best country in the world to live in. According to OECD Better Living Index, Australia ranks tops in environmental quality, health status, housing, personal security, jobs and earnings, education and skills.

If youâre moving to Australia temporarily or permanently, then you should read this article and educate yourself on the type of life insurance cover options available for your consideration. The following article focuses on helping non-Australian citizens find affordable life and/or income protection insurance.

Australia Passed the 24 Million Population Mark in February 2016

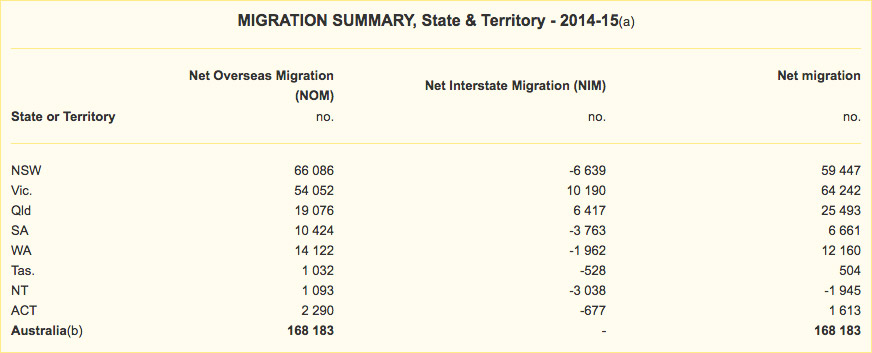

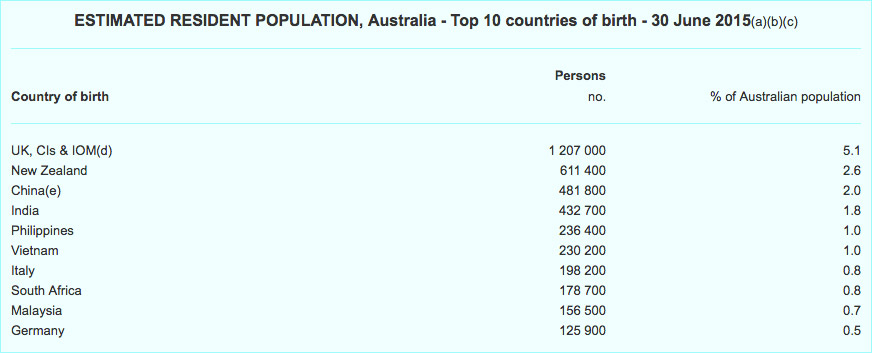

At 30 June 2015, 28.2% of Australiaâs estimated resident population (ERP) was born overseas, thatâs a staggering 6.7 million people. The latest figures from Net Overseas Migration (NOM), reveal a whopping 168,200 people were gained within 2014-2015 period alone.

Images Source: abs.gov.au

Images Source: abs.gov.au Images Source: abs.gov.au

Images Source: abs.gov.au

The life expectancy of people living in Australia is 82 years old, two years higher than the OECD average of 80 years. Compared to the above immigrant population, Australia has by far the highest life expectancy.

Chinaâs average life expectancy is 75 years, Vietnam 73 years, India 68 years and South Africa average life expectancy is a mere 62 years. No wonder Australian insurers are concerned youâre not taking out insurance in their country, to then move back to your country of origin, which often has a much lower life expectancy.

Life Insurance for new immigrants (Non Australian Citizens)in Australia

As shown below, there are many individuals living in Australia, who aren’t Australian citizens. People who recently moved or are planning on moving to Australia can benefit from reading this article.

Images Source: abs.gov.au

Images Source: abs.gov.au

When moving to Australia your exiting policy may require some supplemental coverage. Depending on the terms and conditions of your existing insurance policy your will find most will allow you to continue your cover. However may not or may not now provide the level or type of cover your family will need in Australia .

In cases where youâre not covered overseas by your existing plan, we suggest contacting an Australian insurance specialist, such as Life Insurance Direct.

We understand that there can be a number of uncertainties when you are weighing up the pros and cons of taking out cover through and Australian insurer vs retaining your existing coverage. There are a number of considerations such as, costs, coverage and /or you may have a whole of life or endowment style policy from your country of origin which may be worth retaining. It’s understandable that you might be feeling a little overwhelmed at this point and we are here to help while we havenât answered all questions we get here is a some information below to guide you in finding affordable life and/or income protection insurance in Australia.

Different Visa Types and Their Insurance Eligibility

You are strongly advised to take out appropriate to cover yourself in Australia as the financial impacts of being prematurely passing away, becoming disabled, suffering from a significant sickness or accident can have a major impact on your familyâs financial well-being.

Depending on what visa you hold, youâll have different insurance options available to you in Australia.

Generally, anyone holding a permanent residence visa will find it much easier to obtain cover, and receive similar benefits to an Australian citizen, than a non-citizen on a temporary visa.

However, it important to know that most people are granted a type of temporary visa first, then while in Australia they apply for their permanent residency (PR) visa, after which they become a citizen, if the PR was accepted.

A temporary visa permits you to travel to Australia and remain until a specified period of time. You must then either depart Australia before your temporary visa expires or apply for another visa. You can apply for permanent residency through two main pathways:

1. Family migration stream:

The partner visa is most common in this stream. This is where you are in a genuine and continuing relationship with an Australian citizen or Australian permanent resident.

2. Skilled migration stream:

You need to have relevant qualification, work experience and skills that Australia is in demand for.

There are currently over 150 different Australian visas, both temporary and permanent. If youâre unsure about which visa type to apply for, visit the Department of Immigration website for assistance.

Below is a list of visas accepted by most Australian life insurance companies.

Please note that this list is by no means comprehensive, and may vary depending your personal circumstance therefore itâs advisable that you contact an insurance specialist for help.

Work Visas

132 Australia business talent visa

186 Regional sponsor visa

189 Skilled independent visa

190 Skilled nomination visa

887 Skilled regional visa Australia

890 Business owner visa

891 Investor visa

892 State/Territory sponsored visa

893 Australia State/Territory sponsored investor

Migrant Visas

100 Australia partner visa

101 Australia Child visa

102 Australia Adoption visa

103 Australia Parent visa

114 Australia aged dependent relative

115 Australia carer visa

116 Australia orphan relative visa

117 Australia contributory parent visa

143 Australia partner visa

801 Australia child visa

802 Australia aged parent visa

804 Australia aged dependent visa

814 Australia interdependency visa

835 Australia remaining relative visa

836 Australia carer visa

837 Australia orphan relative visa

838 Australia aged dependent relative visa

864 Contributory aged parent visa

Other Visas

Here is the list of visas types that new immigrants to Australia may find it difficult to find cover for, however always best to check with the insurer and include

405 Investor retirement visa

400 Temporary work short stay

401 Temporary work long stay

403 Temporary work international relations

476 Australia skilled recognised graduate visa

485 Australia skilled graduate visa

402 Training and research visa

405 Investor retirement visa

410 Retirement visa

416 Special program visa for the seasonal worker

417 Working holiday visa

420 Entertainment visa

462 Australia work and holiday âtemporary visa

601 Electronic travel authority

601 Electronic travel authority

602 Medical treatment visa

651 eVisitor

Reviewing Your Existing Policy

Depending on your visa, you might want to take out additional or new insurance cover for you and your family. But before you do that, make arrangements to review your current coverage.

If you decide to keep your current policy, take copies of all your documentation with you. If you have then decided you need additional protection or want to replace this policy then you need to know the following.

Key Things An Underwriter Want to Know if Youâre Planning to Stay in Australia

Itâs a good idea to bring copies of any past medical records for you and your family with you when you move to Australia. If you have children, bring their immunisation records as well, these are needed by schools and child care centres.

When applying for a life insurance policy from an Australian insurer, a typical questionnaire will include questions about your immigration status. Youâll need to confirm if youâre an Australian citizen or have an Australian Permanent Residentâs visa.

If you recently moved to Australia and are applying for insurance cover, youâll need to have the following information ready:

The amount of time (years and months) youâve lived in Australia. Your future plans for obtaining permanent residency and when this would likely be granted. The type of visa you have and when it expires. The country you were born in. Your nationality and in which other countries you have residency/citizenship rights in.

Most insurers want to know of your travel plans for the next 12 months, so as to ensure you intend to stay in Australia. Be clear about your travel plans:

Clearly advise where youâll be travelling to. The date of your departure and the frequency of which you intend to travel. The duration and purpose of each trip must be clearly stated within your application. Is it for business or personal reasons? You must indicate if you intent to move overseas, even if just temporarily, and where you plan on living.

Itâs important that you fully disclose all your relevant above migration information in your application and any of the other standard question underwriters will want to know with include your:

Age and genderHeight and weightMedical history: Send copiesFamily medical historySmoking and drinking statusOccupationFinancial information, including your annual income and net worthDangerous hobbies

Beware of Exclusions on Your Insurance

An exclusion is a policy provision that eliminates coverage to specific conditions, circumstances or situations. While certain exclusions can be unavoidable it is always best to ensure that any exclusions are fully understood and where possible kept to a minimum as if an excluded event were to occur while your policy was in place your loved ones will NOT receive the monetary benefit you were covered for and example of this may be:

A territorial exclusion may be put onto the policy if you are deemed a âhigher riskâ, because insurers are concerned you might move back or onto higher risk counties where there is a higher risk or war or terror attacks, or it may be difficult for insurers to translate/validate your medical records, or the country you’re intending to travel to does not have adequate health care.

Common Exclusions we see on policies for people who have recently immigrated to Australia on temporary or permanent visas, it is important to note that exclusions are generally reviewable (if the life insured circumstance has changed to now be a ânormalâ âlessorâ risk than originally assessed. Please note underwriting is subject to each individual applicant, and this is not an extensive list but some of the commonly used territorial exclusions:

Used for permanent residents who are either working or intend to take an extended holiday (greater than 3 months) in countries such as Canada, US, UK, which have good health care facilities.

Type of Cover: Income Protection

After three monthly benefit amounts have been paid, the insurer shall not be liable to make payments under this cover in respect of any period during which the life insured is travelling or residing outside of the territorial boundaries of Australia or New Zealand.

Used for permanent residents who are either working or intend to take an extended holiday (greater than 3 months) overseas in countries in which it may be difficult to manage a claim due to limited health care facilities, language barrier.

Type of Cover: Income Protection / Total and Permanent Disablement Cover

No claim shall be payable under [the Income Protection / Total and Permanent disablement benefit] where any claim arises whilst the life insured is overseas, until such time as the life insured returns to within the territorial boundaries of Australia or New Zealand.

Used for immigrants who are on temporary residents of Australia but have or intend to apply for permanent residency and meet the criteria for acceptance.

Cover Type: Income Protection / Total and Permanent Disablement Cover

No claim shall be payable under this policy where the claim directly or indirectly arises whilst the life insured is outside the territorial boundaries of Australia or New Zealand, unless such travel is for holiday or business purposes only and demonstrably scheduled for no more than three months duration. Where any such claim meets the aforementioned criteria and is admitted, then after three monthly amounts insured have been paid, The Insurer shall not be liable to make further payments under this cover whilst the life insured is travelling or residing outside the territorial boundaries of Australia or New Zealand, unless the life insured is confined in a recognised hospital, and according to both the appropriate medical specialist at that hospital and in our opinion is unable to travel.

Used for immigrants who are temporary residents of Australia, and have no intention of taking out permanent residency, but who meet the criteria for acceptance.

Cover Types: ALL

No claim shall be payable under this cover for [Life/TPD/Trauma/Income Protection]benefits that occurs whilst the life insured is travelling or residing outside of the territorial boundaries of Australia or New Zealand other than for business or holiday related travel of up to three months in any period of 12 consecutive months.

Important to note:

Generally when you are granted permanent residency you can call your chosen insurer and have the exclusion(s) reviewed & potentially removed / revised. Just because you entered Australia on a visa doesnât mean that you will have to have an exclusion on your policy, there are many insurers and if you are not satisfied with the offer shop around.

Conclusion

Listing every conceivable form of residency or visatype to explain the exclusion is not feasible. However, your chosen insurerâs exclusions and eligibility terms should be highlighted in its Product Disclosure Statement (PDS) or the offer document following the assessment of your application by an underwriter from the insurer. Be aware of your options and when in doubt, talk to a specialist like Life Insurance Direct.

Life Insurance Directâs founders immigrated to Australia from South Africa, and have personally gone through the same vigorous processes youâre currently going through. Weâve helped thousands of people, many of whom are on a variety of Visas, obtain life cover.

Let us help you.