ILS market shows resiliency & value proposition to stakeholders: Aon

The insurance-linked securities (ILS) market’s ability to rebound from recent historical losses, resume its growth trajectory and deliver what investors have been looking for, is a true testament to its resiliency and overall value proposition to all stakeholders, Aon has said.

In the latest report from Aon’s Reinsurance Solutions division, which was presented just in advance of the annual Monte Carlo Rendez-Vous event and in which the broker looks forward to market conditions for the end of the year, catastrophe bonds and the ILS market’s resumption growth are highlighted as positive signals.

“The ILS market has experienced significant growth over the past twelve months, despite headwinds in the form of heightened catastrophic activity and persistent macroeconomic uncertainty,” the broker explained.

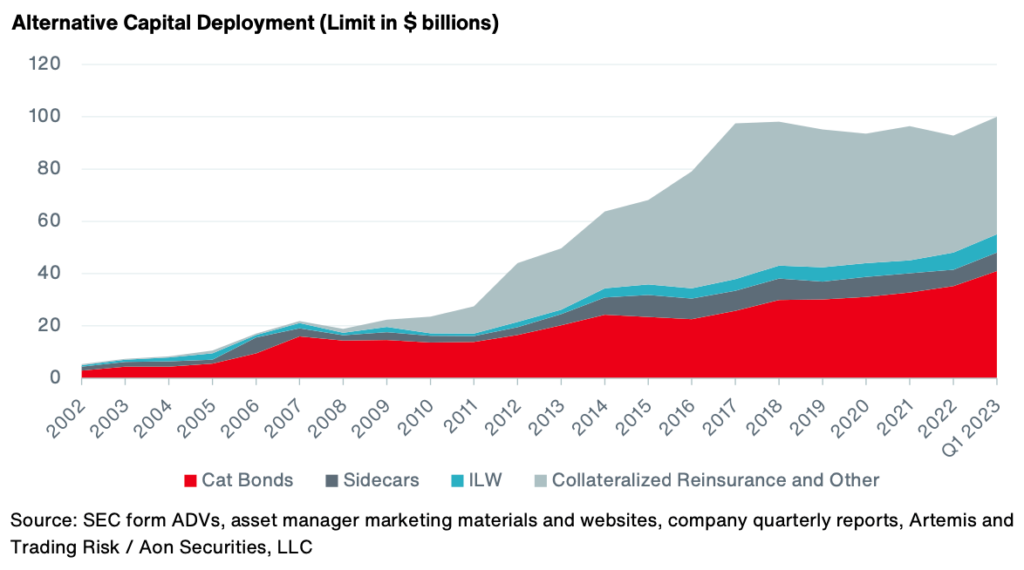

“The ILS market has grown to over $100 billion in outstanding limit, including $38.6 billion in catastrophe bonds as of June 2023.”

The chart below, from Aon’s report, shows the steady contribution that catastrophe bonds have made to the ILS market’s resumption of outright growth.

The market has seen “an ideal environment for investors to raise capital,” Aon explained.

Going on to say that, “Investors have been successful in those efforts, with a $5 billion increase in AUM since year-end 2022.

Growth in AUM — resulting from both investors’ success in raising fresh capital and reinvested premium earned on outstanding issuance — is poised to result in record-breaking cat bond issuance volume for 2023.”

“The market is poised for further growth in the second half of 2023, particularly given anticipated returns for the year,” Aon explains.

The elevated returns available in the ILS market are a key driver of the much-improved position the market now finds itself in.

Aon highlights, “All-time high total coupons earned on cat bonds over the past twelve months, despite headwinds felt across the broader economy.”

The total coupon for catastrophe bonds is now seen as above 12%, thanks to rising risk interest spreads and much higher risk-free rates, Aon notes (as seen below, from the report).

Aon sums up the market outlook in ILS, with special reference to catastrophe bonds, “The catastrophe bond market’s growth in 2023 has been welcomed by insurers, reinsurers and governments who have sought to complement their risk transfer program with ILS.

“With the ILS market now in its third decade, its ability to bounce back and grow during a time of economic uncertainty and increasing natural catastrophe frequency, is a true testament to its resiliency and overall value proposition to all stakeholders.”