ILS market remains key provider of reinsurance to Florida: Moody’s

The insurance-linked securities (ILS) market and alternative sources of reinsurance capital are key providers of protection to Florida’s insurance sector and investor appetite for the risk will continue, rating agency Moody’s has said.

“Alternative reinsurance capital in the form of catastrophe bonds, collateralized reinsurance and other insurance-linked securities plays an important role in transferring risk in peak zones, like Florida.

“In addition to providing much needed capacity to the market, these vehicles also add counterparty diversification and can spread large risks across broad pools of institutional investor capital,” Moody’s Investors Service said in a recent report.

Florida hurricane risk remains the main attraction here, as the ILS market and alternative reinsurance capital seek out the true peak exposures for the global insurance industry.

The ILS market has been hurt in the past by secondary peril impacts in Florida, as numerous carriers there suffered heavy losses from severe weather and storms that were not tropical in nature.

But, given the hard reinsurance market we now find ourselves in, the ILS market has shifted its appetite further up reinsurance towers, installed tighter terms on coverage and greatly reduced its exposure to loss aggregation across more minor events, returning to being one of the biggest providers of peak hurricane reinsurance protection in Florida.

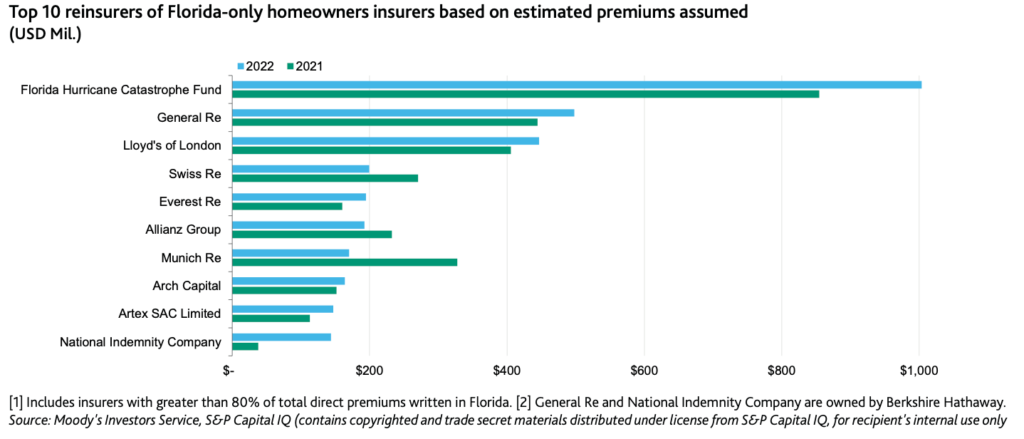

The ILS market’s role is evident in the top-10 reinsurers of Florida homeowner insurers, based on premium assumed, Moody’s data shows.

As you can see from the above, two companies that front a relatively significant amount of ILS capital feature here, Allianz and Arch, while Artex SAC makes it into the top-10 and presumably all of the capital backing the reinsurance deals that vehicle supports will be from ILS funds or investors.

Of course, in addition to that the catastrophe bond market has provided a significant amount of Florida hurricane focused reinsurance protection this year as well.

View details of every catastrophe bond ever issued in the Artemis Deal Directory.

Moody’s explained, “Florida hurricane risk, in particular, has historically attracted large amounts of capital from investors. 2023 has been no exception. In a year where a record amount of catastrophe bonds have been issued during the first half of the year, we estimate approximately $4.5 billion of cat bonds covering US windstorm exposure (including Florida) were issued between January and July of this year, up from $3.9 billion during the prior year period.”

In the outstanding catastrophe bond market, there is currently almost $2.5 billion of limit exposed purely to Florida named storm and hurricane risk, Artemis’s chart that breaks down the market by peril shows.

But, of the over $4.4 billion of US named storm exposed cat bonds outstanding featured in the same chart, at least 60% has exposure to Florida as well.

Then, you also need to consider the fact a considerable proportion of the $8 billion plus US multi-peril cat bond bucket in that chart also features Florida hurricane exposure, while there is even some embedded in certain international multi-peril cat bond deals.

Florida remains ground-zero for the cat bond markets appetite for peak peril catastrophe risks, so it is no surprise it also pays the highest risk-adjusted spreads, generally.

Looking ahead, Moody’s expects that, “Investor appetite for Florida catastrophe risk is likely to remain strong given the improved risk-adjusted returns and the diversification benefits offered by the reinsurance risk asset class.”

Read all of our news and analysis on the Florida insurance and reinsurance market.