ILS fund returns continue record-setting pace in 2023: ILS Advisers Index

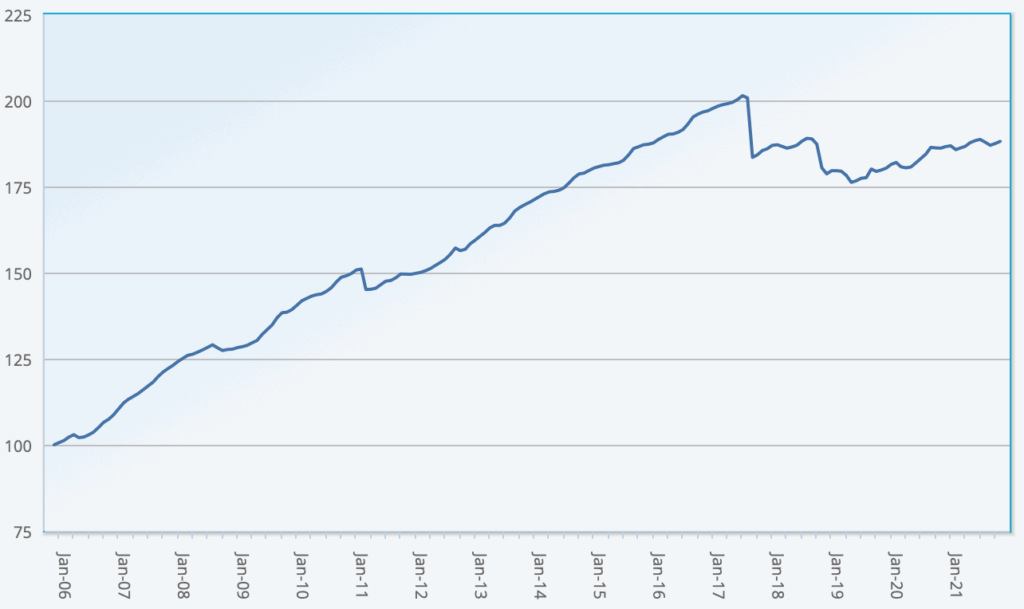

The returns of insurance-linked securities (ILS) funds as a group continue on a record-setting pace through 2023, as the Eurekahedge ILS Advisers Index delivered 0.82% for July, taking the year-to-date to 7.83%.

It was actually a more muted month for the returns of the ILS funds tracked by the Index, with the 0.82% average ILS fund return for July 2023 actually the lowest month of this year so far.

But, the year-to-date average ILS fund return of 7.83% remains higher than any previous year in the Index history, for ILS fund returns to the end of July.

ILS Advisers noted that, while ILS fund returns are on record-pace, it is not a year without the potential for some loss impacts.

This is especially true in low-attaching aggregate layers of reinsurance and retrocession, as well as catastrophe bonds providing aggregate coverage.

ILS Advisers explained, “The multiplication of small to mid-sized events so far this year is starting to threaten the lower attaching annual aggregate structures, mainly those exposed to secondary perils (thunderstorms, winter storms, tornadoes, hail, wildfire, etc.).”

For July 2023, pure catastrophe bond funds performed best, as a group, delivering a return of 0.82%.

Meanwhile, private ILS funds, so those that also invest in collateralised reinsurance or retrocession positions, gained 0.79% for July 2023.

2 of the ILS funds tracked by ILS Advisers were negative in July, but 24 reported positive returns.

As a result, there was a much wider range in performance than we’ve seen in recent months, ranging from -4.66% to +2.24%.

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 26 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.