ILS fund Index sets new annual record, hits 13.33% return after 11-months

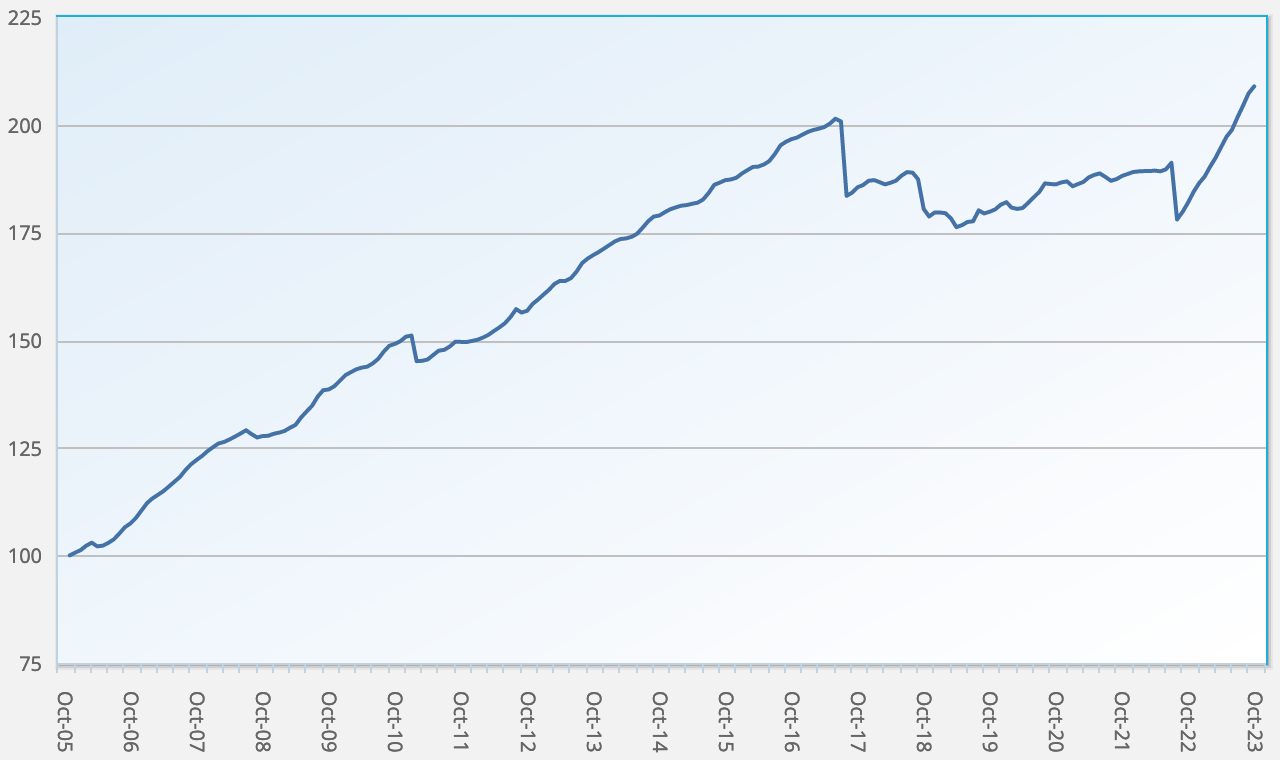

With one month still to be counted, the Eurekahedge ILS Advisers Index has already set a new record high annual return in 2023, as the average return of the insurance-linked securities (ILS) funds tracked rose to 13.33% after November.

The previous high for the annual return of the Eurekahedge ILS Advisers Index, which tracks a basket of ILS fund strategies, was set way back in 2007 when it hit 13.22%.

Since then, the ILS fund Index has never reached double-digits for a full year return, until 2023 came along.

Now, the hardening of reinsurance premium rates-on-line and resulting elevated catastrophe bond and insurance-linkd securities (ILS) spreads have driven this ILS fund Index to a new high for any year and with one month to go, an annual return of 14%+ is now in sight for 2023 (it’s already tracking above that level including the early reporting funds December returns).

With no major catastrophe loss events in December, the annual record for this Index is now assured and the only question remaining is where the final total will be.

November 2023 saw the average ILS fund up by 0.79%, according to the Eurekahedge ILS Advisers Index

During the month, pure catastrophe bond funds were again outperformed by the private ILS fund category, which includes strategies that also invest in collateralised reinsurance and retrocession instruments.

Pure cat bond funds rose by 0.68% in November, while those funds investing in private ILS as well gained 0.81% for the period.

The month saw all 27 constituent ILS funds of this Index deliver a positive performance, although the spread from best to worst performer was quite broad once again.

The lowest performing ILS fund for November 2023 gained just 0.1%, while the best performing ILS fund strategy rose by 1.5% for the month.

As we had reported recently, the insurance-linked securities (ILS) niche asset class has come out as the top performing segment of the hedge fund world, according to data provider Preqin.

As we reported Friday, the Swiss Re cat bond Index was up by a very impressive 19.69% for the full-year.

With attractive returns expected to continue in catastrophe bonds and private ILS, according to SIGLO Capital Advisers and investment manager Plenum forecasting that cat bond funds can again deliver double-digit returns in 2024, loss activity allowing, the prospects look good for another strong showing by this ILS fund Index next year.

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 27 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.