ILS capital to hit $150bn in 2030, but reinsurance to outpace it: Berenberg

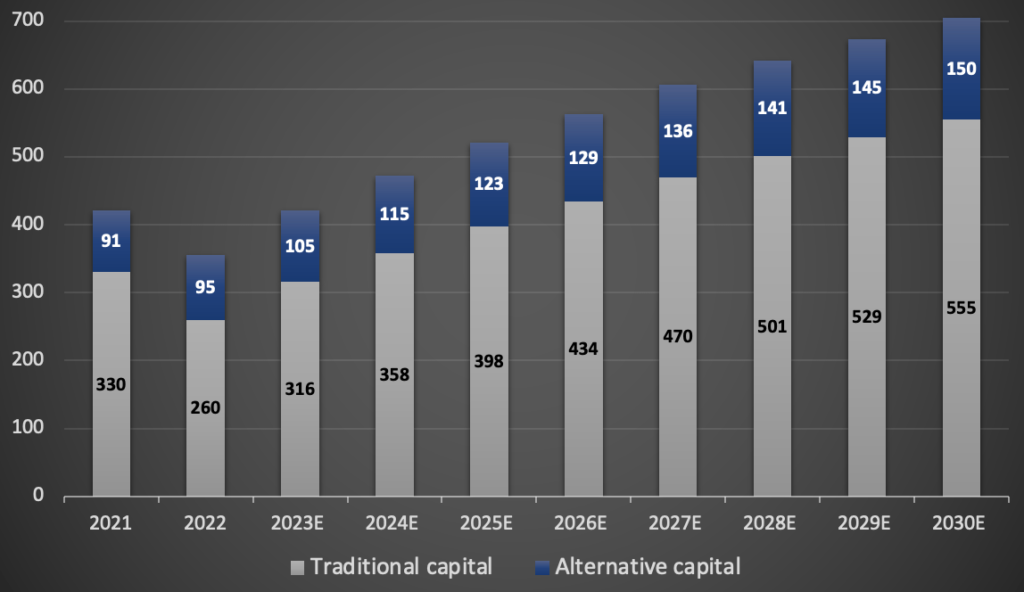

Insurance-linked securities (ILS), or alternative, capital is expected to grow to become a $150 billion market by 2030, but traditional reinsurance capital is expected to grow at a faster pace over the same period, according to an estimate from analysts at investment bank Berenberg.

Recently, insurance and reinsurance broker Aon said that alternative reinsurance capital, or ILS capital, had reached $100 billion as of the end of the first-quarter of 2023.

That signified a new high and reflects the strong growth seen in the catastrophe bond market through the start of 2023.

That cat bond market growth has continued, while ILS funds focused on private contracts and collateralized reinsurance are also starting to report some fund-raising successes as well.

All of which bodes well for continued growth, in the short-term and while the market avoids major catastrophe loss impact, at least.

Berenberg’s analyst team provided their estimate for how both alternative and traditional reinsurance capital might go recently.

The forecast calls for alternative and ILS capital to grow at a compound annual rate of 5.80%, to reach $150 billion in 2030.

Given the recent rate of growth in the catastrophe bond market, which by Artemis’ numbers grew by almost 10% over the first-half of 2023, it seems safe to assume the Berenberg estimate for $105 billion of alternative and ILS capital by the end of 2023 to be a reasonable target for this year.

That would be 10% growth of alternative capital this year, beyond which Berenberg’s analysts call for alternative and ILS capital growth of 10% through 2024 and 7% through 2025, slowing to 5% for the next two years and down to 3% later in the decade.

Traditional reinsurance capital though, is seen as having even greater growth potential, with Berenberg’s forecast calling for a compound annual growth rate of 9.90% out to 2030, to reach $555 billion.

The starting point for this data was reinsurance broker Howden Tiger’s estimates, hence the traditional reinsurance capital being lower than some others.

While the CAGR for traditional reinsurance is seen as higher, it’s important to note that a lot of that is coming in over the next two years and attributed to recoveries in asset values as well as market expansion. But beyond 2024, as the growth rate slows, it is still forecast to outpace alternative capital and ILS, by Berenberg’s analysts.

As a percentage of the whole though, Berenberg’s forecast suggests that alternative reinsurance capital and ILS will shrink their share of total reinsurance capital, from around 25% at the end of 2023, to roughly 21% by the end of 2030.

From the ILS market’s point of view, how reasonable that is will depend on two things, in our opinion.

First, how quickly private ILS, collateralized reinsurance and collateralized retrocession strategies bounce-back and start seeing more meaningful inflows, which this year’s hurricane season seems set to have a significant bearing on. A cleaner year, in catastrophe loss terms, could lead to bumper full-year private ILS fund returns and that has the potential to attract much more capital, it seems.

Second, whether there are any market structure innovations that stimulate increased ILS activity, both cost-related efficiency such as cat bond sponsorship becoming cheaper, and whether ILS fund managers find new and incremental ways to source risk (cat and non-cat) for their strategies more efficiently.

Both of those factors could accelerate ILS market growth considerably, helping it to keep pace or even beat the growth curve of traditional reinsurance capital.

Finally, Berenberg’s analysts also forecast reinsurance demand growth at a CAGR of 6.3%, which means reinsurance capital growth is set to outpace demand, if their projections are correct and we all know what that has historically meant for the market and its pricing discipline. In fact, they anticipate capital outgrowing reinsurance premiums by the end of 2025.

That news will be less welcomed than market capital growth. It suggests a need for continued efforts to “grow the pie” by increasing demand for risk transfer and also increasing the breadth of the overall insurance market where alternative capital plays, to avoid a situation where catastrophe rates spread compression is purely caused by weight of capital, rather than by capital efficiencies.

But the analysts do note that there is some uncertainty over how fast demand for reinsurance capital will grow and also how fast it is growing now, saying demand may be stronger than we realise, especially while there is a trend towards some participants pulling-back and citing problems with the insurability of certain risks and regions.

In a world where risk is increasingly in-focus, for so many reasons, there is a chance that forecasts for the demand for risk transfer and insurance capital overall, prove lower than the reality.