ILS capital outpaced AM Best / Guy Carpenter forecast to hit $100bn in 2023

Earlier this year, rating agency AM Best and reinsurance broker Guy Carpenter had projected that third-party capital in reinsurance, so alternative capital or insurance-linked securities (ILS) market capacity, would end 2023 at $99 billion, but the market has actually outpaced this forecast.

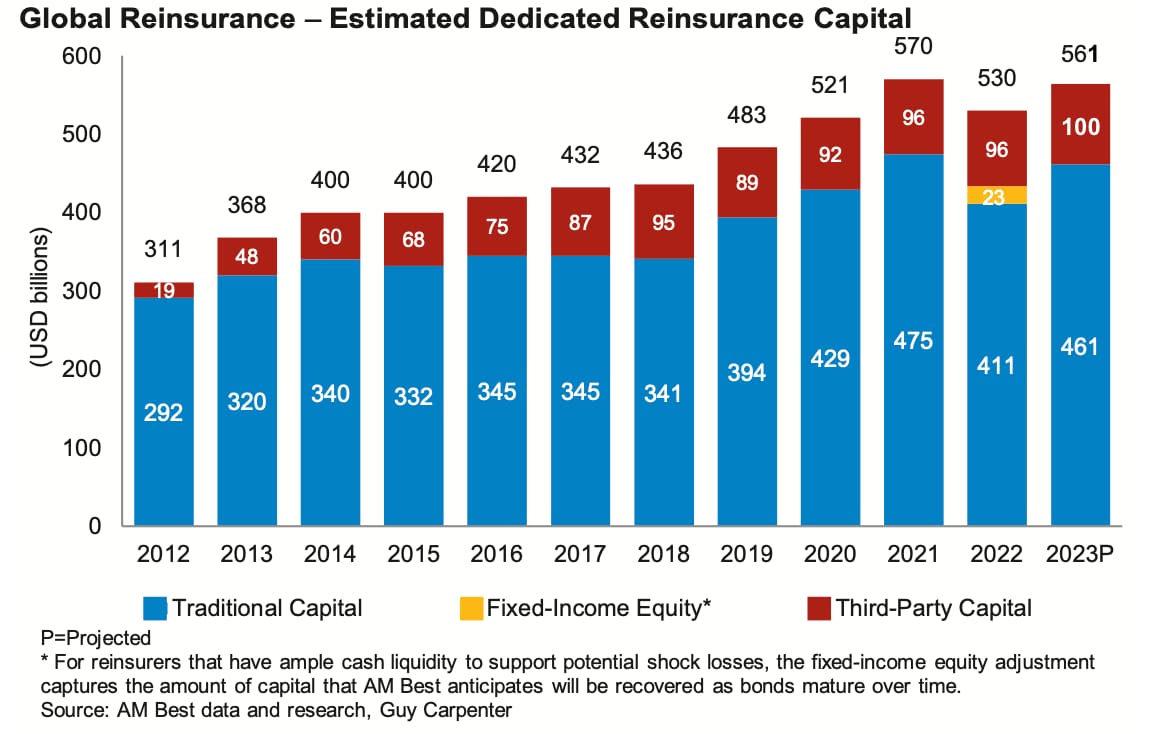

Now, Guy Carpenter has reported that the latest estimate from it and AM Best is that dedicated reinsurance capital grew by 12% over the full-year 2023, which puts it now at the second highest level since 2021 and well on its way back to reaching a new high in 2024, we suspect.

After the middle of this year, AM Best and Guy Carpenter had estimated that dedicated reinsurance capital would end the year at $560 billion, consisting of $461 billion of traditional reinsurance capital and $99 billion of capital from the ILS market, so made up of catastrophe bonds, collateralized reinsurance and other ILS instruments backed by third-party investors, such as sidecars.

As it turns out, Guy Carpenter and AM Best were very accurate on traditional reinsurance capital, as the broker said in its renewals report that the end of year estimate for the traditional side remains at US $461 billion.

But, on the ILS and third-party reinsurance capital side, activity levels and inflows of capital from investors appear to have outpaced the forecast from the mid-year.

Now, Guy Carpenter explains that the latest estimate derived alongside AM Best is that ILS or alternative capital has reached $100 billion again at the end of 2023.

Which sets another record high for the ILS and alternative reinsurance capital markets and signals growth over the course of 2023.

On how reinsurance capital levels developed in 2023, the broker explained, “Dedicated reinsurance capital, calculated in partnership with AM Best, bounced back in 2023, aided by strong underwriting and investment earnings and the unwinding of the significant mark-to-market investment losses that hit the sector hard in 2022.”

Adding that, “Guy Carpenter and AM Best’s 2023 estimate of traditional dedicated reinsurance capital is USD 461 billion, a 12% increase from the initial year-end 2022 level, while alternative capital is estimated to have increased 3.7% to USD 100 billion net. Overall, dedicated reinsurance capital increased 10% from the initial 2022 year-end estimate.”

We’ve taken the liberty of updating the chart that Guy Carpenter and AM Best had published at the mid-year, to add in the additional ILS market growth they now estimate.

It puts ILS capital on a very solid baseline for the start of 2024, with ample capital to absorb demand and still high investor interest in at least certain parts of the asset class.

There’s a strong chance we see additional growth of the alternative capital figure through 2024 and it may prove that this end of year estimate also gets upgraded slightly, given the increased activity being seen around some ILS fund strategies and sidecars, as well as the fact the catastrophe bond market has experienced a very strong year of growth.