ILS Advisers Index records best monthly return since inception in 2006

For the month of August 2024, the broad benchmark index for insurance-linked securities (ILS) funds, the Eurekahedge ILS Advisers Index, has recorded its highest monthly return since its inception in 2006, being up by 1.71% for the month.

It’s testament to the strong returns being enjoyed by catastrophe bond and insurance-linked securities (ILS) investors, as this benchmark of ILS funds has now hit a 7.59% return for the first eight months of 2024.

By the end of August 2024, this Index has now reached its third-highest return for this stage of the year, only trailing last year’s record performance and 2007.

August 2024 saw the catastrophe bond and ILS funds tracked by the Eurekahedge ILS Advisers Index deliver an average return of 1.71%.

With no major catastrophe events that hit ILS positions directly in the month, the returns generated from premiums and seasonal performance have driven the Index to a new high for a single month.

ILS Advisers did note that some of the catastrophe events that occurred may have further eroded some annual aggregate structures, but this was not sufficient to dent the month’s stellar ILS fund returns.

The previous high month was a return of 1.60% in January 2007.

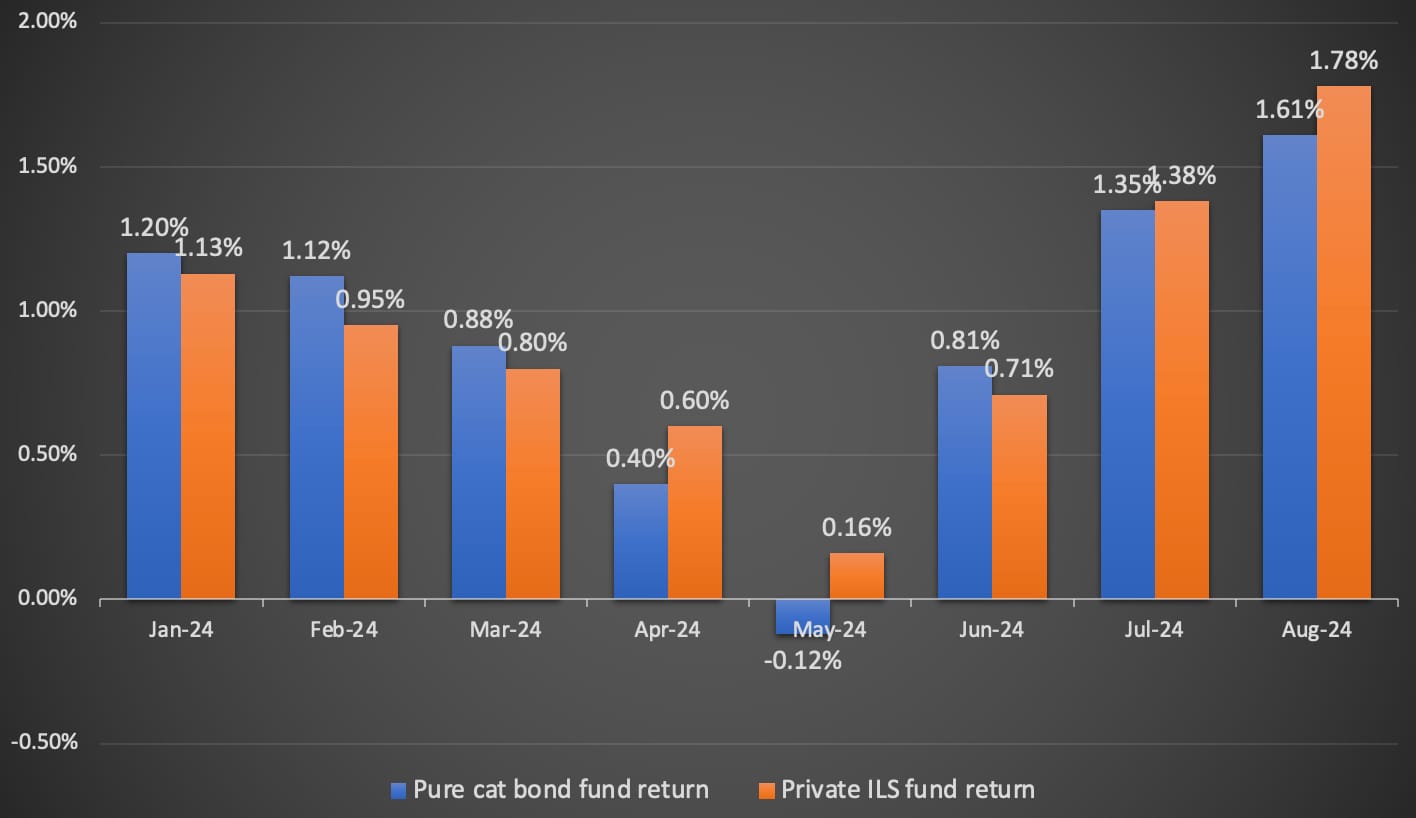

Both pure catastrophe bond funds and the private ILS funds that also invest in collateralized reinsurance or retrocession opportunities achieved their highest returns of the year so far, as a group.

ILS Advisers said that, “Pure cat bond funds as a group were up 1.61% in August, while the subgroup of funds whose strategies include private ILS gained +1.78%.”

Catastrophe bond performance was particularly strong in August, with the Swiss Re Global Cat Bond Index seeing a price return of 1.25% and a total return of 2.33% for the month.

Every ILS fund tracked by the Eurekahedge ILS Advisers Index delivered a positive return for its investors in August.

As is typical, there was a relatively wide range of performance, reflecting the broad range of ILS fund strategies available to investors, ranging from +0.81% to +2.41% for the month.

With September seeing continued strong seasonality in cat bond performance and premium accrual to private ILS and reinsurance strategies high, depending on what happens due to hurricane Helene (at this time there are no reports of any significant ILS losses) the Index could be in for another relatively strong showing.

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 27 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.