ILS a versatile, adaptable midfield player offering strong, reliable returns: WTW

Insurance-linked securities (ILS) such as catastrophe bonds are seen as a versatile and adaptable diversifying strategy that can can provide investors strong, reliable return potential, particularly on a risk-adjusted basis, the Liquid Diversifiers team at WTW has said.

Likening the construction of a well-rounded investment portfolio to that of selecting a winning football team, the WTW experts explain that choosing “complementary skills can help maximize diversification benefits in investment portfolios.”

“Investors need to think harder about their starting line-up. On one hand, they face more global market risks and uncertainties than ever before. On the other, diversifiers such as the once-reliable negative correlation between bonds and equities can no longer be taken for granted,” they commented.

Adding that, “In our view, liquid diversifiers play a crucial role in building a portfolio that can help navigate uncertain markets via a variety of strategies with unique characteristics. Investors require a team of these strategies, each playing their individual role to create a robust and resilient portfolio.”

When constructing this well-rounded portfolio, sticking with the footballing narrative, the WTW Liquid Diversifiers team place insurance-linked securities (ILS) such as catastrophe bonds in the midfield.

Investors need “an agile midfield that can respond decisively to changing market conditions,” but investors and managers also require “an experienced team manager who is able to direct and rotate tactically in order to get the best out of the individual components of the team,” WTW believes.

Here, “An allocation to liquid diversifier strategies can achieve success in each of these areas, with the main aims being to mitigate risk, increase diversification and, importantly, generate alpha,” they explain.

The midfield strategies, such as an allocation to ILS or cat bonds, can add versatility.

“Midfield players are versatile and adaptable. They may hold their ground in the center of the field or follow the flow of the game from end to end. You could argue that uncorrelated liquid diversifying strategies are the midfield players of the alternatives world,” WTW’s experts state.

Adding that, “For example, insurance-linked securities typically hold their ground, collecting premia to deliver returns while the market moves around them.”

An allocation to ILS, such as catastrophe bonds or reinsurance contracts, allow investors to “benefit from steady coupon payments and principal preservation on catastrophe bonds.”

Also noting that, “Return potential from active allocation also tends to be affected by supply and demand dynamics.”

ILS is seen as a strategy that can deliver a “a consistent source of returns over time, irrespective of broader market conditions,” they explain.

“Insurance-linked securities (ILS) such as catastrophe bonds are a growing asset class that can provide strong, reliable return potential, particularly on a risk-adjusted basis, while remaining uncorrelated with global equities,” they continue.

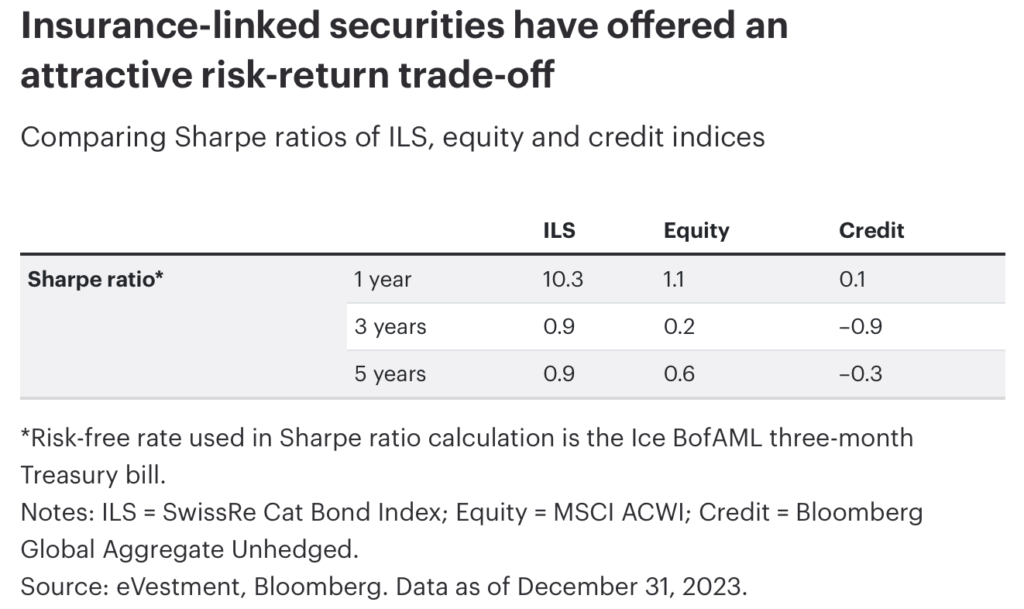

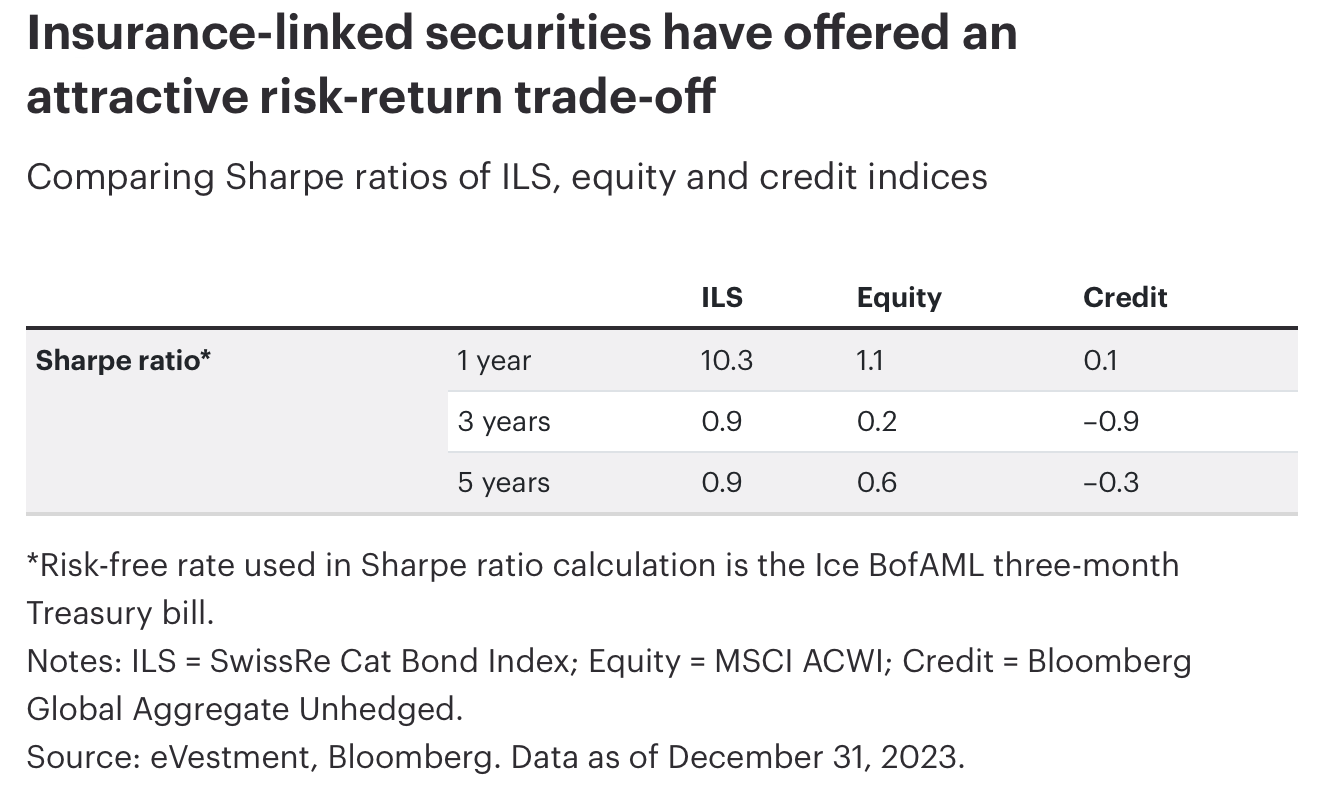

Sharing the below data, the WTW Liquid Diversifiers team highlight how well ILS has performed in recent years, comparably with other asset classes.

Cat bonds, “have outperformed equities and credit on a risk-adjusted basis for the past several years. For equity investors in particular, cat bonds have offered good diversification properties, with a beta to equities of less than 0.2 since 2018.”

Summing up on investor’s team selection, the WTW Liquid Diversifiers team says, “A successful team needs optionality at the transfer window. Portfolio construction should aim to consider every eventuality, including remaining highly liquid to provide flexibility without sacrificing diversity—something we think liquid diversifiers are well equipped to do.

“It’s important to note that, while the diversification benefits and uncorrelated nature of liquid diversifiers can make them a compelling investment opportunity, they are not immune to risks and investors can experience losses. A sound and systematic approach is therefore needed to monitor and manage leverage, left-tail risk and manager selection risk.”