ICHRA plans: what the latest data shows

ICHRA plans are tax-advantaged benefits solutions that represents a fundamentally new way of doing benefits, allowing employers of any size to reimburse employees for health insurance rather than buying it for them. The bipartisan and tri-department individual coverage HRA has the potential to reshape the way we talk about group benefits—and two years in to its existence, it’s growing at warp speed. Here are a few key takeaways from 2 years’ worth of data.

View the full report here.

ICHRA plans offer employees choice

Our data demonstrates the variety of plans employees on our platform chose— from metal tiers to deductibles to carrier choice. Instead of having one or two choices, employees are able to choose the best plan that works for their family’s needs.

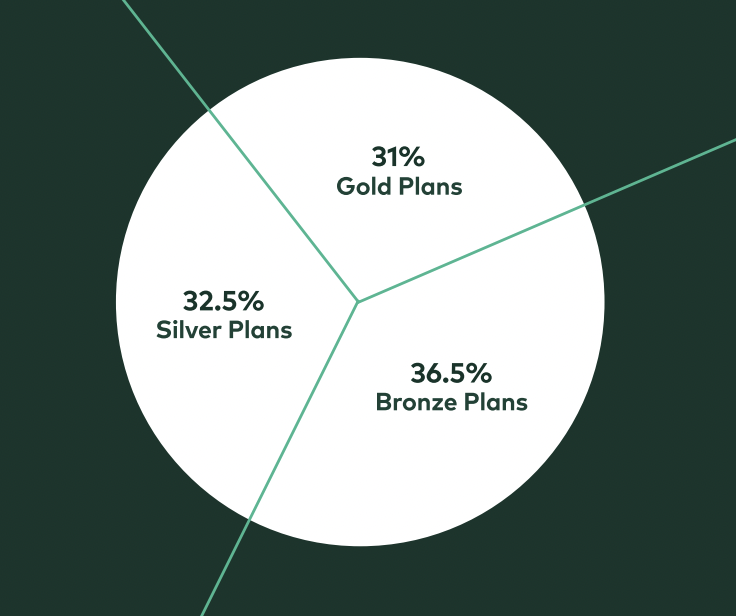

Plan Choice: Metal tier enrollments were pretty consistent across the spectrum: 36.5% enrolled in bronze plans, 32.5% in silver plans, and 31% in gold plans.

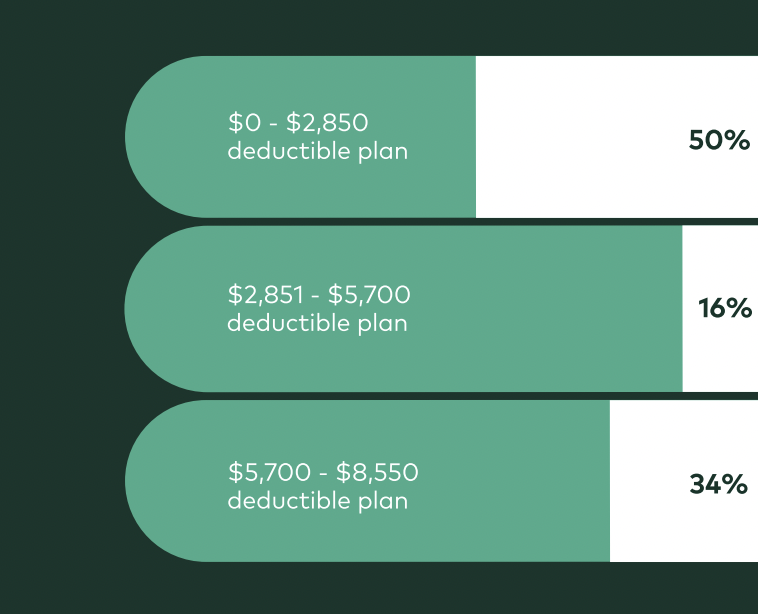

Deductible Choice: Employees opted for a wide range of deductibles as well. Roughly half of all employees on our platform enrolled in a plan with a deductible less than $2,850. Of the people who fall in this bucket, many chose zero dollar deductible plans. For reference, a recent survey from eHealth shows that the average deductible for small group health plans was $3,140 each year.

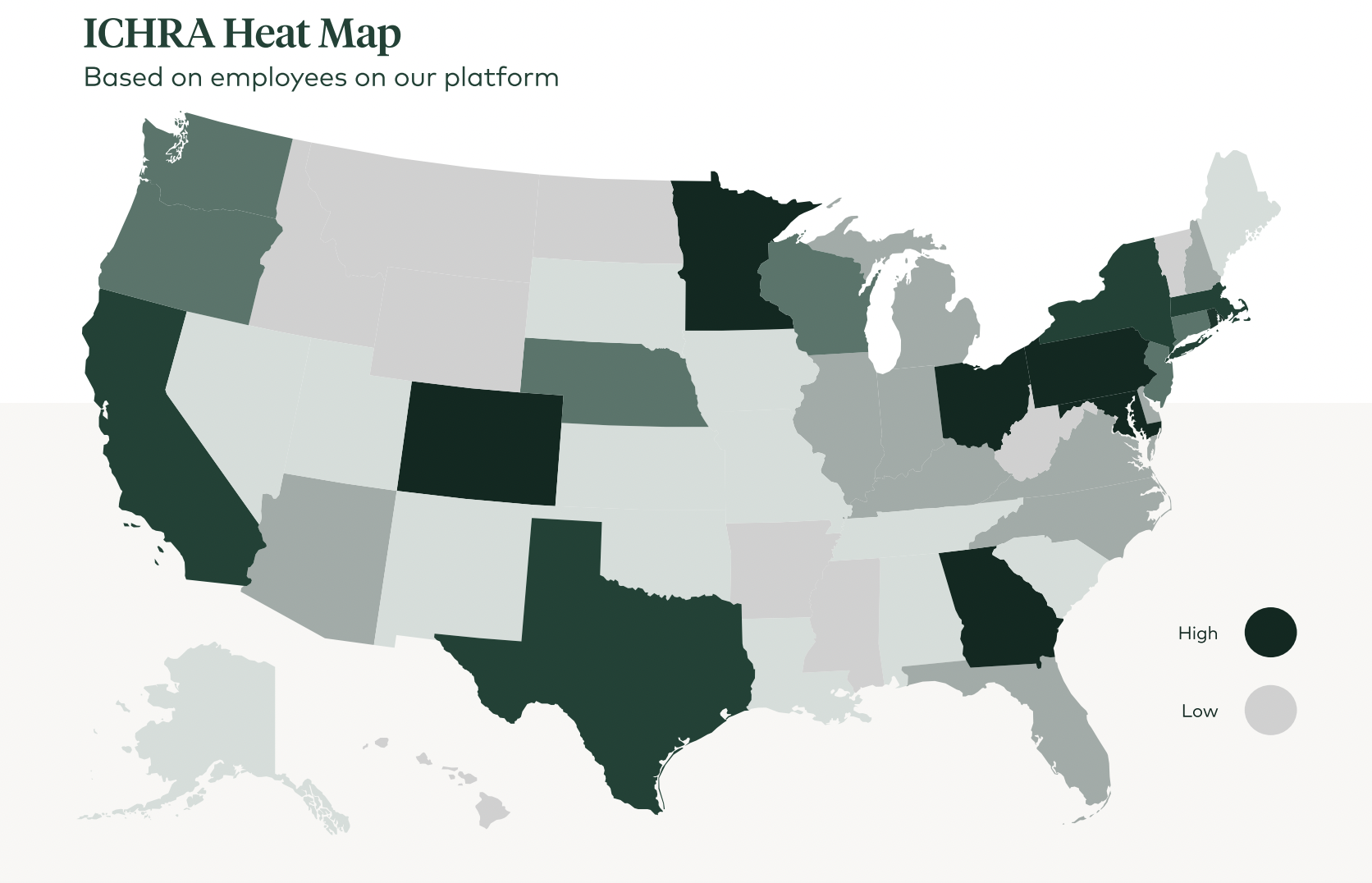

The individual coverage HRA has nationwide appeal

While some locations are better positioned to take advantage of the ICHRA wave, we’re proud to have clients in every single state. We’re seeing ICHRA take off in certain geographies more than others, which typically correlates with strong, local health insurance markets with carrier competition and competitive premium prices relative to those of group plans.

ICHRA plans are expanding coverage

A principal part of our mission is to reduce the number of uninsured by expanding coverage through ICHRAs.

80% of our small business clients offering ICHRA are net new to benefits, combatting the troubling trend of increasing numbers of small businesses dropping group plans. This is a huge win because it means that these employees are receiving employer help with their health insurance for the first time. Remember, companies with less than 50 employees aren’t actually required to offer benefits. These are individuals who might not have had help with coverage in the past. In contrast, the vast majority of our larger employer clients have offered benefits in the past.

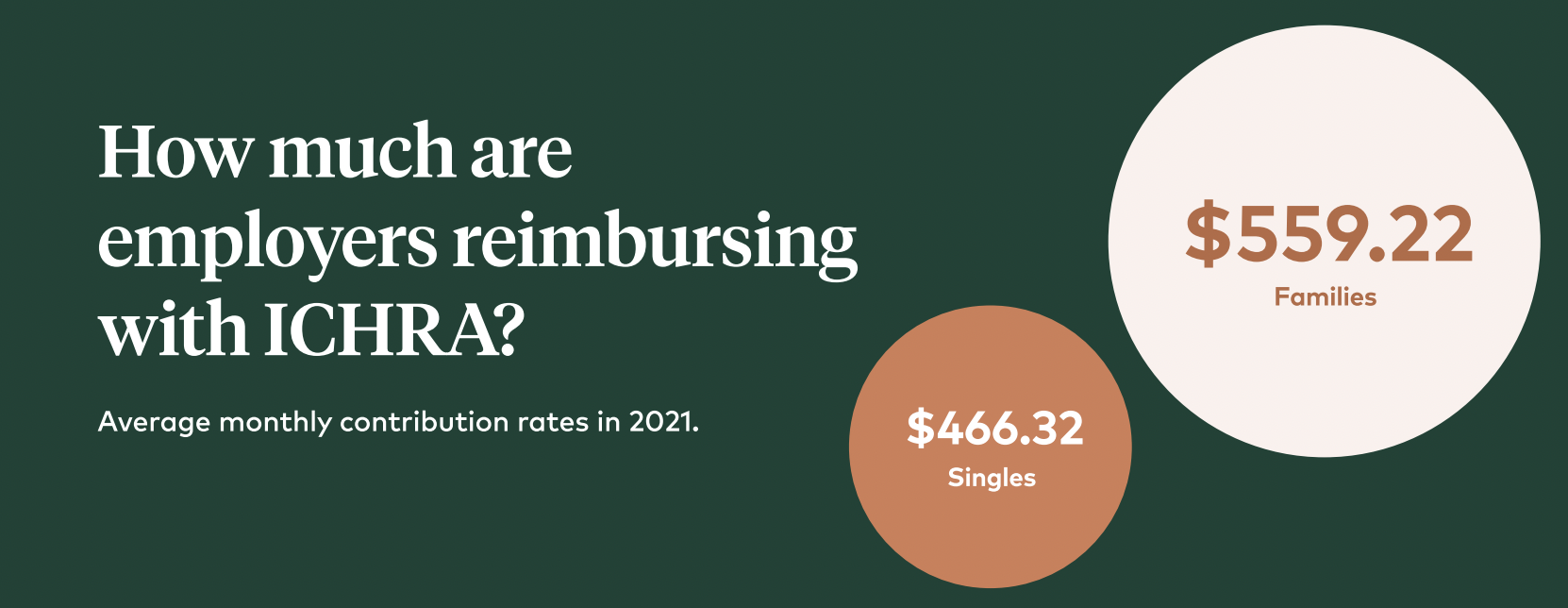

ICHRA plans cover premiums better than traditional group plans

Wondering exactly how far that goes? Glad you asked.

While group plans typically only cover around 83% of premiums for singles and 74% of premiums for families (with the rest coming out of their employees’ paychecks), the average national reimbursement rates of our clients based on 45-year-old employees was $448.39 per employee per month, which covers 147% of lowest cost bronze plans and 122% of lowest cost silver plans.

This varies per state, but an overwhelming majority reimbursed more than local plan premiums with the exception of five states that still had percentages well above group plan premium coverage. For those on small group plans, the burden on employees is even greater, with more than 35% of employees footing more than half the bill, according to The Employer Health Benefits 2019 Summary of Findings.

Check out our article on ICHRA vs. group plans for more info!

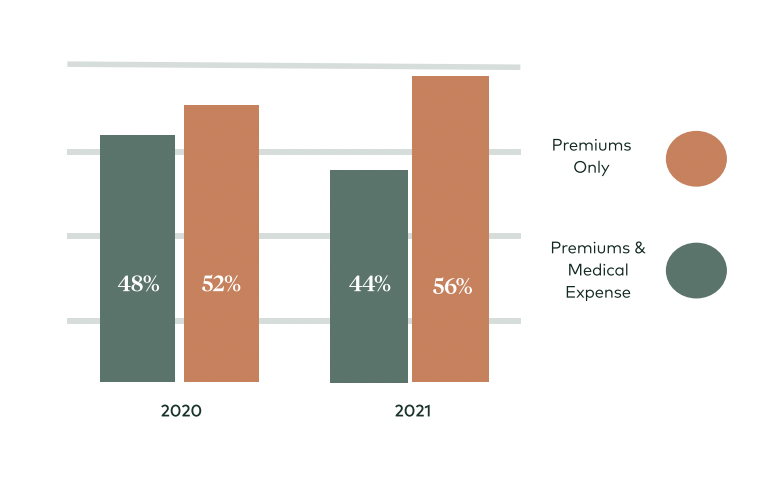

ICHRA plans reimburse employees for premiums and medical expenses

When setting up ICHRA, business owners can choose between reimbursing for premiums only or reimbursing for premiums and medical expenses. If they reimburse for both, leftover funds after the premium can help employees pay for other out of pocket medical costs (like prescriptions, therapy, glasses or copays).

ICHRA plans are growing in popularity

ICHRA plans are growing in popularity

Despite a global health crisis, an economic recession, and a combative political landscape, the individual coverage HRA is gaining momentum based on the numbers we’ve seen at Take Command. And we’re not the only ones. For clients who signed up for ICHRAs during the inaugural year, we’ve seen a 96% renewal rate. Employers who made the switch from their group plan aren’t looking back.

A recent study by KFF and PBGH revealed that 48% of its respondents said they were “considerably or highly likely” to use an ICHRA to offer alternative coverage to employees.

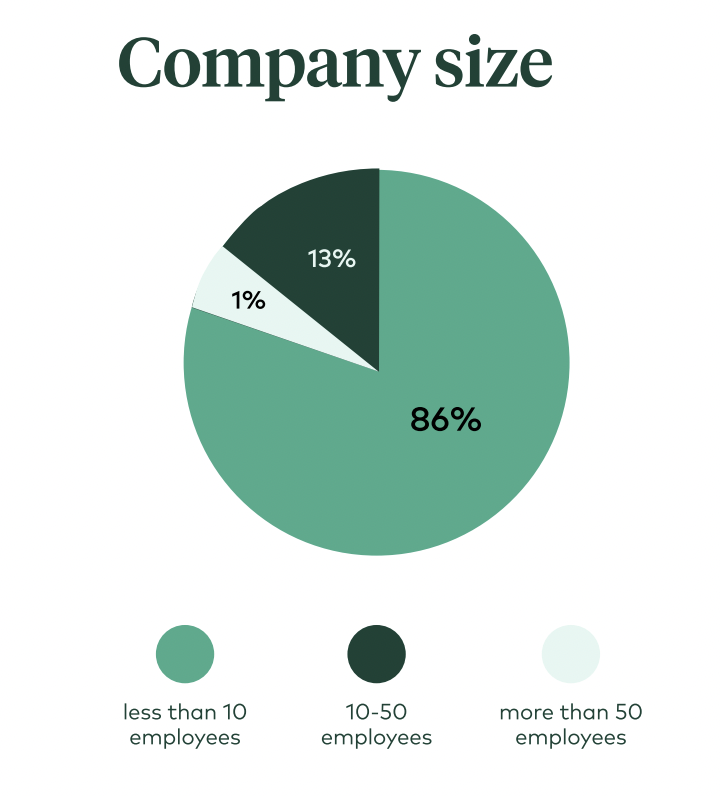

ICHRA plans are for businesses of all sizes

While the average size of our ICHRA clients is 6, that doesn’t really tell the whole story. The majority of our clients fall in the 10 to 20 category, but there is high variance in client size. Legacy small business clients comprise a large portion of our business, but the fastest growing segment is our larger client base. While small companies might not have to offer benefits (the employer mandate doesn’t apply to companies with less than 50 employees), they do want to help with benefits, especially with the competitive labor market.

Large employers represent the fastest growing segment for ICHRA, with a 210% rise in larger employer enrollments over the last year.

Regardless if it’s a small company hoping to help its employees, a larger one with medically underwritten group plans to satisfy the employer mandate, or 1000+ employee companies that are self-funded with a multi-state footprint, ICHRA wins across the spectrum for its optimized approach to risk de-management, choice, and flexibility.

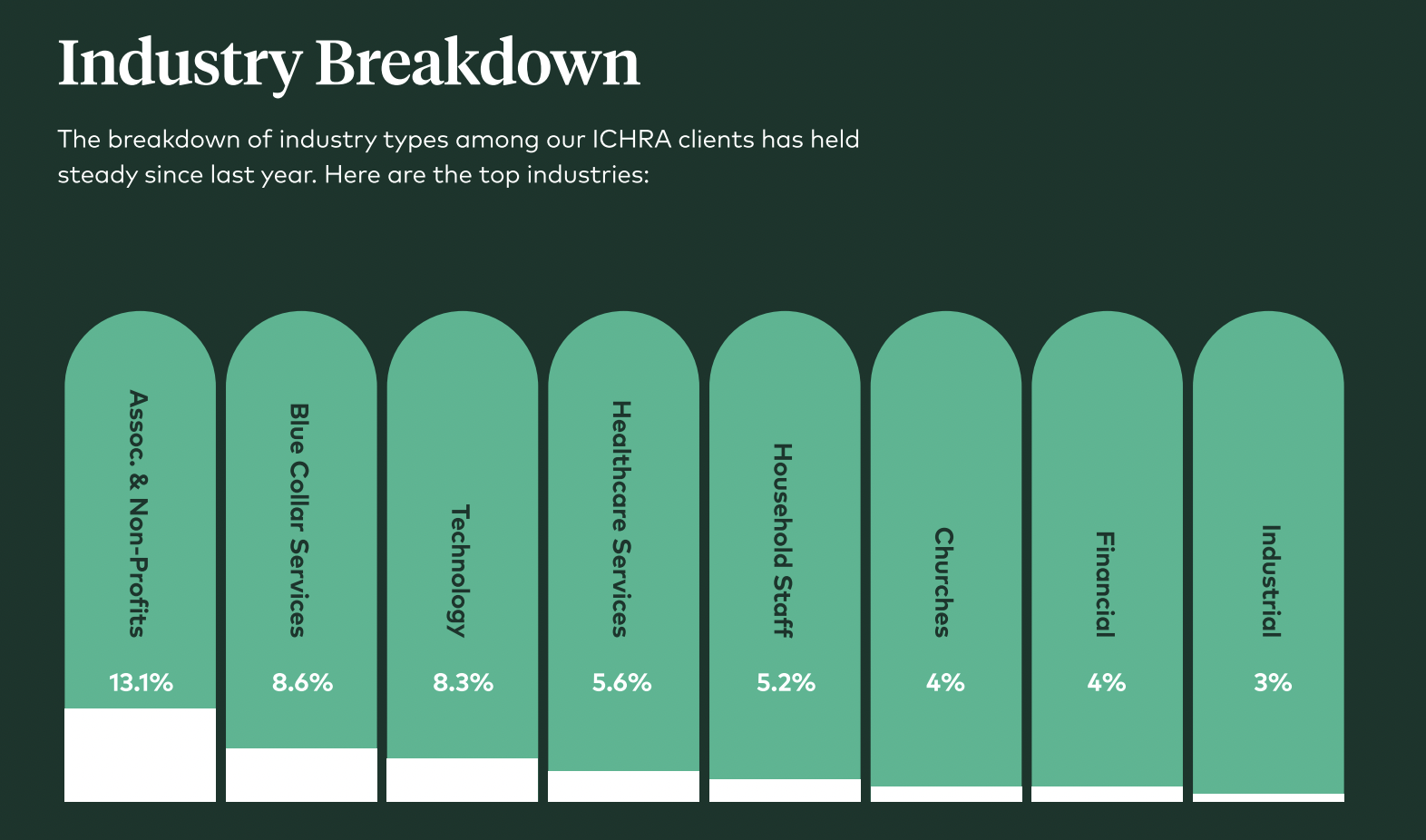

ICHRA attracts many types of industries (some more than others)

Associations and non-profits, technology, hospitality and restaurants, and professional services are a few of the most popular business types that offer ICHRA plans.

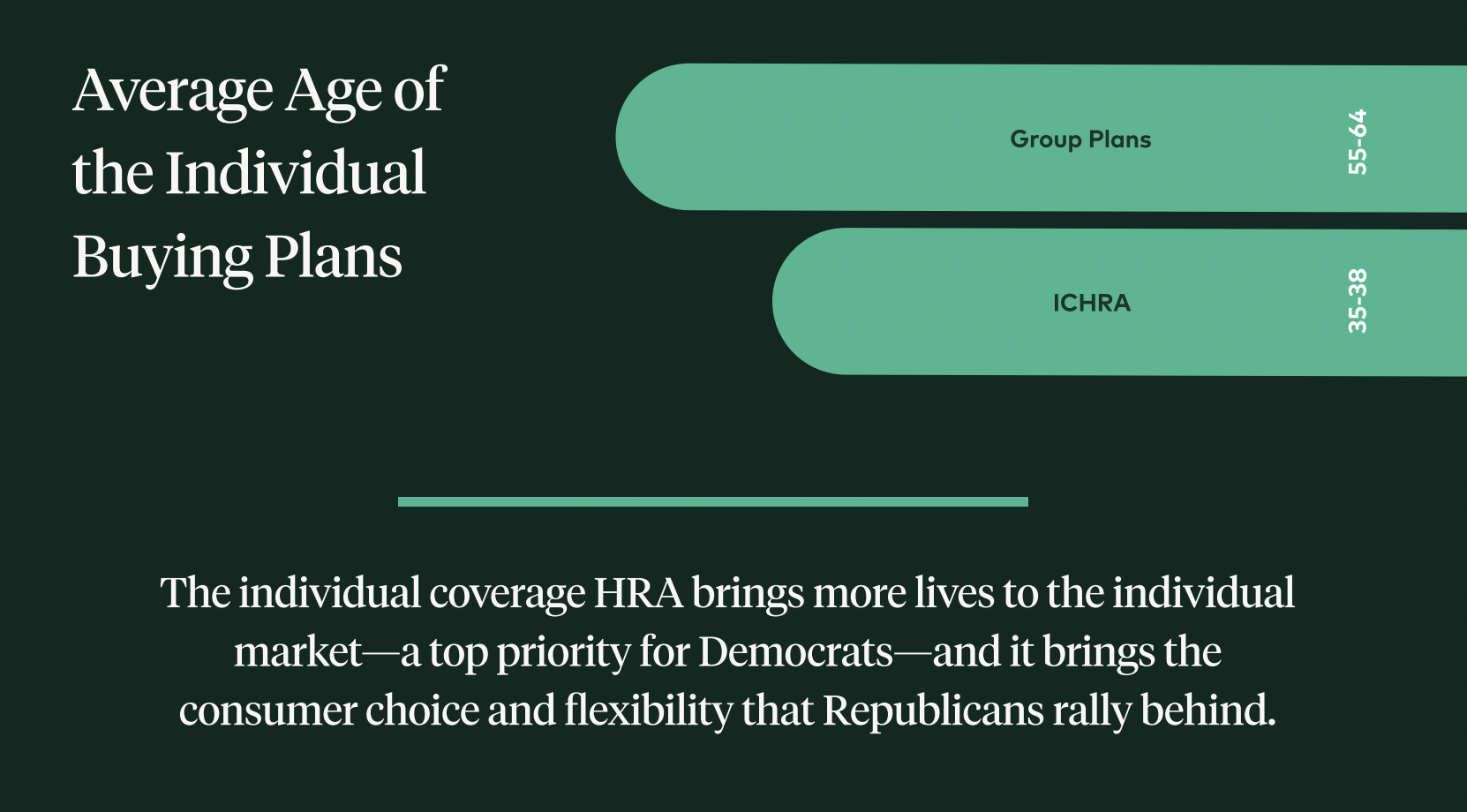

ICHRA is strengthening the ACA

Adding healthy, young lives to the individual insurance market drives down costs and further stabilizes the market. While ICHRA is adding new lives to the market, which grows the risk pool, it’s also important to look at the types of individuals that are being added to the risk pool.

The average age of employees on our platform, for example, is 38 while the median is 35. Both numbers land in the bottom third of eligible ages for coverage, typically the healthiest and least expensive.

In contrast, according to KFF, the most common age group buying plans on Healthcare.gov is between 55 and 64.

The individual health insurance market is thriving – a boon for ICHRA and employees

The growing competition within the stabilized individual insurance market means more choice for individuals and more innovation features from carriers. Since carriers are the ones holding the risk, they are motivated to offer their own wellness incentives and perks.

dental & vision

free telemedicine

wellness incentives

$0 deductible options

free generic drugs

free preventative care

coverage of essential benefits

A growing number of geographies have IFP rates lower than SG, meaning employers’ benefits spend can stretch further with ICHRA.

ICHRA plans are growing in popularity

ICHRA plans are growing in popularity