ICA calls for greater nat cat investment as Australia flood insured loss hits $1.62bn

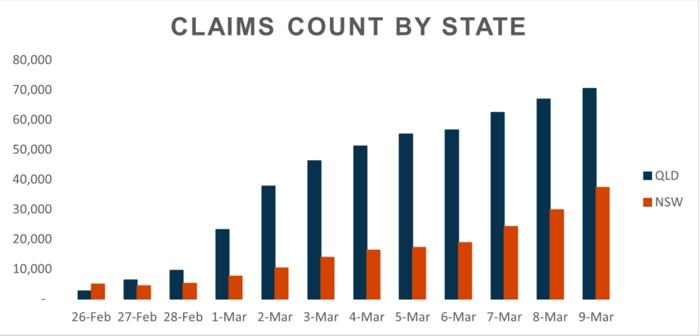

The Insurance Council of Australia (ICA) has reported that insurers in the country have received 107,844 claims from the severe flooding in Southeast Queensland and New South Wales, lifting the insured loss estimate to $1.62 billion.

The latest data from the ICA related to the flooding is as of March 9th, 2022, and represents an 11% increase on the number of claims reported yesterday.

The uplift is a result of a 25% daily increase in the number of claims from New South Wales, which now account for 35% of the total, with 65% of claims from Queensland.

Across both states, the ICA says that 80% of total claims are for domestic property, 17% are for motor vehicles, and 3% are commercial property claims.

In response to the event, the Federal Government has today declared a national emergency, which shows just how severe the disaster is.

The ICA says that greater funding for support measures, clean-up and recovery is welcomed, and highlights the importance of greater funding for measures that improve protections against the impacts of similar events in the future.

In fact, the Productivity Commission has reportedly found that across the country, 97% of natural disaster funding is spent post-event, with just 3% spent on resilience pre-event.

The ICA, alongside insurance carriers in Australia, have consistently called for the Federal Government to increase its investment in this area to $200 million per year, matched by states and territories.

Andrew Hall, the ICA’s Chief Executive Officer (CEO), commented: “Yesterday’s wild weather in New South Wales has seen a big lift in claims from that State, and as the insured damages bill passes $1.5 billion we can see that this event is shaping up to be one of Australia’s most expensive floods.

“The Insurance Council welcomes the Prime Minister’s announcement today of a national emergency declaration. It is important for policyholders to note that a declaration by any government or indeed the Insurance Council has no effect on the application or coverage of a policy, including the excess if there is one.

“The General Insurance Industry Code of Practice commits insurers to respond to catastrophes efficiently, professionally, practically, and compassionately.”

The chart, provided by the ICA, details the claims count by state.