IBT’s and Divisions – News and Noteworthy Developments

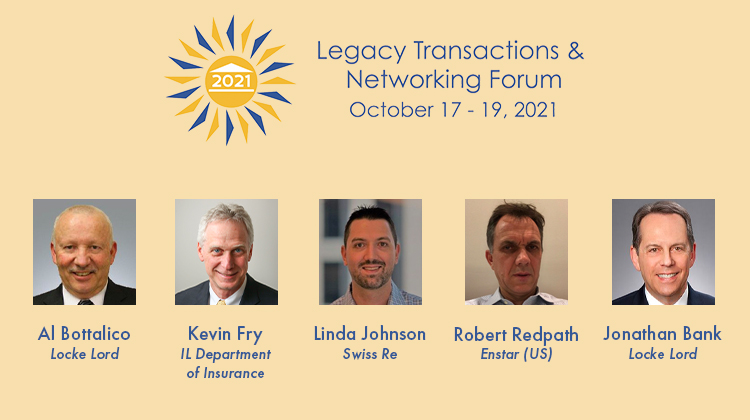

One of the highlights of the 2021 Legacy Transactions & Networking Forum hosted by AIRROC was the presentation by industry leaders and experts on the current legal and regulatory landscape affecting the Insurance Business Transfer (“IBT”) and Division space. Jonathan Bank, Of Counsel, Locke Lord LLP, chaired the panel of state regulators, stakeholders, and experienced professionals who discussed recent developments and shared their view of such tools and frameworks for addressing legacy books. A video replay of this presentation is available “on demand” to members on AIRROC’s video library platform.

The presentation started with an update by Al Bottalico, a former Deputy Commissioner of the California Insurance Department, now an Insurance Specialist with Locke Lord LLP on the NAIC’s progress and long-awaited White Paper on insurance company restructurings, namely IBTs and Corporate Divisions. The Restructuring Mechanisms (E) Working Group tasked with the development of consistent statutory approaches and best practices has issued a draft of the White Paper. A copy of the draft White Paper can be found here. It is anticipated that it will be finalized and circulated for comment at the December meeting in San Diego. The White Paper will begin the process of establishing the necessary guidance and will include recommendations on written standards that will be needed in order to increase familiarity and confidence in IBT transactions by regulators before there can be widespread acceptance among regulators. The guidance will also likely generate referrals to other working groups and subgroups at the NAIC. One of the early concerns raised by regulators was the potential use of IBTs on long-term care insurance (“LTCI”). The Restructuring Working Group has recognized that LTCI blocks may be too complicated and present unique issues so a separate subgroup was established in conjunction with the Long- Term Care Insurance Task Force to review those issues and make separate recommendations. Al shared his view that over the next 12 to 18 months there will likely be a lot more activity by state regulators in this space.

Robert Redpath, Senior VP and Corporate Counsel, Enstar, added his view that it is important that the industry lead in establishing uniform standards with robust procedures. Enstar decided not to wait for the NAIC guidance and instead believed that the only way to move the needle forward with respect to IBTs in the US was to proceed. In other words, move from theory to practice. Enstar worked closely with the Oklahoma Department; there was a learning curve for everyone involved in this first-of-its-kind transaction in a court-managed process. Although it was an internal group transaction between Providence Washington Insurance Company and Yosemite Insurance Company – one Enstar entity to another Enstar entity – it was a very complex book with a full spectrum and wide range of business, including long-tail business dating back 50 years. Despite the hurdles in breaking trail, the Enstar plan received no objections. The key takeaway is that concerns are greatly reduced in the IBT process in the US if you do your due diligence and follow the procedures with a properly vetted transaction.

In retrospect, one area the system can be tweaked is a more focused look at the communications plan. The Oklahoma regulators and court were intently interested in ensuring appropriate notice to a large number of potentially affected policyholders. Ensuring due process to those having an interest in the transaction being the key element. Enstar was overly cautious and notified over 60,000 former policyholders, not only once but twice. In reality, the process was excessively broad and time consuming given that very few comments were received and no objections were filed. The salient point is to work with the regulators to strike a balance in identifying relevant parties who could have an interest so that the administrative burdens do not kill the process and outweigh the goals.

The final chapter in the Enstar IBT transaction is that it recently closed on the sale of Providence Washington Insurance Company as a clean shell. Robert walked through the benefit to old policyholders of the IBT mechanisms in cleaning out the shell versus the classic shell sale transaction using a LPT structure.

The next presenter was David Presley, Senior Legacy Origination Manager, Swiss Re who noted that legal finality is the objective but nonetheless recognizes that the market and regulators need time to develop standards and get a comfort level with IBT transactions. He concurred with Robert’s comments that we need more of the right deals done the right way. These first few deals have been completed with out controversy and have encounter very little push back. Swiss Re is focused on identifying the right transaction for an IBT and doing it the right way. The mature long-tail book of business in their view is a perfect candidate for these types of transactions because of the greater degree of actuarial certainty. Financial transparency is paramount which underscores the need for robust independent expert reports. As for his preference for IBTs or Divisions, both are viable options because they both achieve legal transfer. While the IBT framework provides more procedural safeguards such as court approval, independent expert reports and consent from the transfer jurisdiction, both IBTs and Divisions provide insurers with additional tools to work toward finality.

Kevin Fry, Chief Operating Officer of the Illinois Department of Insurance spoke about the Division Law passed by the Illinois General Assembly in 2018. The legislation was an industry driven initiative in which the Department was neutral but once introduced, the Department added their safeguards. Kevin walked through the major criteria that the Department looks at when reviewing plans of Division. The overarching criterion, of course, is to ensure protection to policyholders and claimants. Most of the other requirements are qualitative, such as: (1) the companies must be properly licensed, (2) they must be members of guarantee associations, (3) the Division does not violate the Uniform Fraudulent Transfer Act, (4) that it is not being made for purposes of hindering, delaying or defrauding policyholders or other creditors; (5) the companies must be solvent; and (6) the remaining assets will not be unreasonably small in relation to liabilities.

Kevin also outlined the keys to success for a Division transaction. The number one key is to approach the Department early on in the process; well before filing the plan. Early engagement and collaboration with regulators can be vital in terms of avoiding future pitfalls. A lot of work, which can be shielded as confidential, can take place in advance of filing. Use of outside consultants and legal expertise is another essential element. With the Allstate plans of Division, the Department hired a project manager and outside counsel. Financial experts, actuarial and capital adequacy consultants were also crucial. In addition, the Department itself must have internal staff that has the expertise to review and understand the outside reports and take all of the various pieces of information to come to the right conclusion. Communication with other regulators is important as well. The Allstate transaction was fairly straightforward as there was only one other state, Michigan that was involved. The Michigan regulators were made aware of the situation early on and there was an open dialog through out the process so that they were comfortable.

As far as lessons learned, the communication piece is going to play a major role in the transaction. The financial solvency part is paramount and this is where the expert consultants come into play. The importance of selecting the right hearing officer is also critical. A retired Judge served as the hearing officer in the Allstate transaction. The Allstate Division was a case of first impression and the Department was very keen to do a comprehensive and thorough job.

The presentation ended with the Panelists taking audience questions, moderated by Jonathan and Marcus Doran, Senior Director Commutations, Reinsurance Finance, AIG. Most of the questions focused on some of the details of the Enstar and Allstate transactions. A member of the audience, Russ Galbraith, Chief Deputy Commissioner of the Arkansas Insurance Department, noted that earlier this spring, Arkansas joined the handful of US states in adopting an IBT law. He also announced that the Arkansas Department just promulgated rules necessary for implementation of the IBT Act that become effective January 1, 2022. There was some skepticism expressed by the audience as to whether the NAIC White Paper will open the floodgates to other states enacting IBT or Division legislation. The point was made you do not need all 50 states to adopt the IBT or Division Model Act but rather just one platform. The guidance will be the glue that gives regulators from other states confidence that the states engaged in these transactions are following the prescribed process. The industry must jump in and promote the IBT and Division structures to obtain buy-in from regulators. There is a growing momentum for these transactions in a market that is looking for restructuring options.

A special thanks is due to Robert Romano of Locke Lord LLP who was instrumental in assembling the panel and assisting with the presentation.

Please follow and like us: