IBC seeks to bridge protection gaps a decade after devastating floods

IBC seeks to bridge protection gaps a decade after devastating floods | Insurance Business Canada

Catastrophe & Flood

IBC seeks to bridge protection gaps a decade after devastating floods

The event sparked a national conversation

Catastrophe & Flood

By

Mika Pangilinan

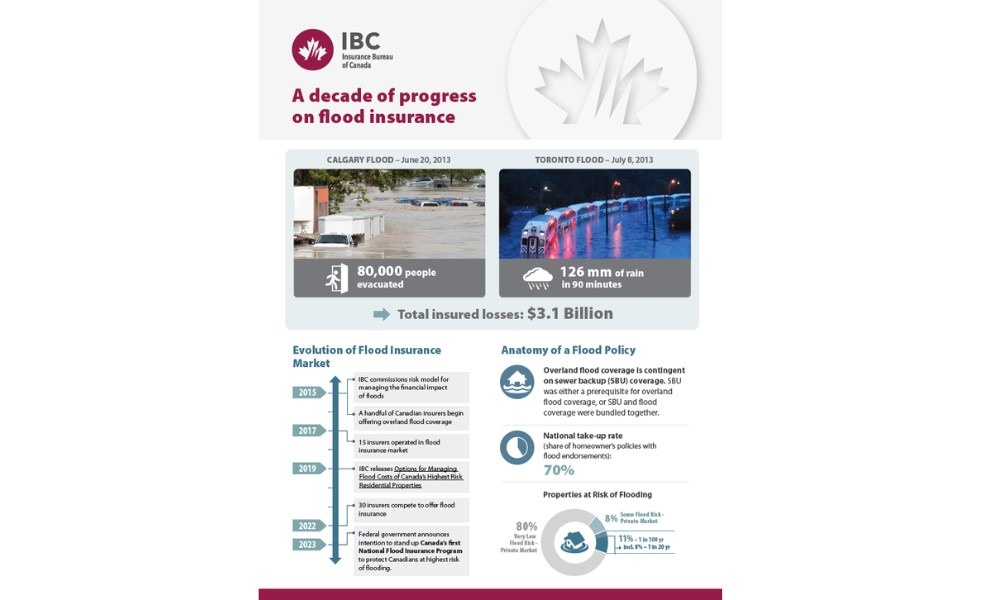

Ten years since devastating floods wreaked havoc in Calgary and Toronto, the Insurance Bureau of Canada said that much progress has been made to ensure better financial protection for Canadians against flood.

Celyeste Power, president and CEO of the Insurance Bureau of Canada (IBC), reflected on the floods in a statement, highlighting the national discussion it raised on the need for comprehensive insurance coverage against natural disasters.

What happened during the 2013 Calgary and Toronto floods?

On June 20, 2013, Calgary and its surrounding communities were struck by one of Canada’s worst natural disasters. The flooding forced nearly 80,000 people from their homes, caused extensive damage to thousands of properties and businesses, and took the lives of five individuals.

Two weeks later, on July 8, 2013, two storm cells swept over the Greater Toronto Area, unleashing record rainfall that resulted in the most severe flooding the region had experienced since Hurricane Hazel in 1954.

According to Power, these two flood events resulted in approximately $3.1 billion in claims paid out by the country’s property and casualty insurers.

She said the financial toll of the disasters sparked a national conversation about the lack of financial protection from flooding that many Canadians faced, pushing insurers to develop Canada’s first overland model flood insurance product.

Power stressed the importance of a national flood insurance program, especially as flooding in 2021 caused by atmospheric rivers in southern British Columbia worsened the protection gap for properties in known flood plains considered too high-risk to underwrite.

“We hope this program can be up and running in two years,” she said. “At a time of increasing risk from flood, Canadians at high risk deserve to have access to protection in a way they don’t right now.”

Canada has witnessed 35 catastrophic flooding events since 2013, according to IBC, each resulting in insured losses exceeding $30 million.

On average, these events have caused close to $800 million in annual insured losses over the past decade. Currently, 30 insurance providers operate in the flood insurance market nationwide, and approximately 90% of homeowners have access to such coverage.

What are your thoughts on this story? Feel free to comment below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!