IAG’s aggregate reinsurance shrinks & attachment rises at renewal

Australian primary insurance giant Insurance Australia Group (IAG) has announced the renewal of its aggregate catastrophe reinsurance cover at more stringent terms, with less protection secured and at a higher attachment point for the second year running.

IAG’s experience in persisting with an aggregate reinsurance cover is indicative of reinsurance market conditions, where reinsurance carriers are shying away from frequency and secondary peril event losses.

Recall that IAG had renewed its $10 billion catastrophe reinsurance tower for 2023 back at the January renewals, seeing its maximum first-event retention has risen 75%, which the company said was in response to inflation and global reinsurance market conditions.

Now, as is customary for the insurer, IAG returns to renew its aggregate reinsurance and has experienced similar market conditions it seems.

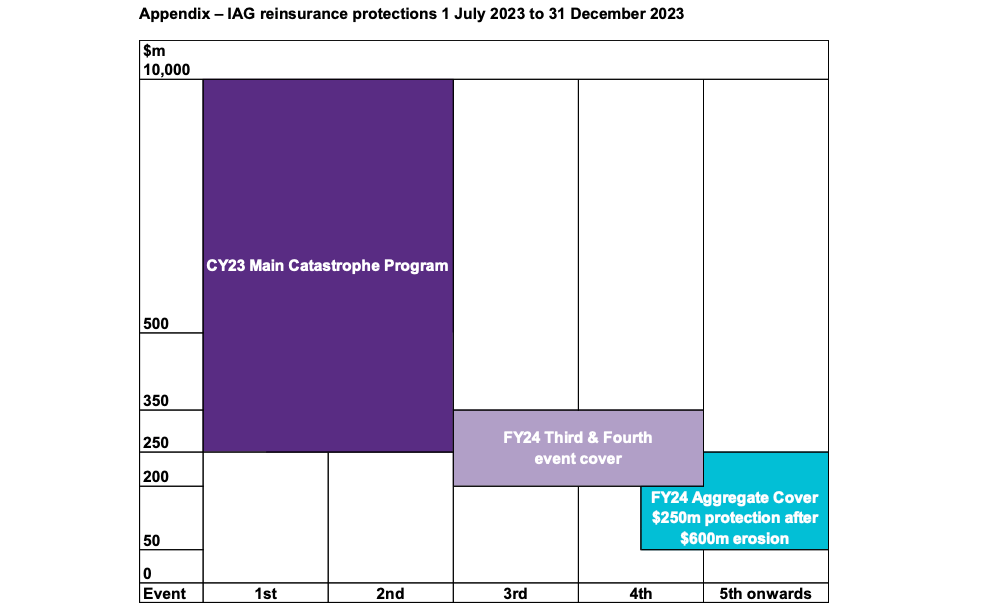

A year ago, IAG’s aggregate reinsurance was renewed to provide it $350 million of cover in excess of a $500 million attachment point.

At the mid-year 2023 renewals, the aggregate reinsurance has been renewed to provide IAG $250 million of cover, in excess of a $600 million attachment point, so providing $50 million less cover at more onerous terms f a $100 million higher attachment level, it appears.

For the 2023 through 2024 aggregate reinsurance, IAG again has individual qualifying events capped at $200 million of losses in excess of $50 million per event, while third and fourth event occurrence covers have been purchased to provide $150 million of protection for events greater than $200 million (last year it was $100m for events above $150m).

The aggregate reinsurance has been 67.5% placed, reflecting IAG’s whole-of-account quota share arrangements, which is typical for the insurer.

Remember that just earlier this week, IAG’s fellow Australian insurance giant Suncorp renewed its catastrophe reinsurance and dropped its aggregate cover completely from the renewal.

This, alongside the reduction in coverage and worse terms IAG has received, are clearly indicative of the hard reinsurance market environment.

IAG also renewed its 2.5% whole-of-account quota share reinsurance arrangement with Hannover Re, that had been due to expire on 30 June 2023. The new quota share arrangement is effective from 1 July 2023 and has a term of five years.

IAG Chief Financial Officer, Michelle McPherson commented, “IAG has now renewed all four whole-of-account quota share reinsurance arrangements with leading global reinsurers. The 32.5% quota share arrangements are an important part of IAG’s capital structure, providing certainty for the next five to seven years.

“The quota share arrangements have been renewed providing materially consistent financial outcomes and are particularly valuable in a challenging reinsurance market. These arrangements cover 32.5% of all gross claims costs, meaning we are only required to purchase 67.5% of the main catastrophe program in global reinsurance markets.”

Of course, IAG has benefited from its aggregate reinsurance in recent years, but as the attachment increases it becomes less likely to attach in any given year, so can reduce the usefulness of this cover, while at the same time the cost of coverage has risen.

Including its quota share arrangements, IAG has now a maximum event retention of $169 million for a first and second event.

.