Hurricane Milton is biggest potential ILS market threat since Ian in 2022: Steiger, Icosa

As hurricane Milton heads towards Florida, the developing storm situation poses the biggest potential threat to the insurance-linked securities (ILS) market since hurricane Ian in 2022, according to Florian Steiger, the CEO of catastrophe bond investment manager Icosa Investments AG.

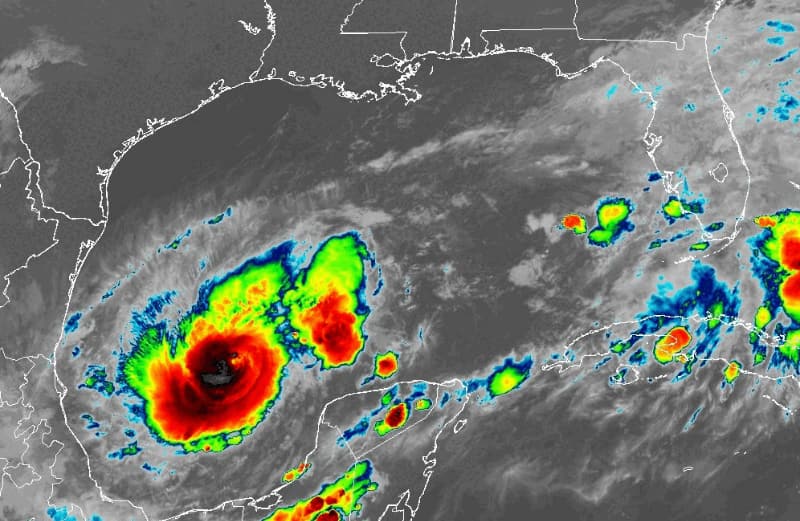

Hurricane Milton is organising and heading east towards Florida, while forecast models suggest rapid intensification over the next couple of days then some slight weakening prior to landfall sometime on Wednesday. There remains uncertainty over its eventual landfall location, but Milton’s wind field is expected to grow and the storm poses a meaningful insurance industry loss threat, it appears at this time.

Model agreement remains strong for a potentially significant hurricane landfall somewhere on the Florida Gulf coast, with the Tampa Bay area still seemingly favoured by most models and so the insurance, reinsurance, catastrophe bond and insurance-linked securities (ILS) market is watching closely and preparing for the chances of a relatively meaningful loss event.

Read our hurricane Milton update from earlier this morning.

Florian Steiger, CEO of cat bond fund manager Icosa Investments AG, warned Sunday that the still tropical storm Milton at the time was a threat the ILS market needed to watch closely.

“Next week could bring significant developments for the reinsurance industry and cat bond investors. Tropical Storm Milton is shaping up to be a high-impact event, potentially causing major losses for the Florida insurance sector. While it’s too early to predict the storm’s full impact, uncertainty remains about whether it will also trigger losses for reinsurance and cat bond markets,” Steiger explained.

Adding that, “For now, Milton poses the biggest potential threat to the ILS market since Hurricane Ian in 2022.”

Icosa Investments explained more on the storm and the possible impacts in a LinkedIn post.

“Current forecasts suggest that Milton could make landfall at major hurricane strength on Florida’s west coast either Wednesday or Thursday. While the exact path is still unknown, there is a possibility that the heavily populated Tampa area could be affected,” the company said.

Adding, “It is currently too early to estimate potential damages for the insurance industry and consequently for cat bond investors, as both the intensity and trajectory remain uncertain.

“However, we want to highlight that Milton has the potential to cause massive damage in one of Florida’s most densely populated regions. Losses for cat bond investors cannot be ruled out at this point.”

Icosa Investments went on to highlight that, should Milton be an impactful and costly loss event it could trigger a range of ILS instruments, from catastrophe bonds through private ILS reinsurance and retrocession arrangements.

“If the storm fails to become a major hurricane status or avoids densely populated areas, no or minimal losses are expected in the cat bond market,” Icosa Investments said.

“However, if Milton makes landfall as a Category 3 or higher hurricane near the metropolitan area of Tampa, insured losses in the mid-double-digit billion-dollar range are not out of the question.

“Similar events, such as Irma in 2017 and Ian in 2022, had immediate impacts on cat bonds, while medium-term risk premiums spiked, allowing investors to achieve record returns in the following years.

“In addition to cat bonds, private ILS and private reinsurance layers, which tend to have lower attachment points, are significantly at risk.”

You can track this and every Atlantic hurricane season development using the tracking map and information on our dedicated page.