Hurricane Milton industry loss at $25bn+ changes pricing narrative: Goldman Sachs

Analysts at Goldman Sachs believe that a hurricane Milton insurance industry loss of above $25 billion will be sufficient to change the pricing narrative for property catastrophe risks at the end of year reinsurance renewals.

They note that still loss projections are coming in a very wide range, with anything up to triple digit billions still projected by model runs.

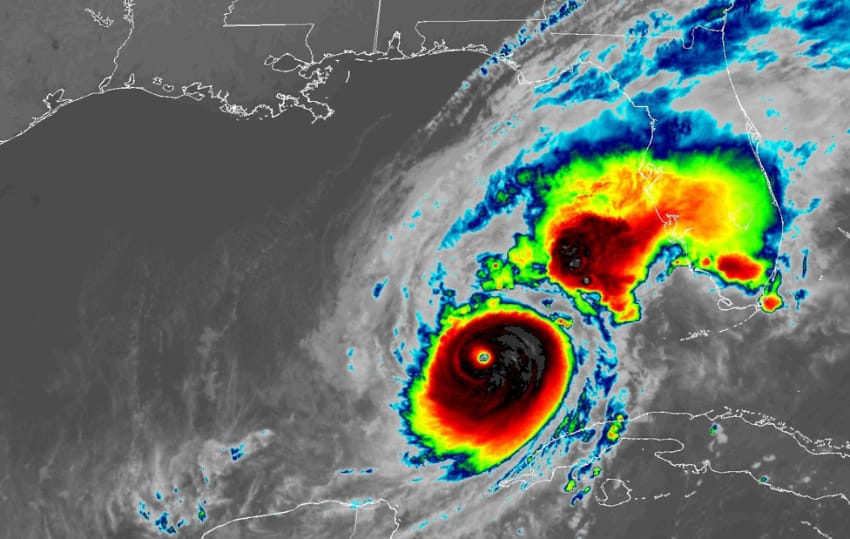

As hurricane Milton’s forecast track has shifted slightly south of Tampa Bay it is easy to think the worst case scenarios may be off the table. But there remains significant uncertainty and, with wind shear expected to influence the storm and expand its wind field, there could still be wobbles in the path and fluctuations in still major hurricane Milton’s direction and impacts.

Which makes it challenging for the insurance, reinsurance, catastrophe bond and insurance-linked securities (ILS) industry to know just what kind of financial impact to expect still.

As we reported earlier, Andrew Siffert of BMS Group wrote that he feels it is safe to say that hurricane Milton is likely to be at least a $20 billion insurance market loss event.

We also reported that Euler ILS Partners gives a roughly 33% chance that industry insured losses from hurricane Milton rise above $50 billion.

While catastrophe bond fund manager Icosa Investments said the difference between best and worst case hurricane Milton insurance industry losses ranges from $15bn to $150bn+, with the corresponding hit to the cat bond market anything from zero to as much as 15%.

All of which drives home the still substantial uncertainty in the eventual losses hurricane Milton will bring, with the precise landfall locations, size of the storm, heights of storm surge that run onshore and the path across Florida all set to define the eventual impacts.

What is clear at this stage is that hurricane Milton remains an extremely dangerous storm for west-central Florida coastal communities and those in its path as it moves inland, so it is to be hoped that evacuation orders are being followed.

But also becoming increasingly clear is the fact the losses it does drive will have the potential to be market-moving.

Goldman Sachs analyst team said that hurricane Milton has the potential to change the trajectory of future property and property catastrophe reinsurance pricing.

While also having meaningful implications for the Florida insurance marketplace and those companies most active in it.

The Goldman Sachs analysts said, “We think that a $25bn+ storm starts to change the pricing narrative that we had previously laid out for reinsurance property CAT (mid-single-digit rate decrease at 1/1/25 absent material incremental CAT losses), while all implications for that FL property insurance market are unfavorable for a state that has been heavily impacted by insurance increases in recent years.”

Adding that, “Insurance brokers likely benefit from stronger pricing all-else equal, while insurers are impacted by yet another year of total annual catastrophe losses well-in-excess of $100bn.”

Homeowners insurers could take the biggest share of losses, as well as their reinsurance panels, the analysts believe, followed by commercial lines and personal auto carriers.

Exactly how losses fall depends on the eventual passage across Florida and its intensity, as well as the storm surge peak heights and locations.

Hurricane Milton remains a dangerous Category 4 storm with 155 mph winds and is still expected to push across Florida while retaining its hurricane wind speeds, so the path inland could be just as critical to the eventual industry loss as the landfall location is, it seems.

At greater than a $25 billion insurance industry loss, hurricane Milton would take annual catastrophe losses well above the $100 billion level again, it seems, as third-quarter global losses are seen into the $30 billion range by some analyst reports we’ve seen and first-half were estimated above $60 billion.

That should serve to steel reinsurer and ILS manager resolve for maintaining attachment points at higher levels and to be less flexible on price at the January 2025 reinsurance renewals, suggesting thoughts that a slight softening would be seen in property cat may now be less likely.

You can track this and every Atlantic hurricane season development using the tracking map and information on our dedicated page.

Also read:

– Hurricane Milton cat bond loss potential still in wide range: Icosa Investments.

– Hurricane Milton seen denting cat bond market -1.4% (excl. surge): Plenum.

– 33% chance hurricane Milton loss above $50bn. Would drive hard market: Euler ILS Partners.

– Hurricane Milton Cat 5 again. Tracks slightly south. Uncertainty still high, loss range wide.

– Safe to say hurricane Milton likely a $20bn+ insurance market event: Siffert, BMS.

– Hurricane wind speeds forecast across entire Florida Peninsula as Milton approaches.

– Mexico’s catastrophe bond presumed safe from hurricane Milton.

– Stone Ridge leads managers cutting mutual cat bond or ILS fund NAVs on hurricane Milton.

– Hurricane Milton could be a huge test for the entire (re)insurance market: Evercore ISI.

– Hurricane Milton losses could amount to tens of billions, but uncertainty high: BMS’ Siffert.

– As hurricane Milton intensifies, Mexico’s catastrophe bond comes into focus.

– Material hurricane Milton losses could change 2025 property reinsurance price trajectory: KBW.

– Cat bond & ILS managers explore options to free cash, as hurricane Milton approaches.

– Hurricane Milton: First Tampa Bay storm surge indications 8 to 12 feet.

– Hurricane Milton is biggest potential ILS market threat since Ian in 2022: Steiger, Icosa.

– Hurricane Milton forecast for costly Florida landfall. Cat bond & ILS market on watch.