Hurricane Milton Cat 5 again. Tracks slightly south. Uncertainty still high, loss range wide

This morning hurricane Milton has strengthened back to a Category 5 major hurricane overnight, with sustained wind speeds of 160 mph and gusts estimated at over 200 mph. Last night, Milton wobbled slightly south of the NHC forecast cone center line, but remains locked onto Tampa Bay, with a track consensus just slightly to the south.

There remains significant uncertainty over the eventual landfall impacts from hurricane Milton and a deviation of just a few miles north or south, in the eventual landfall location, can have a significant bearing on eventual industry losses. As a result, the range of losses being discusses remains fairly wide, although slightly narrower than yesterday.

Critical now, especially to the impacts to the Tampa Bay area and metro, is hurricane Milton’s trajectory into the area at landfall, as well as exact location.

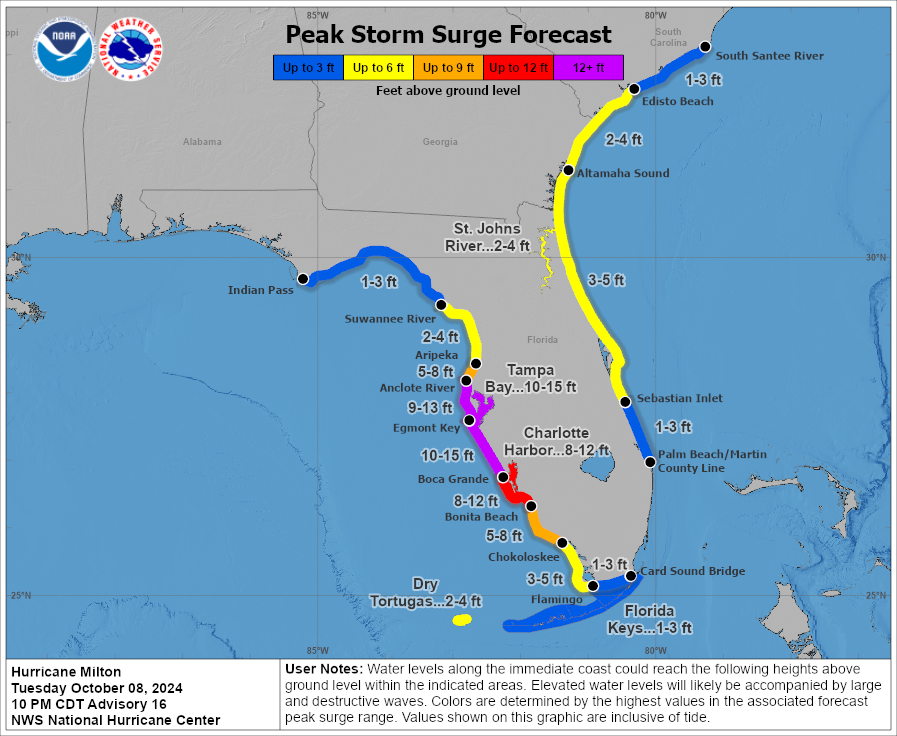

A landfall south of Tampa Bay can still be costly, but less so than a landfall slightly to the north that would push the highest storm surge directly into the Bay and likely flood the down town area.

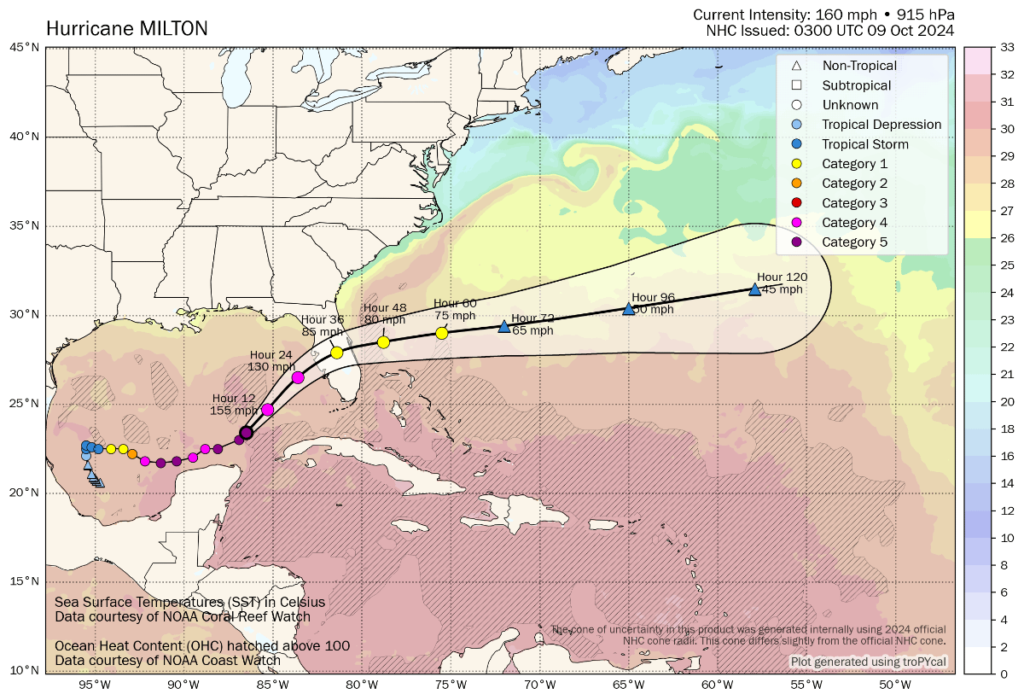

The latest location and forecast wind speeds for hurricane Milton can be seen below, from Tomer Burg. Milton is still forecast to weaken as it approaches landfall, as interaction with a trough, wind shear and a jet bring its sustained winds down to Category 3 at around 130 mph, but at the same time Milton will grow and impacts spread to a wider area.

With the NHC’s forecast cone, as you’ll know, the dots are linked by a curved line and it is unreasonable to think Milton will take precisely that path, which adds another element of uncertainty.

Forecast models are showing Milton moving north-eastward towards Tampa, but then taking more of an easterly direction into land. Some others show a direct north-easterly passage to Tampa Bay. Again, there are differences in the eventual insurance, reinsurance, catastrophe bond and insurance-linked security (ILS) market losses to be expected under every scenario.

The exact track between those dots, or location intervals, prior to and after landfall are another important factor and one that the NHC’s forecast cone diagram does not show too well.

As we’ve been explaining for days, landfall location, intensity at that time, size of storm and wind field, plus the trajectory and path followed ashore and inland, are all critical to defining the eventual loss to insurance, reinsurance, cat bond and ILS markets.

Our sources continue to suggest that losses range up to the triple digit billions, for the very worst case scenarios.

Overnight, the track has come slightly south and the landfall location for some models is now south of the mouth of Tampa Bay, suggesting that if that comes to pass the worst case scenarios may be off the table (still a big if, as a wobble back north is always possible).

The visible eye of hurricane Milton continues to track slightly south of both the ensemble mean and NHC forecast track this morning. This may have a bearing on landfall, or it could just mean a more angled approach to Florida before a turn east.

But, what we are hearing this morning is that bottom-end loss estimates are rising as the landfall location indications narrow and as time passes a loss in the tens of billions remains the most likely outcome, with many sources still suggesting that Milton could still be a more than $50 billion market loss even with landfall just south of Tampa Bay, unless further shifts south are seen and it landfalls in a less exposure-concentrated area.

As we reported earlier, $20 billion may now be a good place to start from.

Storm surge height indications haven’t come down at all and could still rise as hurricane Milton expands its wind field as expected on approach to Florida.

The industry must be ready for potential worst case scenarios still, it seems, with uncertainty still over the eventual landfall location hurricane Milton could still deliver surprises to the up and down sides.

In its latest update, the NHC discusses the expected trajectory of hurricane Milton, which shows how the direction of travel will change.

This is possibly the biggest factor in landfall location now, exactly where and how early the hurricane turns more eastward towards land, as Milton bumps up against a trough to the north.

The NHC said, “Milton is moving toward the northeast near 12 mph (19 km/h). A northeastward motion with some increase in forward speed is expected through tonight. A turn toward the east-northeast and east is expected on Thursday and Friday. On the forecast track, the center of Milton will move across the eastern Gulf of Mexico today, make landfall along the west-central coast of Florida late tonight or early Thursday morning, and move off the east coast of Florida over the Atlantic Ocean Thursday afternoon.

“Maximum sustained winds are near 160 mph (260 km/h) with higher gusts. Milton is a category 5 hurricane on the Saffir-Simpson Hurricane Wind Scale. Fluctuations in intensity are likely while Milton moves across the eastern Gulf of Mexico, but Milton is expected to be a dangerous major hurricane when it reaches the west-central coast of Florida.

“Hurricane-force winds extend outward up to 30 miles (45 km) from the center and tropical-storm-force winds extend outward up to 140 miles (220 km).”

We’ll be looking at those figures on the size of hurricane Milton in future updates throughout the day, as so far the expansion has not begun in earnest.

But meteorologists are saying that Milton is now beginning to show signs of the transition to a much larger storm, with a broader wind-field, so the extent of damaging winds is likely to grow significantly and its potential to push storm surge waters up against the Florida coast may grow as well.

Finally, it’s also worth highlighting some exposure related information that came out overnight.

First, CoreLogic said that 500,000 single-family and multifamily homes in Tampa Bay and Sarasota, Florida metropolitan areas with a reconstruction cost value (RCV) of approximately $123 billion are at potential risk of storm surge damage from Hurricane Milton, presuming a Category 3 landfall.

While Moody’s said that, over 235,000 commercial real estate properties in Florida have a greater than 50% probability of being exposed to wind speeds of at least 50 mph, the level after which some damage is likely. The total estimated value of these properties is $1.1 trillion.

Which gives you an idea of what’s at stake and how impactful hurricane Milton could be for Florida, its population and economy, as well as just how large the exposure is in the region Milton is heading for.

You can track this and every Atlantic hurricane season development using the tracking map and information on our dedicated page.

Also read:

– Safe to say hurricane Milton likely a $20bn+ insurance market event: Siffert, BMS.

– Hurricane wind speeds forecast across entire Florida Peninsula as Milton approaches.

– Mexico’s catastrophe bond presumed safe from hurricane Milton.

– Stone Ridge leads managers cutting mutual cat bond or ILS fund NAVs on hurricane Milton.

– Hurricane Milton could be a huge test for the entire (re)insurance market: Evercore ISI.

– Hurricane Milton losses could amount to tens of billions, but uncertainty high: BMS’ Siffert.

– As hurricane Milton intensifies, Mexico’s catastrophe bond comes into focus.

– Material hurricane Milton losses could change 2025 property reinsurance price trajectory: KBW.

– Cat bond & ILS managers explore options to free cash, as hurricane Milton approaches.

– Hurricane Milton: First Tampa Bay storm surge indications 8 to 12 feet.

– Hurricane Milton is biggest potential ILS market threat since Ian in 2022: Steiger, Icosa.

– Hurricane Milton forecast for costly Florida landfall. Cat bond & ILS market on watch.