Hurricane Milton Cat 3 landfall in Sarasota. Worst case Tampa loss scenarios avoided

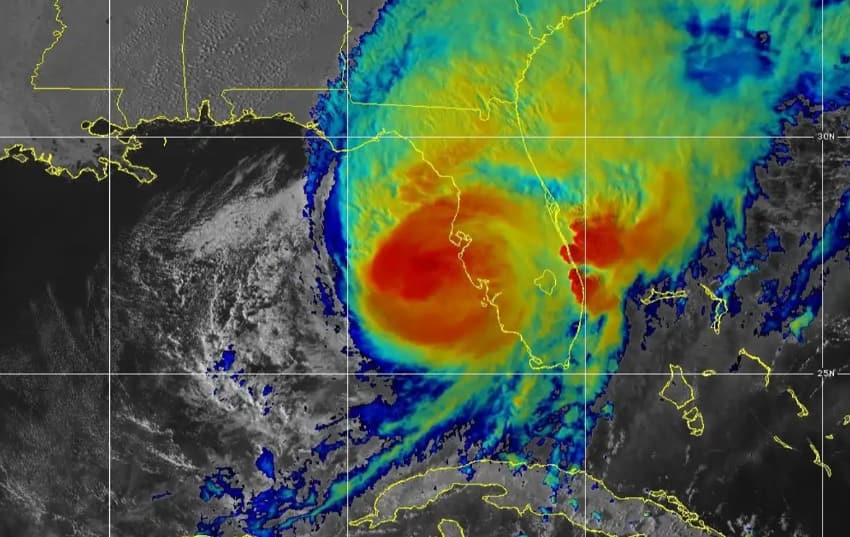

Hurricane Milton made a damaging category 3 landfall in Siesta Key, Sarasota County last night, which is south of Tampa Bay and so the worst case loss scenarios involving significant storm surge into Tampa metro have been avoided. But, Milton is still a large storm, with widespread hurricane wind speeds and impacts across the entire Florida Peninsula.

Hurricane Milton made landfall with 120 mph sustained winds and higher gusts.

Given its position at landfall, the surge into Tampa Bay was not close to the levels seen with Helene a few weeks ago and in fact as Milton passed Tampa tidal gauges eventually experienced a reverse surge, as Milton’s winds sucked water out of the Bay.

Further south of landfall, storm surge heights of 5 feet have been reported for areas such as Naples, but gauges are now broken and at this time there isn’t visibility of how much worse it might have got.

However, reports from storm chasers on the ground suggest the surge from hurricane Milton has not been as significant as seen with hurricane Ian in 2022.

Hurricane Milton was disrupted by wind shear as it approached land and began a relatively early extratropical transition as the jet stream interacted with the storm.

While this may have reduced some of the typical hurricane impacts, the weather system also drove a large number of tornadoes ahead of it, more than 10 inches of rainfall, still a relatively high surge, and most importantly for the eventual insurance and reinsurance market loss a wide and expansive wind footprint.

With a relatively fast forward speed, Milton has brought wind gusts at hurricane force right the way through central Florida, including for the I-4 corridor and Orlando metro, as well as to Daytona Beach as it now begins to move off Florida’s east coast.

As a result, the damage and eventual claims footprint from hurricane Milton could be wide reaching, lifting the ultimate insured loss figures.

Last night, as Milton was nearing land, sources were talking of the range of potential insurance and reinsurance market losses having come down somewhat, with the landfall location, expected lower surge as a result of the changes in storm structure and a drop in intensity.

Still, figures from $13 billion to almost $50 billion were being discussed in our conversations, but at that time the more concerning $70 billion plus numbers were being considered much less likely.

It’s important to note, there is enormous uncertainty in any loss projections made before, during and immediately after hurricane events. It takes time to understand storm impacts and longer still to understand the potential damage to exposed and insured property and assets, while a true reported claims loss estimate takes weeks or months to become available.

At this very early stage, it appears the worst case industry loss scenarios have been avoided, largely due to the fact hurricane Milton missed Tampa Bay and so surge losses will not have been as significant as feared.

Surge impacts also appear less severe than with hurricane Ian from early reports, but as we said the wide wind footprint and fact hurricane force gusts are hitting a huge area of Florida, means the eventual claims total will still be relatively high.

But it does seem more likely to be a sub-$50 billion industry event at this stage, which has ramifications for the catastrophe bond market’s exposure, as well as for other insurance-linked securities (ILS) and reinsurance contracts.

While reinsurance will undoubtedly respond to hurricane Milton, helping insurers par their claims, the share taken by the ILS market may now be lower than had been feared.

In particular, for catastrophe bonds, while it will take time to understand the potential for any direct loss impacts, it appears at this stage cat bonds may be less affected than projections had suggested, when Milton was heading nearer to Tampa.

We have to reiterate, it’s far too early for loss estimates. At this stage, all we can say is the damage reported so far appears less severe than seen with hurricane Ian in 2022, but the widespread wind footprint could still make hurricane Milton a much more meaningful insurance market loss than we saw with Helene a few weeks back.

In projections modelled by cat bond fund manager Icosa Investments, the company had highlighted a Sarasota landfall scenario as anything from $20 billion to a $70 billion industry loss, with a commensurate 0% to as much as 6% hit to the catastrophe bond market.

It is hard to say where losses may fall, but our sources that last night all suggested the industry loss could fall below $50 billion, absent any surprises, would seem to fall well into that Sarasota modelled landfall scenario, which at least gives somewhere to begin thinking about the potential for impacts. That would narrow the potential cat bond market hit range as well.

Greater clarity will emerge over the course of the coming days.

For cat bonds, there will be a lot of uncertainty it seems, particularly for aggregate erosion and any of the riskier indemnity cat bonds. But, many industry loss bonds may now appear safe, given a good number attach higher up than $50 billion.

For private ILS and collateralized reinsurance or retrocession, loss impacts will take longer to understand. But managers will go through their typical process of trying to understand how the quantum of damage experienced might affect their ILS fund portfolios. It isn’t until loss notifications come in, that a true picture of losses will become available.

It feels safe to say though, that for the vast majority of cat bond funds and ILS fund strategies, hurricane Milton will erode this year’s returns generated so far, but seems more unlikely to erase them. How much it erodes them remains to be seen.

At this stage, it’s safe to say the worst case scenarios associated with a Tampa Bay, or just north, landfall were avoided and that as a degraded storm Milton likely won’t reach the top-end of any of the modelled scenarios presented in advance of it reaching the Florida coast.

You can track this and every Atlantic hurricane season development using the tracking map and information on our dedicated page.

Also read:

– Hurricane Milton: Insurance, reinsurance, cat bonds, ILS ready to respond.

– Some mutual cat bond and ILS fund NAVs fall further on hurricane Milton threat.

– Hurricane Milton industry loss at $25bn+ changes pricing narrative: Goldman Sachs.

– Hurricane Milton cat bond loss potential still in wide range: Icosa Investments.

– Hurricane Milton seen denting cat bond market -1.4% (excl. surge): Plenum.

– 33% chance hurricane Milton loss above $50bn. Would drive hard market: Euler ILS Partners.

– Hurricane Milton Cat 5 again. Tracks slightly south. Uncertainty still high, loss range wide.

– Safe to say hurricane Milton likely a $20bn+ insurance market event: Siffert, BMS.

– Hurricane wind speeds forecast across entire Florida Peninsula as Milton approaches.

– Mexico’s catastrophe bond presumed safe from hurricane Milton.

– Stone Ridge leads managers cutting mutual cat bond or ILS fund NAVs on hurricane Milton.

– Hurricane Milton could be a huge test for the entire (re)insurance market: Evercore ISI.

– Hurricane Milton losses could amount to tens of billions, but uncertainty high: BMS’ Siffert.

– As hurricane Milton intensifies, Mexico’s catastrophe bond comes into focus.

– Material hurricane Milton losses could change 2025 property reinsurance price trajectory: KBW.

– Cat bond & ILS managers explore options to free cash, as hurricane Milton approaches.

– Hurricane Milton: First Tampa Bay storm surge indications 8 to 12 feet.

– Hurricane Milton is biggest potential ILS market threat since Ian in 2022: Steiger, Icosa.

– Hurricane Milton forecast for costly Florida landfall. Cat bond & ILS market on watch.