Hurricane Lidia strengthens on approach to Mexico. Risk to Fonden cat bond rises

Hurricane Lidia is bearing down on the western Pacific coast of Mexico with sustained winds of around 125 mph. Some additional strengthening is forecast, and the risk to the Mexican governments IBRD / FONDEN 2020 catastrophe bond has risen thanks to ongoing intensification of Lidia.

Hurricane Lidia is expected to be an impactful storm for the region of Mexico where it makes landfall, with hurricane force winds, up to a foot of rain and a dangerous storm surge all cited in the forecasts.

The center of hurricane Lidia is forecast to make landfall in west-central Mexico this evening or overnight, with the resort town of Puerto Vallarta one of the most exposed areas with higher concentration of economic values.

Updated as Lidia has rapidly intensified since we first published this article: Maximum sustained winds of hurricane Lidia have now increased to near 125 mph (205 km/h) with higher gusts and additional strengthening is forecast today, with the NHC warning that Lidia could still be at or near major hurricane strength as it approaches the coast.

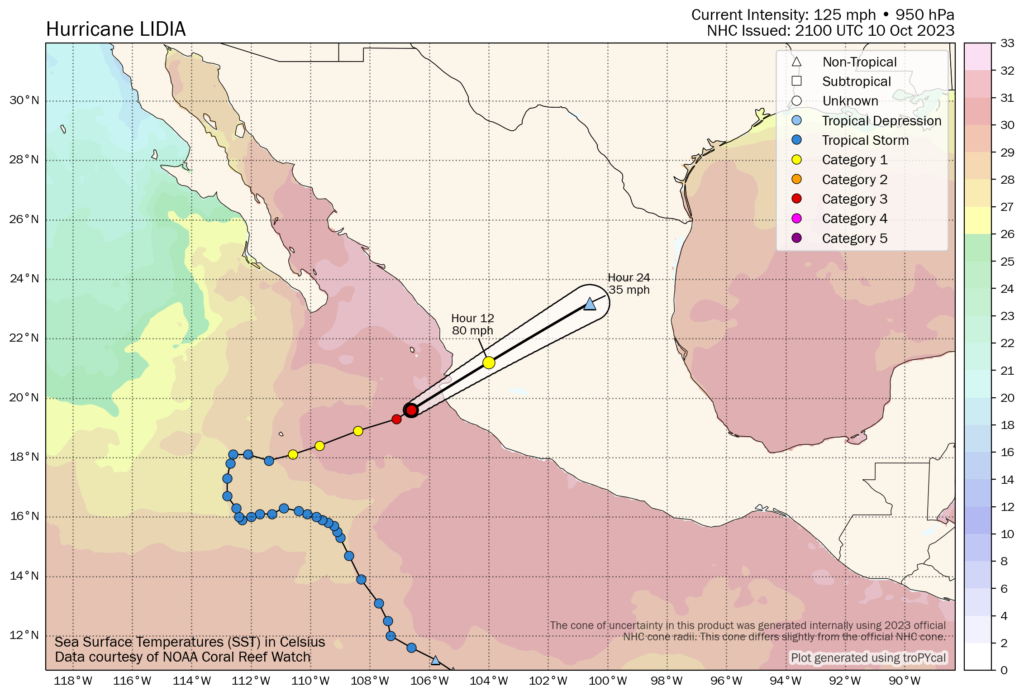

You can see the current position and forecast path for hurricane Lidia in the image below from Tomer Burg’s tropical cyclone website:

The latest forecasts suggest a chance of sustained winds reaching Category 3 to as much as Category 4 strength with higher gusts by landfall, which could cause significant impacts for the immediate landfall region, from winds and storm surge.

Hurricane Lidia has intensified rapidly in recent hours and if that continues it could begin to place the Mexican governments catastrophe bond closer to being at-risk of triggering.

Mexico sponsored the $485 million IBRD / FONDEN 2020 cat bond transaction in March 2020 to provide disaster insurance protection against major hurricanes and earthquakes.

Specifically, the transaction features a $125 million Class D tranche of notes that provide parametric insurance protection against Pacific hurricane events. These Class D notes came with a modelled expected loss of 4.06% at issuance.

The parametric trigger for the cat bond’s Pacific hurricane coverage is based on landfall location and minimum central pressure of any storm that approaches the Mexican coast.

Structured as a cat-in-a-box type arrangement, there is a line drawn along the coast of Mexico, with different grades of exposure, corresponding to a deeper, or lower, minimum central pressure that is required to trigger the cat bond, at the time a hurricane crosses the parametric box (or line) structure.

On the Pacific coast of Mexico, in order for the Class D Fonden 2020 cat bond notes to face any loss, the minimum central pressure of hurricane Lidia would need to fall to 935 mb or below.

The cat bond has been designed to respond to the most severe of hurricanes, with three tiers of payout possible, starting at a 25% payout of the Class D tranche for a storm with a central pressure at or below the 935 mb threshold.

When we first published this article, the latest update from the NHC puts the minimum central pressure of hurricane Lidia at 971 mb, meaning the storm would need to rapidly intensify and its pressure deepen for the cat bond notes to be threatened.

Lidia then intensified faster than forecasters were anticipating, with its central pressure having dropped to 959 mb.

Now, as of the latest update from the NHC, hurricane Lidia’s minimum central pressure is estimated as 950 mb.

As Lidia has intensified further, the risk to the Mexico cat bond has risen somewhat, and with this continuing it is now less certain whether the central pressure will dip sufficiently further to near the trigger parameter.

While some additional intensification is forecast as still possible, there are just hours left to go until landfall, but at this time it is now beginning to seem possible that hurricane Lidia could reach the low central pressure level necessary to trigger the notes.

As the central pressure continues to fall, it could place some uncertainty on these cat bond notes now, given the best track data is the determining source and that can take some time to be reported.

We’ll now have to see what the pressure reported at landfall is, as that should give a better picture of how at-risk, or not, the Class D cat bond notes are.

The impact to those in the landfall region looks increasingly likely to be significant and the forecast for up to 12 inches of rainfall as Lidia moves ashore could cause widespread impacts further afield in the region of Mexico.

You can read all about the $485 million IBRD / FONDEN 2020 catastrophe bond and every other cat bond transaction in the Artemis Deal Directory.