Hurricane Idalia insured losses could hit $9.36 billion – report

Hurricane Idalia insured losses could hit $9.36 billion – report | Insurance Business America

Catastrophe & Flood

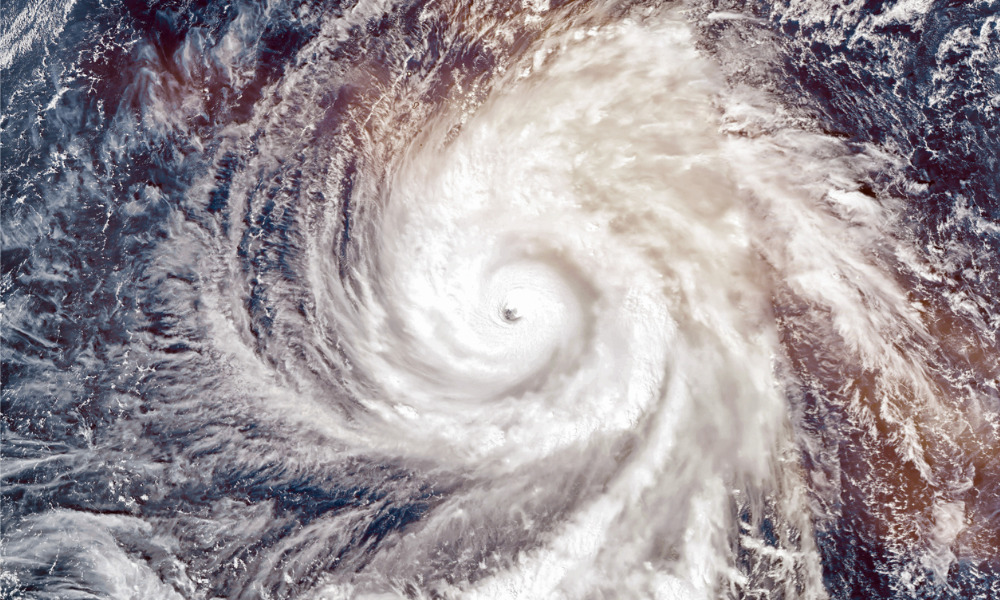

Hurricane Idalia insured losses could hit $9.36 billion – report

Hurricane could become one of the top 10 costliest in the US

Catastrophe & Flood

By

Jonalyn Cueto

Hurricane Idalia arrived in Florida on Thursday as a Category 3 storm, leaving an estimated damage of up to $20 billion. According to a Reuters report, UBS bank has estimated the average insured losses could reach as much as $9.36 billion, which was based on August 28 data. This includes a 50% chance of losses of over $4.05 billion and a 10% chance of losses of $25.6 billion.

A Fox Business report has described the insurance claims for the impact of Hurricane Idalia would become one of the top 10 costliest hurricanes to hit the United States.

Insurers have reported hefty losses with the Ukraine War and an increasing number of wildfires and hurricanes hitting states like Florida and California. Reinsurers have increased the rates on key coverages by as much as 50% from July 1.

Thomas Hayes, chairman and managing member of Great Hill Capital LLC in New York, told Reuters that insurers would likely raise prices following natural disasters. In July, according to reinsurance broker Gallagher Re, reinsurance rates for renewals jumped by 30% up to 50%. In the case of Florida, the rates increased by 30% to 40%.

Other insurance firms have pulled out of Florida due to the risk of heavy losses, according to a USA Today report. Among these firms include Farmers Insurance, Bankers Insurance and Lexington Insurance, a unit of AIG (AIG.N).

Meanwhile, the fleeing of these firms resulted in Florida’s non-profit, state-backed insurance provider Citizens Property Insurance Corp gaining market share over the past year, according to UBS. Michael Peltier, a spokesperson for Citizens Property Insurance, said the company could fund claims for damages by Hurricane Idalia.

“There’s no issue with us paying claims to policyholders,” Peltier said.

Florida has begun its assessment of the damage left by the storm.

Keep up with the latest news and events

Join our mailing list, it’s free!