Hurricane Ian to test ILS fund & reinsurer (re)underwriting discipline

As major hurricane Ian approaches Florida, it’s clear this storm could be the first major test for the re-underwriting that ILS fund markets have been undertaking over the last few years and renewal seasons, providing a test for ILS fund manager and reinsurer processes and discipline.

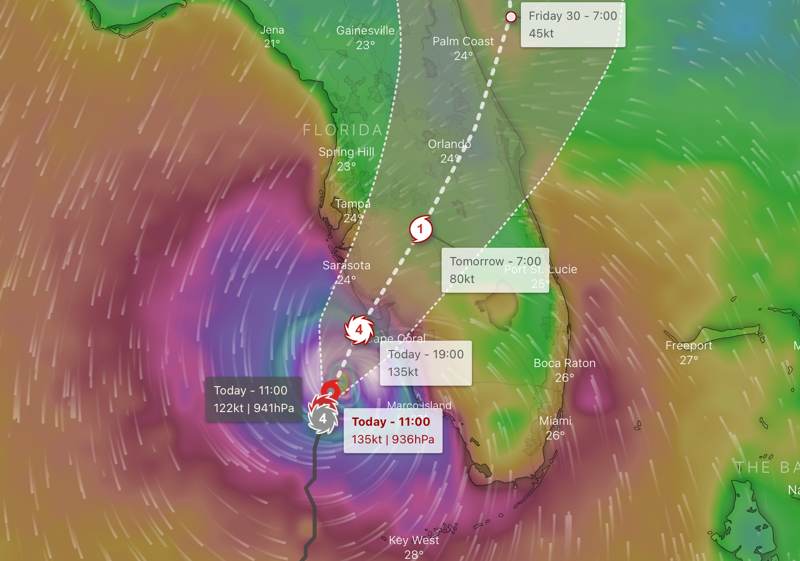

Major hurricane Ian is bearing down on Florida’s west coast with now 155 mph sustained winds, raising the prospects of a significant insurance and reinsurance market loss, with ramifications for insurance-linked securities (ILS) funds, structures and their investors.

It is important to note that the impacts from hurricane Ian are expected to be catastrophic now it has strengthened and it could reach Category 5 before landfall, so all thoughts are with those in the storms path.

While there were a number of more significant catastrophe and severe weather losses that ILS markets took their share of in recent years, being a major Florida hurricane event, hurricane Ian is the first significant test for that region and key component of the ILS market’s portfolio, since hurricanes Irma in 2017 and Michael in 2018.

Of those two storms, hurricane Michael was a Cat 5 Panhandle landfall event, so a much lower industry impact and smaller loss for the ILS market.

Meaning hurricane Irma was really the last significant ILS market loss to come from a Florida hurricane event.

Of course, Irma delivered one of the biggest loss creeps seen with a US hurricane, locking up considerable amounts of collateralized reinsurance capacity and private ILS assets, while driving escalating losses over multiple years.

Since then, and because of the continued challenges faced by insurers in the state, the ILS market’s Florida portfolio has changed considerably.

Exposure has generally moved up the tower, while terms and conditions on ILS structures from collateralized quota shares, to reinsurance and retrocession, as well as catastrophe bonds, have all been tightened up.

At the same time, ILS fund managers have taken the opportunity over now a number of Florida reinsurance renewals since Irma to more thoroughly re-underwrite their participations in reinsurance towers and to extract even more exposure data from counterparties.

We’re aware of some ILS fund managers that have entirely pulled-up and away from Florida lower-layer risk in recent years, while others have become much stricter on terms while still participating in the market.

Ask any ILS fund manager and a month ago they would have told you they felt they are now better insulated from major events in Florida, than they were prior to Irma.

Now, hurricane Ian is set to provide a robust test of that statement.

While portfolios have been re-underwritten, attachments moved up, terms tightened and conditions added to, one other area to consider is hedging.

After hurricane Irma, hedging portfolios remained more reasonably priced than it does today. With reinsurance and retro rates having considerably hardened this year, hedging is more expensive too.

So, for some ILS portfolios, it is possible that whole re-underwritten and exposure adjusted, they may not have the protection against peak loss events that was purchased a few years ago.

It’s also worth considering that some ILS fund managers launched Florida specific, more opportunistic strategies around the mid-year renewals this year. Hurricane Ian will surely test them thoroughly.

Hurricane Ian is now, with its 155 mph winds, looking like a test the ILS market would never want to experience. It’s going to make for some challenges, without doubt fund losses, some quite significant perhaps.

Given the intensification, for some ILS funds the re-underwriting may not matter so much, as if primary insurance market losses reach right up through reinsurance towers, it actually won’t matter how disciplined you’ve been (in the same way, at least).

Of course, this all goes for reinsurance companies as well and there are plenty that have professed to have pulled-back on Florida, or re-underwritten their Florida exposure.

So hurricane Ian is going to test the traditional reinsurance and retro market just as thoroughly as it will test the ILS funds.

One thing is certain, if your focus has been on the lower-down to mid-layers of Florida reinsurance towers, you’re likely to face a considerable hit from hurricane Ian, whether contracts have been re-underwritten with tighter terms, or not.

For the latest on hurricane Ian visit our recent article here, or our 2022 Atlantic tropical storm and hurricane season page.