Hurricane Helene private/public insured losses likely at least in higher single-digit billions: Aon

Public and private insurance market losses from all perils associated with hurricane Helene “will likely reach at least into the higher single-digit billions,” according to Aon’s Impact Forecasting division.

The company said that total economic losses will be notably higher and also noted that hurricane Helene has now become one of the deadliest in US history, with 215 deaths now reported.

“Destructive wind gusts damaged properties from northern Florida to the Carolinas. Notably, a 1-in-1000-year rainfall event occurred over western North Carolina, causing catastrophic flooding and extreme devastation for dozens of nearby communities,” Aon’s Impact Forecasting team explained.

The company further explained, “Helene’s very large and powerful wind field, intense storm surge, and catastrophic inland flooding will result in significant financial implications for much of the southeast United States. As of September 30, over 40,000 claims have already been filed in Florida, according to Florida’s Office of Insurance Regulation.

Across all the affected states and including all the perils that have resulted in financial damages, Aon is expecting hurricane Helene’s industry loss to be the most costly global catastrophe loss event of the year so far for the market, it seems.

“Total private and public insured losses from wind, surge, and flood impacts will likely reach at least into the higher single-digit billions,” the company said.

Which might suggest Aon’s Impact Forecasting sees a chance that the combined private insurance market and NFIP loss will reach into the double-digits, which does seem possible now we have private market estimates pointing to the mid-to-high single-digit billions alone.

Adding, “However, regions in the southern Appalachian Mountains that saw catastrophic flooding damage also exhibit low public and private flood insurance take-up rates, suggesting a fairly large insurance gap. As a result, economic losses will be notably higher.

National Flood Insurance Program (NFIP) losses are being talked about in the $3 billion to $5 billion range by our sources, so it’s not a stretch to imagine the combined private and public insured loss tally surpassing $10 billion.

Also read:

– Some nerves evident as Helene’s Florida claims outpace Idalia, State Farm’s outpace Ian, & on NFIP.

– Hurricane Helene insurance industry loss estimated close to $6.4bn by KCC.

– Direct cat bond losses still seen unlikely from Helene, but NFIP bonds monitored: Twelve Capital.

– Hurricane Helene floods over 100k buildings, at least 10k to over 5 feet: ICEYE.

– Hurricane Helene insured losses anywhere from mid-single to even double-digit billions: RBC.

– Florida reinsurance dependency in focus after Helene, with $5bn+ loss expected: AM Best.

– FEMA’s NFIP reinsurance & cat bonds in focus after catastrophic flooding from Helene.

– Hurricane Helene private insurance loss seen mid-to-high single-digit billions: Bowen, Gallagher Re.

– Hurricane Helene economic loss in $20bn – $34bn range: Moody’s Analytics.

– Hurricane Helene insured wind/surge property loss in Florida/Georgia initially said $3bn – $5bn: CoreLogic.

– Losses to per-occurrence cat bonds from hurricane Helene currently seen as unlikely: Twelve Capital.

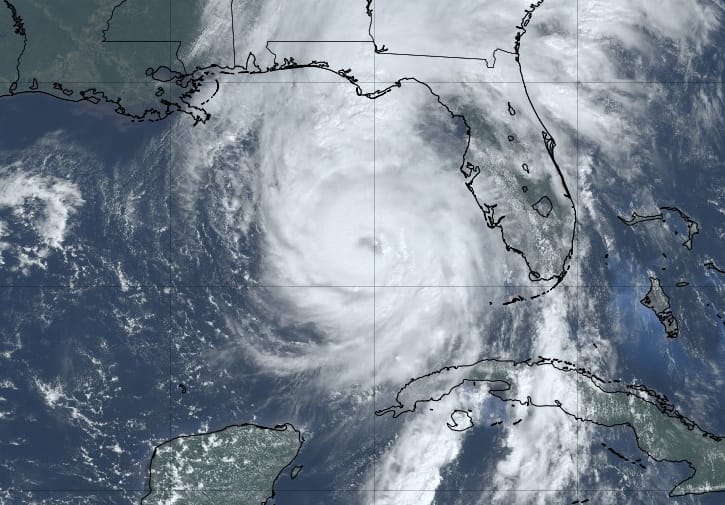

– Hurricane Helene landfall at Cat 4 140mph winds, Tampa Bay sees historic surge flooding.

– Hurricane Helene industry loss seen $3bn to $6bn if Tampa avoided: Gallagher Re.

– Minimal to no cat bond impact expected from hurricane Helene if track unchanged: Plenum.