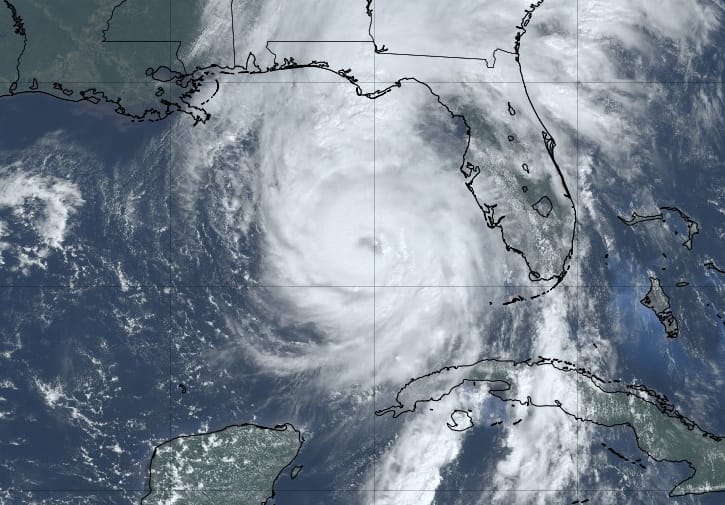

Hurricane Helene private insurance loss seen mid-to-high single-digit billions: Bowen, Gallagher Re

Reinsurance broker Gallagher Re now expects that private insurance market losses from hurricane Helene will rise to the mid-to-high single-digit billion dollar level, higher than its initial pre-landfall forecast of $3 billion to $6 billion, according to Chief Science Officer and Meteorologist Steve Bowen.

Last week, Gallagher Re said that it anticipated the insurance and reinsurance industry loss from hurricane Helene would be in a range of $3 billion to $6 billion, although noting at the time that should it shift closer to Tampa the loss could rise into the double-digit billions.

That shift to Tampa did not occur, although the storm surge levels recorded in the Tampa Bay region have been historically high, as we reported at the time of the hurricane’s landfall.

In a LinkedIn post, Steve Bowen of Gallagher Re said, “Helene was a unique hurricane that has produced devastating consequences in Florida’s Big Bend, but also in areas well away from the landfall location. The extremely wide swath of Helene’s wind field was quite notable and wind-related damage is widespread in Florida and Georgia. But, luckily, the storm’s peak winds missed the largest population areas in Florida and Georgia. This will help limit some of the wind-related loss costs.

“The water damage – coastal storm surge inundation and inland flooding – is catastrophic. Many parts of the highly vulnerable Tampa Bay area, for example, rewrote their record book for storm surge / inundation heights. Areas from Sarasota to Fort Myers and in the Big Bend (>15 feet) were also heavily affected by inundation. The inland rainfall in Georgia, the Carolinas, Tennessee, and southern Appalachia is resulting in historic flooding in many communities.

“It is still very early, and assessments are just beginning, but the private insurance market impact is expected to land in the mid/high single-digit billion range. This is a slight bump from our initial pre-landfall guidance of $3-6 billion for the private market. With a worst-case scenario avoided, this event does not appear to be large enough to meaningfully impact the broader re/insurance market.

“Losses to the NFIP are going to be very notable along Florida’s western peninsula. A multi-billion-dollar NFIP loss is expected. For reference, the nominal NFIP loss from Ian (2022) is now up to $4.7 billion.

“The overall economic loss is going to be well beyond $10 billion. Very limited flood insurance take-up in far inland areas is going to mean a large portion of damage will be uninsured. NFIP coverage limits (Residential: $250k structure / $100k contents + Commercial: $500k structure / $500k contents) will in many cases mean properties will not be fully insured against incurred damage. The gap between the overall direct economic cost and the portion covered by private / public insurance for Helene will be sizeable; similar to other historical flood-driven hurricane events.

“As always: Any loss guidance at this early stage is subject to change as more data becomes available.”

Also read:

– Hurricane Helene economic loss in $20bn – $34bn range: Moody’s Analytics.

– Hurricane Helene insured wind/surge property loss in Florida/Georgia initially said $3bn – $5bn: CoreLogic.

– Losses to per-occurrence cat bonds from hurricane Helene currently seen as unlikely: Twelve Capital.

– Hurricane Helene landfall at Cat 4 140mph winds, Tampa Bay sees historic surge flooding.

– Hurricane Helene industry loss seen $3bn to $6bn if Tampa avoided: Gallagher Re.

– Minimal to no cat bond impact expected from hurricane Helene if track unchanged: Plenum.