Hurricane Helene insurance industry loss estimated close to $6.4bn by KCC

The insurance industry loss from hurricane Helene is estimated to be close to $6.4 billion by Karen Clark & Company (KCC), with the company saying this includes wind, storm surge, and inland flooding impacts across nine states.

The figure is perhaps lower than some might have anticipated, given it includes inland flood insured losses, but it’s important to note KCC’s estimate does not include losses to the National Flood Insurance Program (NFIP) which is expected to pick up the largest inland flood property insurance loss bill.

Using its KCC US Hurricane Reference Model, the catastrophe risk modelling specialist derived its industry insured loss estimate of $6.4 billion from estimates of the privately insured damage to residential, commercial, and industrial properties and automobiles, as well as business interruption. It does not include boats, offshore properties, or NFIP claims.

“In contrast to a typical Category 4 hurricane, most of the damage occurred far from the landfall point, with higher wind damage in Georgia than Florida, more surge damage in Tampa, and the most significant inland flood damage in North Carolina,” KCC explained.

KCC also noted that, “Inland flooding was the most impactful damage-producing aspect of Hurricane Helene from a total property damage perspective, but it contributes a smaller portion to insured losses as most properties are not insured for flood.”

KCC’s estimate of losses that could flow to the private insurance and perhaps reinsurance market is the second post-landfall estimate to come out for hurricane Helene, after CoreLogic estimated the insured wind/surge property loss in Florida/Georgia initially would be between $3bn and $5bn.

As we also reported, reinsurance broker Gallagher Re had increased its prediction, having originally called for a $3bn to $6bn insurance industry loss, the broker updated that to say it expected something in the mid-to-high single-digit billions of dollars.

Analysts at RBC Capital Markets suggested the total insurance market loss from Helene could run into the double-digits.

Also read:

– Direct cat bond losses still seen unlikely from Helene, but NFIP bonds monitored: Twelve Capital.

– Hurricane Helene floods over 100k buildings, at least 10k to over 5 feet: ICEYE.

– Hurricane Helene insured losses anywhere from mid-single to even double-digit billions: RBC.

– Florida reinsurance dependency in focus after Helene, with $5bn+ loss expected: AM Best.

– FEMA’s NFIP reinsurance & cat bonds in focus after catastrophic flooding from Helene.

– Hurricane Helene private insurance loss seen mid-to-high single-digit billions: Bowen, Gallagher Re.

– Hurricane Helene economic loss in $20bn – $34bn range: Moody’s Analytics.

– Hurricane Helene insured wind/surge property loss in Florida/Georgia initially said $3bn – $5bn: CoreLogic.

– Losses to per-occurrence cat bonds from hurricane Helene currently seen as unlikely: Twelve Capital.

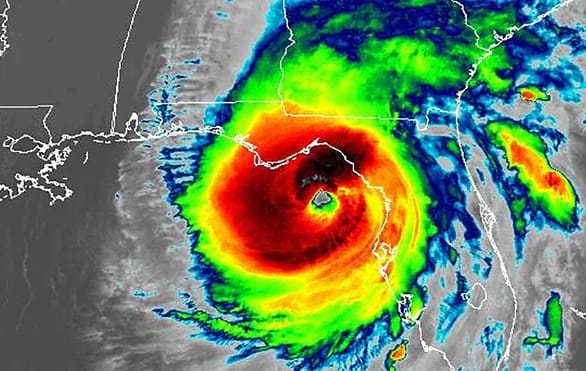

– Hurricane Helene landfall at Cat 4 140mph winds, Tampa Bay sees historic surge flooding.

– Hurricane Helene industry loss seen $3bn to $6bn if Tampa avoided: Gallagher Re.

– Minimal to no cat bond impact expected from hurricane Helene if track unchanged: Plenum.