Hurricane Francine US private onshore & offshore insured loss to be less than $2bn: Moody’s RMS

U.S. private market onshore and offshore insurance industry losses from hurricane Francine have been estimated at less than $2 billion by Moody’s RMS Event Response, with losses to the National Flood Insurance Program (NFIP) expected to be under $200 million.

This estimate from Moody’s RMS Event Response includes onshore insured losses from wind, storm surge, and precipitation-induced flooding, and insured offshore energy losses from wind and wave impacts and associated business interruption.

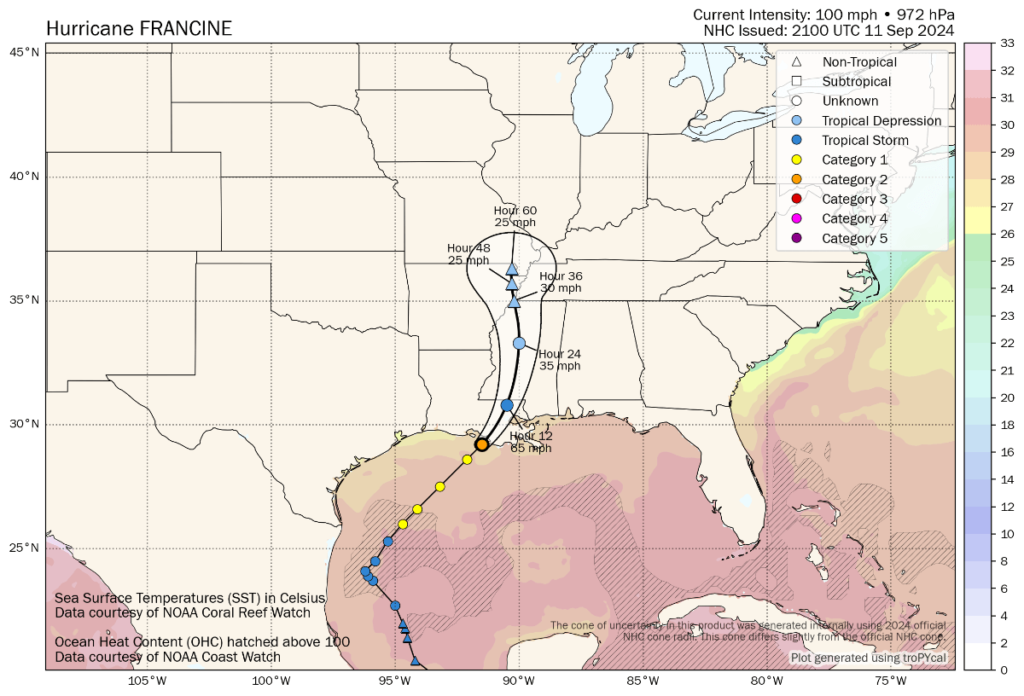

The risk modeller anticipates that the majority of the overall private market and NFIP insured losses will come from wind damage in Louisiana, where Francine made landfall on September 11th as a Category 2 storm with maximum sustained winds of 100 mph.

Hurricane Francine was the sixth named storm of the hurricane season, the third hurricane to make landfall in the U.S. this season, and the first to make landfall in Louisiana since Cat 4 hurricane Ida in August 2021.

This estimate from Moody’s is in line with forecasts from others, with Karen Clark & Company recently pegging private insurance market losses from the storm at close to $1.5 billion.

Brokers Gallagher Re and Guy Carpenter both suggested that the storm is likely to drive insured losses in the low single-digit billions of dollars, and cat risk modeller CoreLogic recently estimated wind and storm surge insured losses from the storm of up to $1.5 billion.

Jeff Waters, Director, North Atlantic Hurricane Models, Moody’s, said, “We expect Hurricane Francine to be another manageable event for the (re)insurance market this hurricane season. Fortunately, the storm encountered strong wind shear just prior to landfall, which limited its potential to strengthen further and helped it to weaken quickly post-landfall. It was also aided by low tide conditions at the time of landfall, which counteracted chances for particularly damaging storm surge. Still, a combination of saturated antecedent conditions and heavy rainfall – particularly within Orleans Parish – contributed to precipitation-induced flooding in many areas.

“Including Francine, Louisiana has now experienced six landfalling U.S. hurricanes since 2019. While some structures have been lost entirely, many of those that remain have been repaired and brought up to more stringent building codes and design standards adopted by the state, thereby improving their resiliency to damaging wind and water. We expect these instances to be more common following Francine, to the benefit of both policyholders and the (re)insurance market at large.”