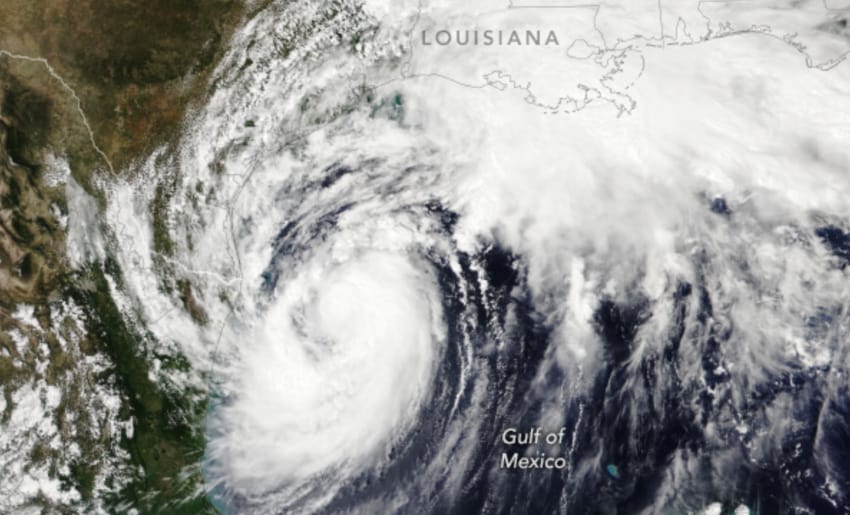

Hurricane Francine insurance industry loss seen in range ~$1bn to $3bn

Early estimates of insurance industry losses for hurricane Francine are coalescing around the $1 billion mark to a maximum $3 billion, with the majority expected to fall to primary insurers with larger footprints in Louisiana.

As we reported earlier, analysts from RBC Capital Markets said that Francine’s losses are expected to be manageable for property and casualty insurers, while minimal impacts are expected to the reinsurance market.

For Louisiana, this is the seventh hurricane landfall event the state has suffered since 2017, which will add further pressure to a region already experiencing some disruptive effects to its insurance industry.

But, overall, the storm is another from 2024, already the third landfalling US hurricane event, that is not expected to be overly onerous for the insurance and reinsurance market to deal with, in claims terms.

Early estimates, both pre and now also post-landfall, bear out the comments from the RBC analysts, in Francine not being especially challenging for the industry.

Broker Gallagher Re was the first to come out with a forecast for hurricane Francine’s insurance market loss potential, saying it anticipated it falling in the low single-digit billions of dollars.

Next, reinsurance broker Guy Carpenter said that based on an analysis of the tracks of previous Louisiana storms, it believed they would cost between $2 billion and $3 billion if they occurred again today.

Another estimate came from CoreLogic late yesterday, with this firm saying it anticipates wind and storm surge insured losses from hurricane Francine would be up to $1.5 billion.

CoreLogic’s estimate is the first modelled analysis post-event and it includes damage to buildings, contents, and business interruption for residential, commercial, industrial, and agricultural property. It does not include precipitation-induced inland flooding or losses to the National Flood Insurance Program (NFIP).

CoreLogic said, “Losses from Hurricane Francine are expected to be manageable for primary carriers, as total wind damage was limited by the sparsely populated coastal region with high degree of resilience.

“The parishes of St. Mary, Terrebonne, Lafourche, and Ascencion are expected to be the hardest hit by wind and storm surge flooding.

“Wind damage to residential property is the primary driver of modeled loss. NOAA tidal gauges recorded some minor and moderate flooding along the coastline from central Louisiana to Mississippi.”

As ever though, the insurance industry loss is not the full picture and with quite significant rainfall induced flooding affecting New Orleans and other urban areas, the uninsured loss and NFIP loss could in this case be almost as significant as the private insurance market loss from Francine, it seems.

Broking group Aon also said, “Given the wind and flooding damage seen across primarily southeast Louisiana, total economic and insured losses may reach into the lower billions USD. Total losses may continue to increase as heavy rainfall from the system’s remnants may generate flooding impacts across the southeast U.S. in the coming days.”