Hurricane Beryl US insurance industry losses could be $750m to $1.2bn: BMS

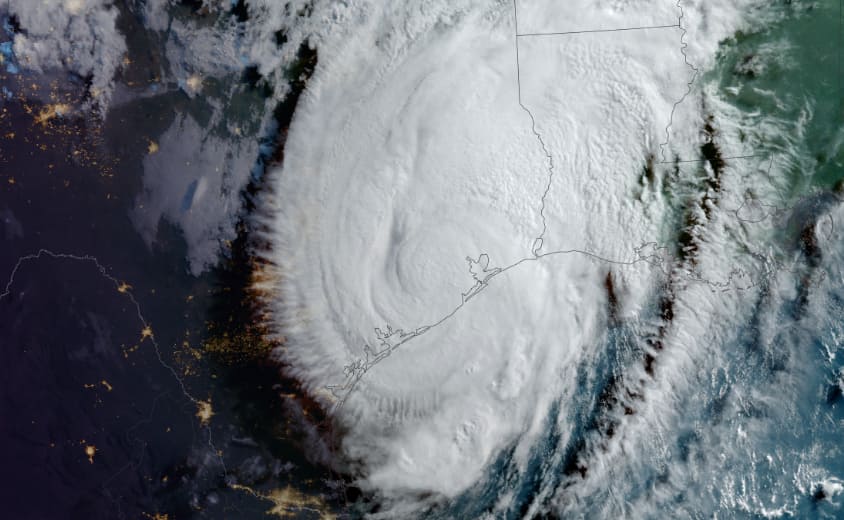

Hurricane Beryl made landfall near Matagorda, Texas yesterday as a Category 1 storm and the fact certain meteorological conditions meant the storm did not intensify as much as it perhaps could have, means the insurance industry loss in the United States from Beryl will not be overly significant.

Hurricane Beryl was hindered by dry air entrainment and wind shear when over the very warm Gulf of Mexico waters, which has perhaps saved Texas from a more impactful disaster.

That said, the State has still felt widespread impacts from the hurricane, with reports of wind damage, more than 2 million losing power, as well as flooding.

Andre Siffert, Senior Meteorologist from reinsurance broker BMS Re, explained in an update that Beryl may have had greater than expected effects in the Houston metro region.

Commenting right after Beryl made landfall, Siffert explained, “The radar shows a broad swirl of heavy rain and thunderstorms. This is providing powerful wind gusts all the way into the Houston metro area, with several stations having recorded wind gusts of 80 – 90 mph on the east side of Beryl’s track. In fact, the Houston Hobby Airport had a wind gust of 74 mph.

“The landfall areas with the strongest winds are very rural, with a total population of 435,297 people. This will limit severe impacts on the insurance industry, which should only be scattered damage and damage to more vulnerable structures such as billboard signs.

“The bigger issue for the insurance industry might be that as Beryl intensified toward landfall, this wind field expanded. This has resulted in tropical storm-force winds in the Houston area, which is the fifth largest city in the U.S. with a population of just over 7 million. The question then becomes how insurance policies will respond. Overall, there are higher wind-only deductibles, and overall deductibles have been on the rise, with many homeowners’ policies increasing the mandatory minimum wind hail deductible to 2% of the dwelling amount.”

Overall though, Siffert said that Beryl’s impacts “could be a lot worse, and thankfully, dry air and shear prevented major rapid intensification before landfall.”

Going on to state, “Of course, that should not take away from the fact that some will be unlucky; even relatively weak landfalls such as this have the potential to cause pain to individuals and business owners. The big question is, how much damage will be above the higher wind deductibles that are in place? These are typically in place to provide coverage for higher related wind damage as, again, named storm activity in this region is not uncommon, getting brushed or hit by a named storm every 2.6 years.”

Having analysed other storms that have affected the same region, Siffert said insurance industry losses in the US from hurricane Beryl could be between $750 million and $1.2 billion.

“Overall, impacts in the U.S. should not be bad, and overall insurance industry losses should be between $750M and $1.2B U.S. This is based on historical analogs like recent tropical storm Nicholas (2021) $250M and Tropical Storm Imelda (2019) $700M. The loss estimate also looks at a selection of catastrophe risk model stochastic track event sets. Insurance carriers will likely retain losses, so the losses of Beryl will not likely be a reinsurance event loss,” he explained.

Also read: Current forecasts suggest limited reinsurance loss from Beryl landfall in Texas: BMS’ Siffert.