Hurricane Beryl forecast path keeps Jamaica catastrophe bond on watch

Overnight, the latest updates to the forecast path of major hurricane Beryl have kept Jamaica’s $150 million parametric IBRD CAR Jamaica 2024 catastrophe bond transaction on watch for its potential to be triggered. Cat bond market participants tell us it may be too late for any trading activity now, but at the same time we’re told offers have slipped further.

The forecast for major hurricane Beryl hasn’t really worsened overnight, the storm has weakened a little more in fact. But, from the point of view of the Jamaican catastrophe bond and its holders, the outlook hasn’t really changed very much.

As of the 03:00 UTC update on July 3rd, Beryl was a major hurricane with 145 mph sustained winds and gust in excess of 165 mph, hurricane Beryl remains a Category 4 storm, with a minimum central pressure of 946mb.

The major storm is forecast to bring life-threatening winds and storm surge to Jamaica later today and the Cayman Islands tonight and into tomorrow.

Weakening is still forecast, but the NHC warns that “Beryl is forecast to be at or near major hurricane intensity while it passes near Jamaica later today and the Cayman Islands tonight.”

Importantly, for the catastrophe bond community, the path towards Jamaica that hurricane Beryl is forecast to take continues to bring the storm right up to the island, perhaps making a direct landfall, or if not a landfall then scraping its shores.

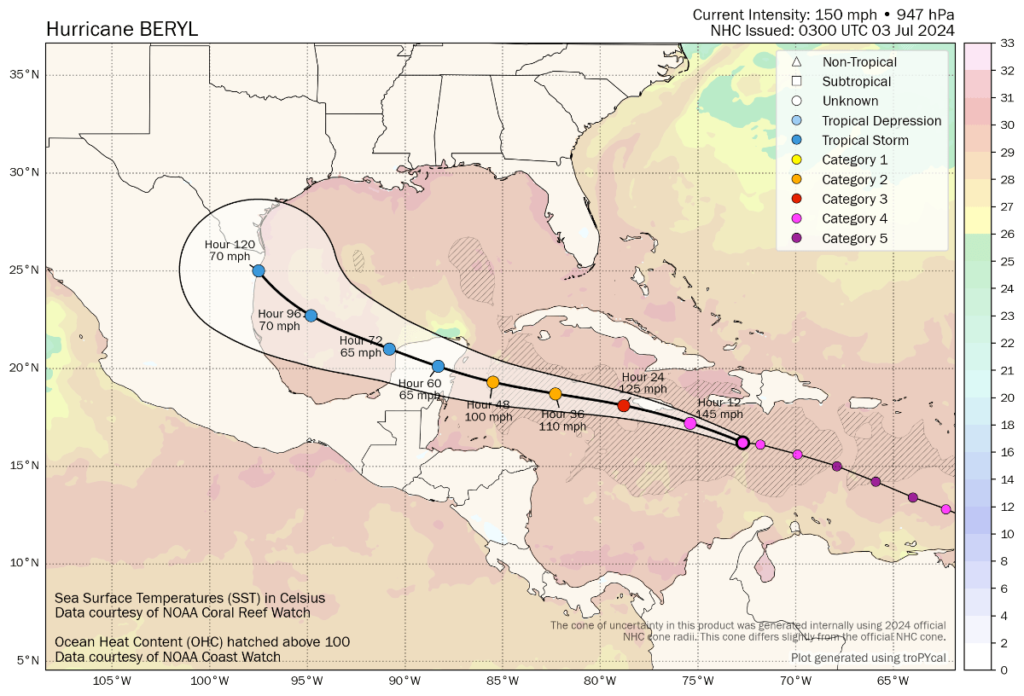

The map below is from Tomer Burg’s excellent resources (click it for the very latest version).

As the forecast map above shows, major hurricane Beryl is set to come very close to Jamaica, perhaps making a landfall.

The NHC said, “On the forecast track, the center of Beryl will move rapidly across the central Caribbean Sea and is

forecast to pass near or over Jamaica on later today. The center is expected to pass near or over the Cayman Islands tonight or early Thursday and approach the Yucatan Peninsula of Mexico Thursday night.”

Hurricane Beryl keeps growing as well, with hurricane force winds still only extending 40 miles out from the center of the storm, but the tropical storm wind field now extending 185 miles out.

Jamaica is set for hurricane force winds from around midday today, after which it depends on how close hurricane Beryl gets as to whether the island faces stronger, major storm wind conditions.

Jamaica is also facing a storm surge of up to 9 feet, as well as rainfall that could reach 12 inches in localised maxima.

It’s important to note that, should hurricane Beryl make a direct landfall or impact Jamaica more directly, a dangerous situation is possible and lives could be threatened by the storm. Preparations need to be urgently made as this is a life-threatening hurricane event for the Caribbean island nation.

On the current forecast track, major hurricane Beryl is expected to have sustained winds of somewhere between 125 mph and 140 mph at the time it is closest to Jamaica, or makes landfall.

That would put Beryl as still a major Category 3 storm, with the potential to trigger Jamaica’s catastrophe bond protection should the hurricane move close enough to enter one of the parametric trigger boxes.

It’s worth recapping what we wrote yesterday about the catastrophe bond, as the situation and threat to it has not changed a great deal overnight:

As we’d noted before, the minimum central pressure will need to be at 969mb or lower for any triggering to occur, although that would require that pressure to be read in one of the central boxes of the parametric trigger structure, over a region like Kingston, Jamaica.

A pressure of 950mb could be sufficient to trigger the cat bond in one of the parametric boxes a bit further out from the capital region, we understand.

The catastrophe bond minimum payout is for 30% of the $150 million of principle, after which it pays out on a sliding scale up to the 100% of principle mark.

When it comes to translating wind speeds to pressure of hurricanes it is not an exact science, but when it comes to the Saffir Simpson scale, there are estimates that a hurricane of Category 3 strength (wind speeds of 111-130mph) would have a central pressure in the region of 945mb to 964mb.

A Category 2 hurricane (wind speeds of 96-110mph) is estimated to have a central pressure in the region of 965mb to 979mb.

Which would suggest that if hurricane Beryl does impact Jamaica, or at least cross into the parametric boxes, it could have a central pressure low enough to cause a triggering event. How much is impossible to estimate, given the parametric trigger is constructed from multiple small boxes across Jamaica and close to its shores, but based on the latest forecast path outlook hurricane Beryl does pose a real threat to this cat bond at this time.

Cat bond fund manager Icosa Investments has created a handy visualisation of how the Jamaica cat bond parametric trigger works, which can be viewed on Linkedin here.

At this time, it appears that the exposure is to a low-level triggering event occurring, so somewhere above the 30% mark, but certainly not the full principle unless hurricane Beryl strengthened more on approach (which forecasters say is unlikely now).

Given the general trend of weakening, it does not seem likely any re-intensification will occur.

But, the cat bond remains on watch for the market as if hurricane Beryl reaches Jamaica with the wind speeds currently forecast and its core makes a landfall, or brushes the coast, then a partial loss event is possible if the central pressure remains at a sufficiently low level, which seems possible at the time of this update.

A passage slightly further offshore could see no impact to the catastrophe bond at all, with its parametric trigger unscathed.

As a result, it’s still uncertain and impossible to forecast any loss, or no loss. Meaning the uncertainty over the Jamaica cat bond will continue today.

Yesterday we reported that our sources in the catastrophe bond market said that earlier on Tuesday offers were being made in the secondary market for the IBRD Jamaica cat bond notes at around the 97 mark, but as the forecasts were updated the offer range tumbled to 50 to 60 cents on the dollar.

Sources told us the cat bond was still unlikely to trade at those levels, given the forecast path that had been published.

Now, with little change and in fact a slight worsening of the outlook as the weakening of hurricane Beryl is now expected to take slightly longer than forecasts earlier yesterday suggested, we’re told some offers are coming in lower than that now.

As we said in our report yesterday, “In order to find any buyers, those offers may need to halve or more. However, at this stage and with the forecast outlook worsened for Jamaica, finding buyers may not be easy, we’d imagine.”

That remains true this morning and our cat bond sources have reiterated today that trading the notes will be hard, unless at very low offer levels, given the uncertainty still evident over whether the cat bond faces a triggering event or not.

Given the forecast path at this stage, it is possible this will be a situation where the market will not know the fate of the Jamaica cat bond until some time after the storm has passed, as if it breaches any of the parametric trigger zones but the pressure is seen to be borderline, the market will need to wait for a calculation report to have a clear idea of its fate.

If that happens the Jamaica cat bond notes will likely be marked down by 30% or more in the secondary market.

Should Jamaica receive a more direct hit from hurricane Beryl and its cat bond be triggered, it would provide Jamaica a valuable source of disaster financing, for its recovery from storm impacts, demonstrating the importance of insurance and the value of parametric triggers, as well as capital markets structural and funding diversification.

Based on the current forecast it seems possible Jamaica’s parametric insurance coverage under the CCRIF may respond and payout to support the islands recovery, as it triggers at levels below the cat bond, so does not require as intense a hurricane Beryl to impact the island for a payout to be due.

That would be an equally valuable source of just-in-time disaster risk financing and a valuable source of recovery liquidity for the country.

Beyond Jamaica and the Cayman Islands, with Cayman currently set to be in the hurricane to tropical storm wind speed swathe if Beryl turns as forecast, the Yucatan Peninsula is next in the hurricane’s sights.

The forecast suggests Beryl could still be a weak hurricane at the stage it hits Mexico’s Yucatan, at which level it would not trouble that country’s catastrophe bond.

After that, the Gulf of Mexico is the destination for what remains of Beryl, with some strengthening seen as possible and the latest forecast suggesting a landfall not far from the Mexico-Texas border. We’ll only know more on this once Beryl has cleared the Yucatan in a few days.

Also read: Jamaica Minister of Finance highlights risk transfer as hurricane Beryl approaches.

Track the 2024 Atlantic tropical storm and hurricane season on our dedicated page and we’ll update you as new information emerges.