How will the Inflation Reduction Act affect your health insurance

The Inflation Reduction Act was Signed into Law!

Recently, President Biden marked the Inflation Reduction Act (IRA) into regulation. The IRA is noteworthy health care, tax, and climate change policy provision that incorporates arrangements to broaden the expanded and extended monetary assistance at first included in the American Rescue Plan (ARP). This is very welcome news that the American Rescue Plan subsidies, which were set to terminate toward the end of 2022, will currently be accessible through the end of 2025. A few vital features of this new regulation that proceeds with the American Rescue Plan, making health insurance through the marketplace more affordable and also helping Medicare policyholders, include: Health care coverage charges covered at 8.5% of family pay, which expanded how much monetary assistance is accessible for qualified consumers.

Free Silver plans accommodated individuals who procured under 150% of the federal poverty level (FPL).

Monetary assistance reached out to middle-income consumers who were previously ineligible for federal assistance.

Limits Insulin copays to $35/month in Part D (implemented in 2023)

Reduces costa and improves coverage for adult vaccines in Medicare, Part ., Medicaid & CHIP ( 2023 )

Requires drug companies to pay rebates if drug prices rise faster than inflation for (2023 )

Eliminates in 5 % coinsurance for Part D catastrophic coverage – will be implemented in 2024

Adds $ 2,000 out-of-pocket cap in Part D and other drug benefit changes (will be implemented in 2025)

2026 – to 2029 – Medicare will start to be able to negotiate prices for certain high-cost drugs, starting with 10 drugs, then 15, and then 20 drugs in 2029

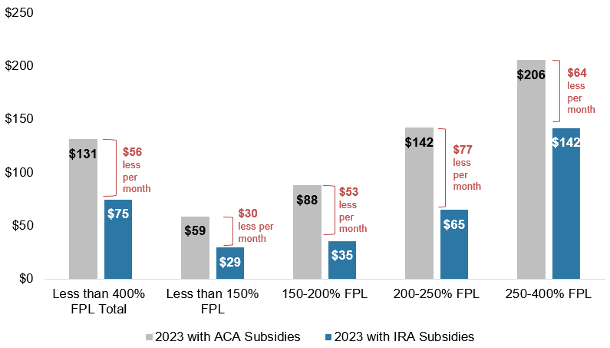

Figure 1: Monthly Net Premium Savings for Subsidized Enrollees Under 400 Percent FPL With Extension of American Rescue Plan Subsidies

Who benefits from the expanded and extended monetary assistance?

Covered California’s 1.7 million enrollees: With additional individuals qualified for monetary assistance than any time in recent memory, 90% of Covered California’s 1.7 million enrollees are currently getting federal subsidies. With the expansion of the extended federal subsidies, Californians making under 400% of the federal poverty level (FPL) — which adds up to $51,520 as an individual and $106,000 for a family of four — will save a normal of an extra $56 each month when compared to Affordable Care Act subsidies. Low-income earners in Californian will benefit the most

Figure 2: Monthly Net Premium Savings for Subsidized Enrollees Over 400 Percent FPL With Extension of American Rescue Plan Subsidies

Covered California intends to start sending renewal notices that reflect the continued savings to its existing consumers from October; Open Enrollment starts November 1. We will keep you updated on the proceedings.

In case you want to read the full Press Release of the Inflation Reduction Act Signed into Law!

Read the full Press Release HERE

Please contact us, or visit our website at Solidhealthinsurance.com if you need to make changes to your income, address, or family status. Due to the still-going pandemic, Covered California is still allowing us to make changes to your 2022 health plans.