How to sustain growth through the market cycle

How to sustain growth through the market cycle | Insurance Business Asia

Insurance News

How to sustain growth through the market cycle

Insurer shares useful tips

Insurance News

By

Noel Sales Barcelona

In the ever-changing insurance market, it is critical to sustain profitable growth. Aon shares its insights on how to sustain profitability despite the ebb and flow of the insurance market.

There are lots of opportunities – all you need is to find them

In its latest market insight, Aon stated that there is no shortage of opportunity for those seeking first-mover advantage. Citing its own 2024 Climate and Catastrophe report, Aon noted that only 31% (around $118 billion) of the economic losses in 2023 ($380 billion) were covered by insurance.

“This 69% protection gap highlights the opportunity to support global communities,” Aon stated.

The global insurer also revealed that there are ongoing transformative trends that will affect – and shape – the insurance landscape, creating over $200 billion market potential for insurers in 2030.

“Addressing these trends will enable insurers to respond to evolving customer demand while increasing the industry’s relevance, growth and diversification,” Aon said.

Risk and reward trade-offs must be addressed immediately

However, global insurance leaders must know the critical role they play in addressing the pressing issues and risks that their industry is facing.

“Insurance leaders are tasked by their boards and shareholders with maintaining hard-fought gains and delivering profitable growth. This is heightened in a market where pressure is building from evolving risks that range from climate to geopolitical tensions,” the report stated.

Aon challenged global insurance leaders to answer the following questions:

How would you deal with problematic areas before they become detrimental to the performance of the company?

How would you hold on to profitable and strategically important business when the supply of capital is outstripping demand and placing downward pressure on rates?

How would you identify new opportunities to diversify and establish future sources of profit?

Are you best-in-class?

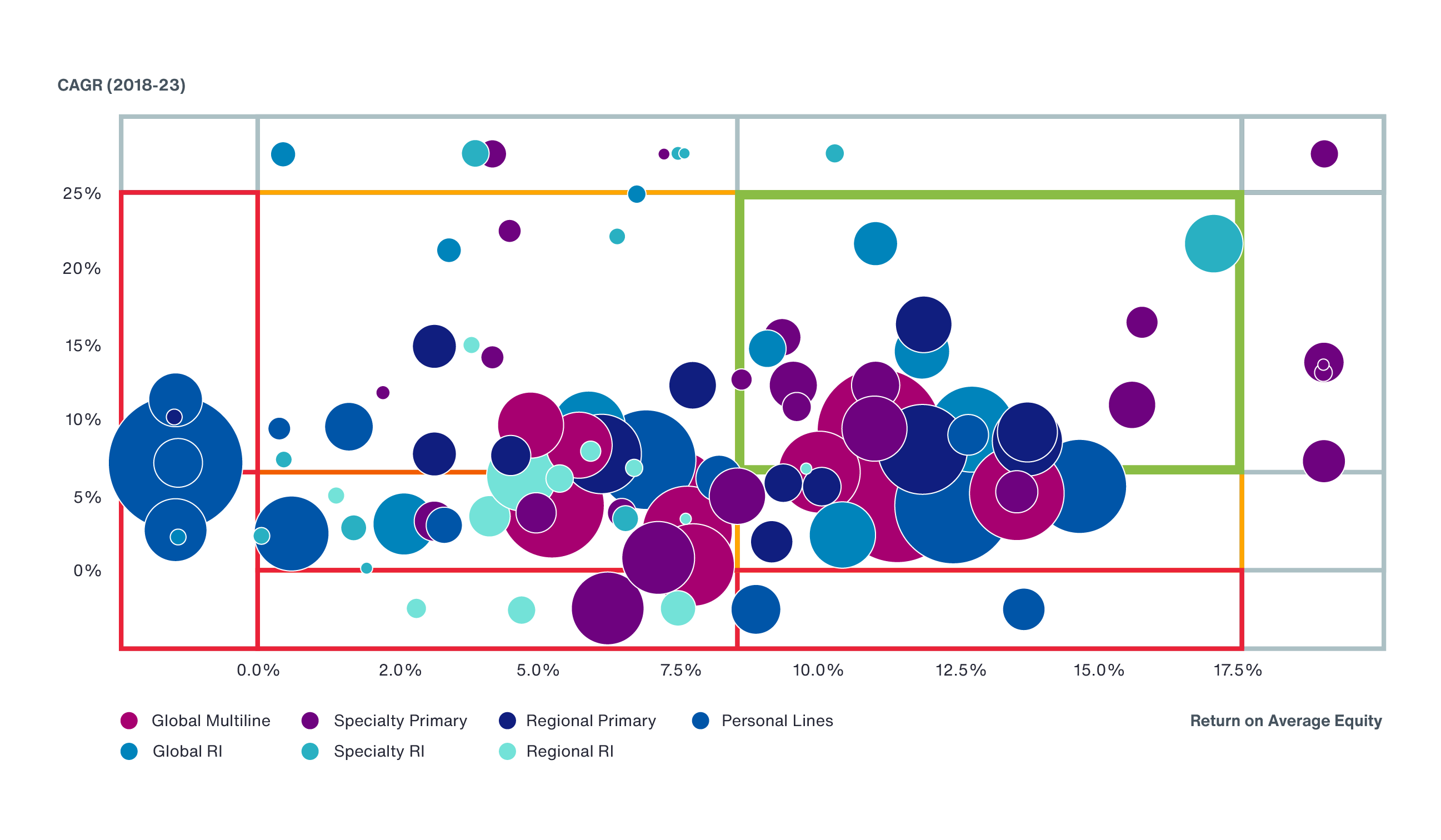

Aon’s latest market analysis also examined the performance of 100 (re)insurers across the globe operating in different segments of the property and casualty insurance market and saw high variance in return on average equity. This high variance, according to Aon’s analysis, is important as it measures the performance of a company based on its average shareholders’ equity.

“Higher growth is correlated with higher returns, especially when insurers reach a level of scale and maturity. The study also found that size is not the primary determinant of success and that insurers can deliver impressive returns with selective and client-focused strategies,” the analysis stated.

However, the results of their performance analysis among 100 (re)insurers saw that only a handful of these companies are achieving spectacular returns on average equity.

In their analysis, Aon used the following metrics:

Capital

Data analytics

Distribution

Risk appetite

Speed and agility

Talent

Underwriting

“Leaders who do not excel in evidence-based decision-making risk falling behind the pack, consistently delivering combined ratios that are multiple percentage points higher than the market,” the report said.

To read the full analysis, please click this link.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!