How to get cheap car insurance in Canada

Insurance Business answers this question and more in this handy guide. If you want to understand how car insurance works across the nation and get practical tips on how to minimize insurance costs, then this article is for you. Read on and score great premium-reduction ideas.

As the table below shows, there can be a massive difference between auto insurance premiums for motorists living in different provinces and territories. In Québec, for instance, where average car insurance is the cheapest, rates cost about 161% lower than those in British Columbia, where premiums are priced the highest.

Industry experts, however, admit that there is no simple and straightforward way for each driver to get cheap insurance in Canada as premiums are based on how much risk insurers perceive you to be.

To help you find ways to save on car insurance costs, Insurance Business referred to the websites of various industry specialists, from personal finance firms to auto insurers, for practical tips. Here are some of the strategies we gathered.

Review your policy annually to determine how much coverage you actually need.

Consider usage-based insurance or telematics.

Maintain a good credit history.

Install safety features in your vehicle such as an upgraded alarm system or snow tires during winter.

Keep a clean driving record.

Choose vehicles that have excellent crash test ratings, low-theft scores, and are not sporty or attract lots of attention.

Bundle policies together.

Consider a higher deductible.

Shop around for and compare rates.

Never miss a payment.

Stay with providers that offer loyalty discounts when their customers reach milestones.

Keep gaps off your driving history even if you do not have a car by asking family or friends to add you as a secondary driver to their policy.

You can find additional tips on how to get cheap car insurance in Canada by checking out this premium-reduction guide that we prepared.

To get a picture of how much car insurance premiums cost across the country, Insurance Business analyzed rates from several price comparison websites. We also checked the quotes from several major auto insurers. The table below shows how much motorists pay in premiums annually in each province and territory, starting with the cheapest car insurance in Canada.

One thing to take note of is that the figures below are merely estimates and that final prices will vary depending on the specific requirements of each driver.

When calculating premiums, car insurance companies consider a range of parameters, some are based on your profile, while others are related to the vehicle you drive. Here are some of these factors:

Age: Your age is often associated with driving experience and the risk of getting into an accident. Because of this, the younger you are, the higher your auto insurance rates will be.

Gender: Statistically, men are more likely to get involved in accidents than women. This pushes up the premiums male drivers need to pay.

Postal code: Living in a safe area where car theft and vehicular accidents are a rarity will likely qualify you for cheap car insurance in Canada. By contrast, those living in high-crime and accident-prone areas usually pay more expensive premiums.

Driving record: A clean driving record indicates a lower probability of filing a claim, which can help you score cheap car insurance.

Mileage: The less you drive, the lower the likelihood that you will get into an accident, reducing the insurance premiums you need to pay.

Vehicle make and model: How much your car costs, how expensive it is to repair, how powerful the engine, what safety features it incorporates, and how prone it is to theft all have a major impact on your car insurance rates. If you live in Ontario and want to know which vehicles there have the least and most expensive premiums, you can check out updated rankings.

Level of coverage: Minimum coverage policies require cheaper premiums than comprehensive plans but offer limited protection.

Credit score: Car insurers – except those in Ontario and Newfoundland and Labrador – use credit-based insurance scores to help determine premiums as these providers often believe that drivers with high ratings tend to file fewer claims than those with lower credit scores. Motorists with a good credit history, therefore, are given cheap car insurance in Canada.

Premiums work slightly differently depending on the policy you’re purchasing. Check out how in our comprehensive insurance premiums guide.

Personal finance experts say that paying for your premiums in monthly instalments is like paying for a car loan – you are also likely being charged for interest or finance arrangement fees. If you can afford to, opt for annual payments. This can slash a substantial amount from your car insurance.

Ever wondered what other types of discounts you may be eligible for? Check out our comprehensive car insurance discounts guide to learn more.

Although not much data is available about when the best time of the year is to buy insurance for you to get cheaper rates, a 2018 Ontario study has found that when you purchase your policy may have an impact on premium prices.

According to the research, insurance prices in the province are lowest between July and October partly because insurance companies receive a higher volume of business during these months. This can also be because car manufacturers typically release new vehicle models during this period.

If you want to know when the best time is to get cheap car insurance in Canada, an experienced insurance agent or broker can tell you when.

To operate a vehicle, Canadian motorists must carry auto insurance. It is required by the law in all provinces and territories. Getting caught driving without a policy can result in hefty fines and affect future eligibility for obtaining coverage. However, there is a huge difference in how the car insurance system works between provinces and territories.

For those living in British Columbia and Manitoba, auto insurance is regulated by government-owned organizations, the Insurance Corporation of British Columbia (ICBC) and Manitoba Public Insurance (MPI). Car insurance in Saskatchewan is also run by a crown corporation, Saskatchewan Government Insurance (SGI), but motorists can purchase additional coverage through private insurers.

In Québec, the Société de l’assurance automobile du Québec (SAAQ), another public institution, handles minimum limits for bodily injury, while private companies offer third-party liability, property damage, and additional protection. Drivers in the remaining provinces and territories can purchase car policies from private carriers.

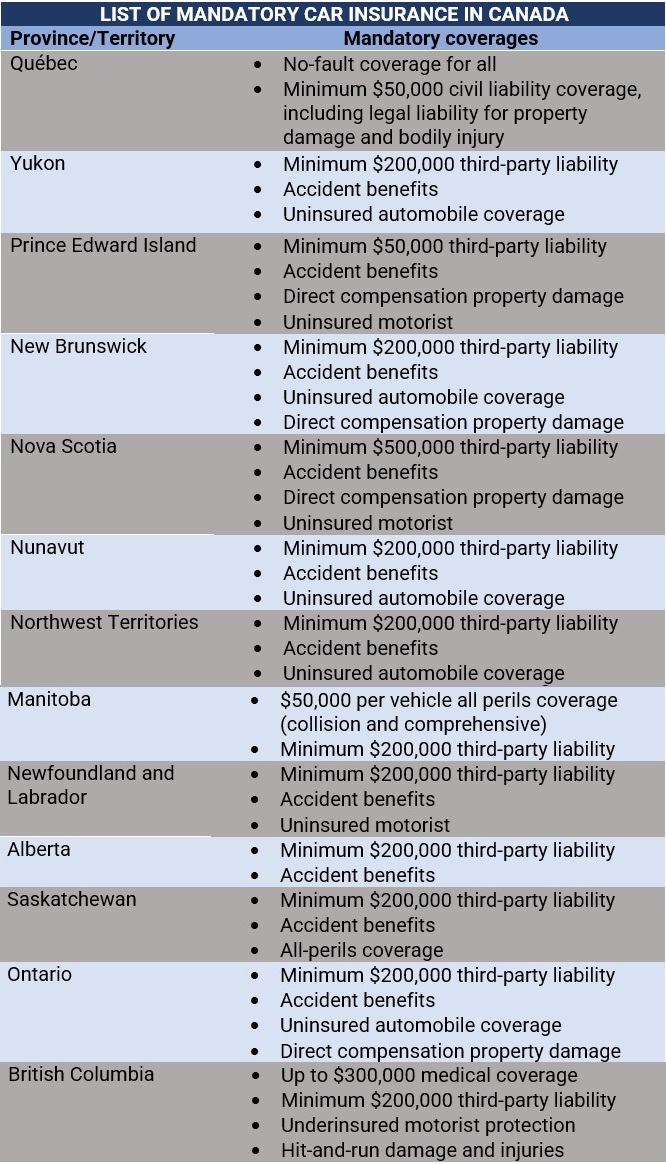

Provinces and territories also have their own rules and regulations when it comes to mandatory coverage, but there are similarities. These are:

Third-party liability: Covers the cost of lawsuits if a motorist is responsible for an accident that causes bodily injury, death, or property damage. The minimum amount varies depending on the location but is typically pegged at $200,000.

Uninsured automobile/motorist: Coverage kicks in if the policyholder or their passenger is injured or killed by an uninsured driver or in a hit-and-run incident. It also covers damages to the vehicle.

Accident benefits: Pays out for medical treatments and income replacement if the policyholder is injured in an accident, regardless of who is at fault. It also covers funeral expenses should the driver succumb to their injuries.

Direct compensation property damage: Applicable in Ontario, Québec, Nova Scotia, New Brunswick, and Prince Edward Island, this policy covers damages to the vehicle and its contents resulting from an accident with another insured vehicle as long as the policyholder is not at fault.

The table below sums up the mandatory coverages in each Canadian province and territory.

Car insurance providers also offer optional coverages for enhanced protection, including:

Collision coverage: Covers repair costs incurred if the policyholder’s vehicle collides with another vehicle or object, even if they are at fault or someone else was driving the car. It also pays for a replacement if the vehicle is wrecked beyond repair.

Comprehensive coverage: Covers repair costs from damages caused by vandalism, theft, fire, natural disasters, and other hazards.

Specific-perils coverage: Protects against losses from specific perils identified in the policy.

All-perils coverage: Compulsory in Manitoba and Saskatchewan, this covers everything under collision and comprehensive policies and all other incidents beyond the policyholder’s control.

Can you think of other ways that you can get cheap car insurance in Canada? We’d love to hear from you in our comment box below.