How to get a life insurance license

How to get a life insurance license | Insurance Business America

Guides

How to get a life insurance license

Here’s a step-by-step guide on how you can get a life insurance license. Getting a license takes a lot of effort but you can reap the rewards

You’ve decided that becoming a life insurance agent is the right move careerwise. The next step would be securing your life insurance license.

In this article, Insurance Business gives you a walkthrough of the entire process. We will give you a rundown of the licensing requirements, how long it takes to secure your license, and what it takes to build a successful career.

If you’re new to the industry and at a loss on where to start, then you’ve come to the right place. Read on and find out how you can obtain a life insurance license.

If you’re planning to build a career as an insurance sales professional, the first thing you must do is obtain a license from your state’s insurance regulation department. Here’s how you can get one.

1. Meet the basic eligibility requirements.

There are certain minimum requirements that you need to comply with to secure a life insurance license. These may vary depending on the state but typically, aspiring life insurance agents and brokers must:

be at least 18 years old, the minimum age to apply for a license in most states

be free of any fraud or felony charges

not owe any federal or state income taxes

be able to successfully complete a background check

Some states also require that insurance agents and brokers not have past-due child support to be eligible for a license. Meet all these criteria and you’re ready to move on to the next step.

2. Complete the pre-licensing coursework.

Completing a pre-licensing course is necessary to prepare you for the state licensure examinations. Depending on your preference, you can take the subjects online or in a face-to-face classroom set up.

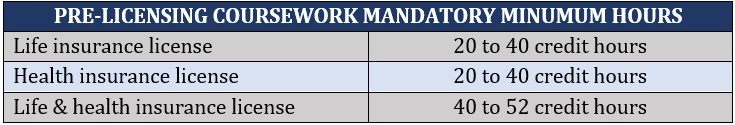

Each course comes with minimum mandatory hours. The coursework covers a range of topics, including:

policy types

insurance industry regulations

insurance principles

ethics

Many aspiring life insurance agents and brokers also take up health insurance courses. This allows them to branch out and sell health insurance policies.

Here are the required hours for both lines. The requirements may vary depending on the state.

Insurance veterans who have earned certain industry designations, however, can skip the pre-licensing coursework and take the life insurance license exam directly. Those with Chartered Life Underwriter (CLU) designation, for instance, are only required to take the Life & Health Laws and Regulations test.

3. Pass the state insurance licensure exam.

Once you’ve finished the pre-licensing coursework, you’re now ready to take the state licensure exam. If you’re getting a life insurance license, you need to pass the Life, Accident, & Health (LA&H) test.

Depending on where you’re taking it, the exam can have between 50 and 200 items and must be completed in two to three hours. The tests are proctored, meaning you will be taking them in a classroom setting with someone – called a proctor – supervising the exam.

The passing scores also vary depending on the state. Typically, you must get at least 70% of your answers correct to pass the test.

An insurance licensure exam may be one of the most difficult tests you’ll take because of the broad range of topics covered. According to data from the National Association of Insurance Commissioners (NAIC), the average passing rates for health and life insurance licensure exams are:

Life insurance: 62.9%

Health insurance: 60.4%

Life & health insurance: 64.8%

The test results are valid for two years. This means that you must apply for your life insurance license within that span. If you fail to do so, you will need to retake the exam to get your license.

How much does it cost to take the life insurance licensure exam?

Each attempt of the insurance licensure exam can cost around $40 to $150, depending on where you’re taking it. You’ll need to show one valid signature-bearing ID with your photo and the original copy of your pre-licensing education certificate before taking the test.

You won’t be allowed to take the exam if you’re unable to present any valid ID. This also means that you forfeit your payment.

4. Apply for your life insurance license.

Congratulations! Now that you’ve passed the exam, you can apply for your life insurance license. You can submit your license application to your state’s department of insurance regulation. You should wait at least 48 hours after passing the licensure exam.

You can fill in the application form online on the state department’s website. You will also need to pay a licensing fee, which varies between states. If you’re applying for a health insurance license, you will need to pay a separate fee.

The insurance regulation department will review your application. There is often no set timeframe for this as the department treats each license application differently. If something comes up from the background check, the department may contact you to clear things up. This can also delay the process.

You can find out if your application has been approved through the department’s website. Once approved, you can ask for a copy of your life insurance license. Some departments don’t mail printed licenses, so you may need to download your license and print it yourself.

If you feel that there’s a delay in processing or your application is erroneously rejected, you can also contact the department to provide clarity.

How long does it take to get a life insurance license?

Depending on your pace, the entire process of getting a life insurance license can take between two and eight weeks. You will be spending a big chunk of this time completing your pre-licensing coursework and studying for the state licensure exam.

Once you get a life insurance license, you’ll need to take a minimum of 24 hours of continuing education (CE) credits during a two-year term. These include three hours of ethics training.

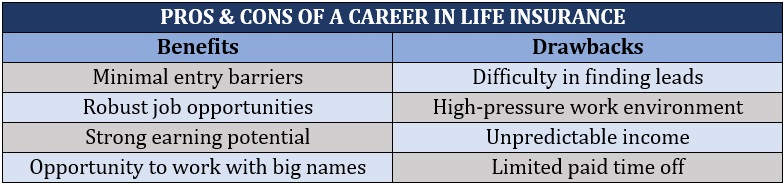

What makes a career in life insurance truly rewarding is having the opportunity to leave a positive impact on people’s lives following a tragic loss. Just like any other insurance career, the job comes with its share of pros and cons.

Pros of a life insurance career

Fewer entry barriers

All life insurance agents and brokers need licenses to sell policies. Apart from this, there aren’t too many requirements to enter the profession. While some insurance companies prefer candidates with a college degree, the role doesn’t necessarily require one.

Plenty of job opportunities

Do a quick online search for insurance jobs and you’ll find thousands of vacancies in life insurance. Insurers and agencies will always look to hire new people as long as there’s strong demand for policies that can provide families with financial protection.

Strong earning potential

Life insurance agents are among the highest paid sales professionals in the industry. Agents are paid mostly through commissions, so those who have a great work ethic are rewarded with more opportunities to earn more.

Opportunity to work with the industry’s biggest names

By pursuing a career as a life insurance agent, you get the chance to work with some of the most prominent players in the industry. Check out our latest rankings of the largest life insurance companies in the US to find out more about these industry giants.

Cons of a life insurance career

Sales challenges

As a life insurance agent, you will be tasked with finding life insurance leads on your own. This is especially challenging in a notoriously competitive line. While some agencies provide employees with leads, there’s a high chance that other insurance agents already got to those leads first.

High-pressure work environment

Get ready for long work hours and constant pressure to meet different targets and quotas. This can create a work environment that leads to stress and burnout, especially for new agents.

Unpredictable income

Because your role is mostly commission-based, it can be difficult to predict how much your next paycheck will be. This will depend largely on the number of sales you close. If you want to earn more, you will need to push yourself harder.

Limited paid time off

If you choose to be an independent agent, you will rarely have access to a full range of employee benefits. This means you will also have limited paid time off. In addition, taking days off from your job means that you will be spending time away from building relationships with clients and searching for leads. This can cost you part of your income.

Here’s a summary of the benefits and drawbacks of a life insurance career.

Your success as a life insurance agent or broker depends mostly on the kind of relationship you establish with potential clients. Here are some ways to develop good partnerships:

Practice good customer service.

Successful agents and brokers provide quality customer service by understanding the unique needs of their clients. This is key to getting potential clients to buy life insurance policies from you.

Build a strong professional network.

Selling insurance is all about establishing strong relationships with clients. That’s why it’s important to focus on this aspect first before turning your attention to sales. As you slowly build your network, closing deals will eventually follow.

Develop empathy.

Most clients already know that they need some form of financial protection; they just don’t know what type of policies they need. The best life insurance professionals have the empathy to identify the right type of coverage for their clients.

Leave a professional impression.

Dressing and communicating in a professional manner can help a lot in establishing clients’ trust. If you’re an independent agent working outside the office setting, for example, your choice of venue to meet customers plays a key role in helping impart a professional impression.

Understand that selling life insurance is a long game.

Trying too hard to sell policies right away is a quick way to ruin customers’ trust. Focus on building relationships instead. Agents who play the long game are more likely to secure a long-term client who may be willing to refer them to other potential customers.

Life insurance is a constantly evolving line and changes can occur in a snap. Another way to succeed in the field is to keep abreast of the latest developments. Our Life and Health News Section can help you with that. Be sure to bookmark this page to access breaking news and the latest industry updates.

Do you think getting a life insurance license is an easy task? Is a career in life insurance worth it? Share your thoughts in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!