How to find cheap car insurance for young drivers

How to find cheap car insurance for young drivers | Insurance Business America

Guides

How to find cheap car insurance for young drivers

Finding cheap car insurance for younger drivers is a challenging task, but there are several practical ways to get affordable coverage. Read on and find out how.

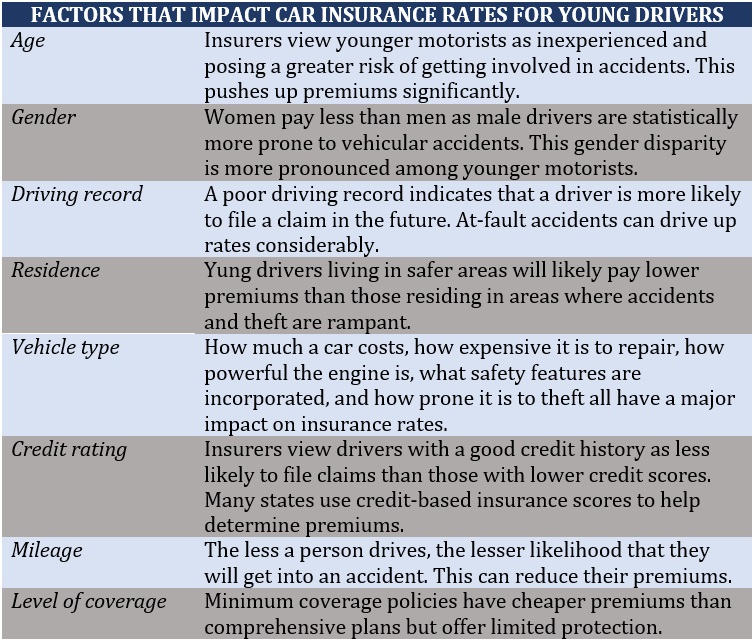

A driver’s age plays a huge role in how car insurance companies determine premiums. In general, insurers view younger motorists as inexperienced and, therefore, are at greater risk of getting involved in accidents. This pushes up premiums significantly. That’s why finding cheap car insurance for young drivers is often a challenging task.

To help younger motorists find affordable coverage, Insurance Business delves deeper into the different factors that impact auto insurance rates. We also turned to an industry expert for practical tips on how young drivers can save on car insurance costs.

If you feel that your age is hindering you from accessing affordable auto policies, then this article can give suggestions on how you can find one. Read on and learn useful strategies for obtaining cheap car insurance for young drivers in this guide.

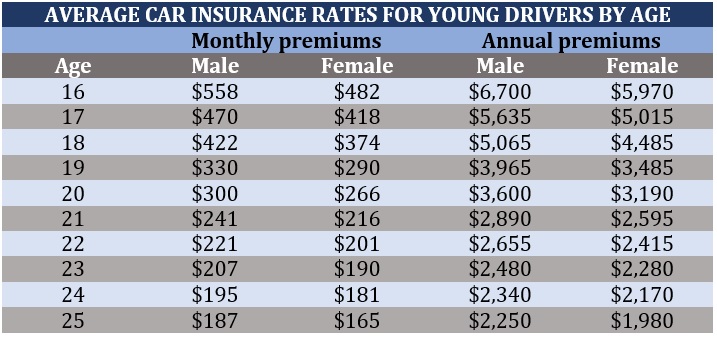

The table below shows the average cost of full coverage car insurance for drivers 16 to 25 years old. These estimates are based on data from the various price comparison and insurer websites that Insurance Business checked out.

As you may have noticed, teenage drivers, or those aged 16 to 19, pay the most expensive premiums as the age group is deemed the riskiest to insure. Rates tend to go down as motorists enter adulthood. By the age of 25, you can expect car insurance costs to drop considerably.

Gender is also a major contributing factor in how insurers determine auto premiums. Female drivers pay less than their male counterparts as men are statistically more prone to vehicular accidents. This gender disparity in car insurance premiums is more pronounced among younger motorists but closes once drivers approach 25 years old. From that point on, men and women are roughly on equal footing.

Some states, however, prohibit insurers from using a person’s gender as a basis for insurance pricing. These are Hawaii, Massachusetts, Montana, North Carolina, and Pennsylvania.

Unfortunately, there’s no way around it. If you’re under 25, you will have to pay more for auto insurance compared to the average driver because of the perceived risks you face. However, there are simple and practical ways to bring your premiums down. Here are a few strategies that can help you in getting cheap car insurance for young drivers.

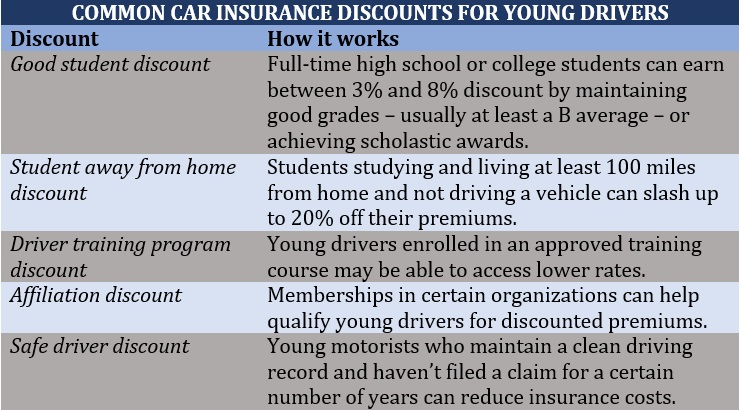

1. Take advantage of discounts.

Car insurers offer young drivers several opportunities to save on premiums in the form of discounts. These money-saving perks can be based on a range of factors, including your driving habits, your grades, and the type of vehicle you drive.

One of the most common ways for young drivers to cut insurance costs is through multi-car discounts, which you can access as long as you’re living with your parents.

“When shopping for an insurance policy, start by checking to see if there’s a parent or family plan that offers a multi-car discount on the premium,” insurtech firm Lemonade suggests. “If a new teen driver (and their car) needs to be added to a policy, a family could be eligible for a multi-car discount.”

Under the company’s car insurance product, Lemonade Car, premiums are automatically slashed off from both vehicles once a second car is added to the policy. Lemonade Car is currently available in Illinois, Ohio, Oregon, Tennessee, and Texas.

The table lists some of the most common discount options that car insurance companies offer young drivers:

Lemonade also offers discounts for young drivers who use hybrid or electric vehicles.

Those who sign up for the Lemonade app are also automatically enrolled in the company’s tree-planting program. Under the initiative, the insurtech firm calculates your mileage to determine how many trees to plant on your behalf.

2. Skip the unnecessary coverage.

Car insurers offer several coverage options to help you access the best possible protection. These optional extras, however, add to your auto premiums. When taking out car insurance, think about what types of coverage you really need.

If you’re confident about your driving skills and consider yourself a safe driver, for instance, you can ditch the accident forgiveness feature of your policy if this adds to the cost.

3. Choose annual payments for your premiums.

Paying for auto premiums in one lump sum rather than by monthly instalments can result in savings. When you do this, you can avoid being charged for interest or finance arrangement fees.

Car insurance companies also prefer this arrangement as it reduces your risk of missing a payment. Insurers generally give discounts to drivers who pay for coverage yearly.

4. Consider usage-based or pay-per-mile insurance.

Also called telematics, usage-based insurance works by adopting onboard technology or mobile applications to monitor your driving habits. The technology then uses the information it gathers to reward safe drivers in the form of discounted premiums.

“Many young drivers don’t have a long enough driving history yet to prove they’re a safe driver, so unfortunately, insurers generally see new drivers as being riskier,” Lemonade explains. “A telematics-based insurance policy could be beneficial, allowing any young driver to prove their good driving habits and unlock potential opportunities for low-mileage and safe-driving savings.”

The Lemonade app uses mileage and safe driving behavior, among other factors, to calculate a policyholder’s safety score, which ranges from 0 to 10.

“Habits like harsh braking and phone usage while driving will, unsurprisingly, impact that score, while responsible road behavior will get a driver closer to that perfect 10 – a benefit to any parent as well,” the company adds.

5. Shop around and compare quotes.

With the vast number of policies available, the simplest and fastest way to find cheap car insurance for young drivers is to shop around and compare quotes online. By doing so, you can make a side-by-side comparison of the features and benefits of the different auto policies from multiple insurance providers.

The Insurance Information Institute (Triple-I) suggests comparing quotes from at least three carriers to give you a clear picture of which features match your profile and how much coverage costs. You can even purchase online car insurance to get more savings.

When searching for cheap car insurance for young drivers, the key to getting the best deal is knowing what to look for. Apart from the price, there are other factors you need to consider when choosing coverage. These include:

Minimum coverage requirements: Each state has its own minimum requirements when it comes to car insurance. Make sure your policy complies with state-mandated coverage by checking with your state’s insurance commissioner’s office or motor vehicle department.

Discount options: Car insurance companies offer premium-reduction opportunities for young drivers. Check out which ones fit your driving profile and personal circumstances.

Coverage limits: While states impose minimum mandatory coverages, these may not provide sufficient protection, especially if you get involved in more serious accidents. Raising your limits will likely increase the premiums you need to pay, but it also gives you the assurance that you’re adequately protected when accidents occur.

Company reputation: Be sure to go with an established insurer with a stellar reputation when it comes to handling claims.

Lemonade also advises young drivers to keep an eye on services that add value to their policy.

“Roadside assistance is a popular one that can help provide peace of mind for any young driver, whether it’s a dead battery in the winter on the way to school or accidentally locking keys inside the car,” the company explains. “And because it’s the first time out on the road for many, it’s incredibly important to understand what type of coverage a policy includes and, where necessary, what optional coverages, like collision, could be beneficial.”

Besides age and gender, there are several factors that affect car insurance premiums for teens and young adults. The table below details some of these variables.

Because car insurance is one of the biggest costs associated with operating and owning a vehicle, it can be tempting to go with an insurer the provides the cheapest coverage. But doing so comes with a huge risk – you may end up losing more, especially if your policy is not enough to cover the costs of an accident.

As with any other type of insurance, cheaper doesn’t necessarily mean better when it comes to your car coverage. It is also important to look beyond the insurance rates and assess if the policy offers the level of protection that matches your needs.

Do you find searching for cheap car insurance for young drivers difficult? Do you have other tips to share on getting affordable coverage? Feel free to type in your comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!