How to Buy Life Insurance Wisely: A Step-by-Step Guide

What to Know Before Buying Life Insurance

Life insurance is for anyone who has someone depending on them. It can replace your income and ensure those you leave behind don’t struggle financially.

Seven common reasons why people buy life insurance:

Replace lost income and secure your family’s standard of living

Ensure family doesn’t need to sell their home

Take care of childcare or school tuition

Repay debt left behind (credit cards, student loans, medical bills)

Prevent forced selling of assets (car, stocks, jewelry)

Prevent early withdrawal from survivor’s retirement funds

Pay for your end-of-life expenses (funeral, burial, medical bills, and taxes)

How to Purchase Life Insurance

The concept of life insurance has been around since Ancient Rome. Luckily, types of life insurance and how they are purchased have changed with the times.

Buying life insurance in the 21st century is easier than ever. You can do the whole process online.

Let’s look at a few different ways to buy life insurance.

Independent brokers represent you. Brokers have contracts with many insurance companies and can shop the market to offer more options.

Captive agents represent one insurance company — their employer. They only offer products from that insurance company.

Direct – People assume you can buy straight from the insurance company and save money by ‘cutting out the middleman.’ Because insurance rates are regulated by state laws, discounted rates don’t actually exist. Applying on an insurance company’s website directs you to one of their captive agents.

Financial advisors provide financial advice, which includes life insurance. Some advisors are licensed to sell life insurance policies to their clients.

Your Employer – Many employers offer life insurance as part of their employee benefits package. Typically, employees are eligible for a small amount of group life insurance coverage with premiums paid for by the employer. Employees may also have the option to buy supplemental coverage at an additional cost.

Step 1: Understand Your Options

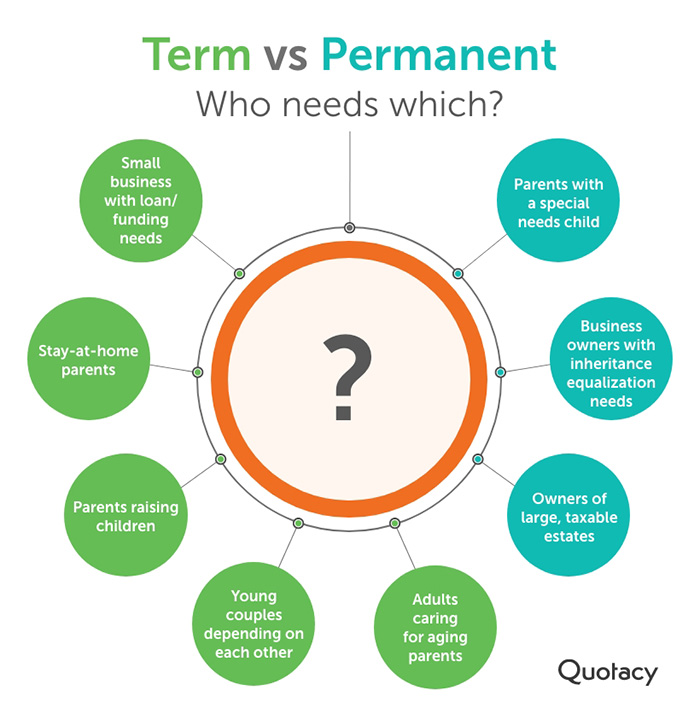

The first step in purchasing life insurance is education. Life insurance policies can be sorted into two categories: term life insurance and permanent life insurance. The type(s) you need depend on your circumstances.

Term Life Insurance

Folks often purchase term life insurance as income replacement to protect their families against the what-ifs.

Term life insurance provides coverage for a specific period. If the insured individual dies within the term, the policy’s beneficiaries will receive a check from the life insurance company.

When the term is over, the coverage expires. If you decide you need more coverage before the term ends, you may have some options.

Term life insurance is more affordable than permanent life insurance due to its simple, temporary coverage.

Let’s review the different types of term life insurance.

Level-term life insurance is often just called term life insurance because it’s the most common choice. It’s the best type of life insurance for families because it’s easily customizable and affordable. With this option, your premiums remain the same.

Decreasing term life insurance coverage decreases over time. The premium will be a fixed rate, but you will pay less for this type of policy because of the decreasing coverage. It’s usually purchased to help secure a mortgage or business loan.

Annual renewable term life insurance (ART) allows you to purchase one year of coverage at a time. You lock in a set number of years you can renew annually without proof of insurability. During this time, your premiums are assessed annually and increase as you get older.

Return of premium term life insurance refunds your premiums if you outlive the policy term. Like level-term, the premiums are fixed but much higher due to the potential refund.

Permanent Life Insurance

Permanent life insurance provides coverage for your entire life as long as the premiums are paid. Because it covers your whole life, whole life insurance, a type of permanent life insurance, is often used interchangeably with “permanent life insurance.”

Many permanent life insurance policies have savings components that generate a cash value you can borrow against as policy loans or withdraw from. Certain permanent policies also pay dividends to policy owners.

Because of the policy features, permanent life insurance premiums are much higher than term life premiums.

Let’s examine the different types of permanent life insurance.

Whole life insurance lasts your entire life, usually has fixed premiums, and accumulates cash value over time. It is the most comprehensive permanent coverage option, which also means the highest premiums.

Universal life insurance (UL) offers fewer value growth benefits in exchange for a lower price and flexible payment options. UL policies have a savings component that accrues cash value based on market interest rates.

Indexed universal life insurance (IUL) accumulates value through investments in a stock market index. There is a guaranteed 0% floor for your risk, but there is a cap.

Guaranteed universal life insurance (GUL) is one of the least complex options. A GUL policy has a set face amount and regular payment. As long as you make payments on time, your rate and death benefit are locked in and guaranteed to stay the same. This is the best budget option for permanent life insurance.

Guaranteed issue life insurance offers guaranteed acceptance. To qualify, you do not need to take a medical exam, answer any medical questions, or have your medical records reviewed. In exchange for this simple guaranteed coverage, the premiums are high, coverage is limited, and there is an age range requirement.

Simplified issue life insurance doesn’t require a medical exam, but you need to answer a few medical and lifestyle questions to be approved. It’s more expensive than most permanent policies but less expensive than guaranteed issue.

Learn more about your life insurance policy options and how they work.

Step 2: Find a Policy that Best Fits Your Needs

Your family situation, finances, and goals will help determine which policy is best for you. A level-term life insurance policy is the best option for most families. For others, permanent life insurance or a mix of both is the ideal solution.

Term Life Insurance

Term life insurance is ideal if you have specific years you need to provide financial protection. In many cases, these are the 20-30 prime earning years before retirement.

Term life insurance can replace your income, pay off debt, and protect your family’s standard of living.

Term life insurance can benefit the following individuals:

Young couples that rely on each other financially.

Parents raising children.

Sole financial providers whose spouse is a stay-at-home parent.

Stay-at-home parents.

Adult children caring for their aging parents.

Individuals who have significant debt their family will inherit upon their death.

Small business owners with loan requirements or buy-sell agreement funding needs.

Permanent Life Insurance

While permanent life insurance is 10-20 times more expensive than its term counterpart, it has many benefits and can be the right fit for some circumstances.

Permanent life insurance can benefit the following individuals:

Parents of a child with a life-long disability or special needs.

Individuals with a large, taxable estate.

Business owners with inheritance equalization needs.

Step 3: Determine How Much Life Insurance You Need

One of the most critical steps in buying life insurance is figuring out how much you need. The right amount of life insurance is different for everybody.

Think through your life insurance goals and, most importantly, consider what you can afford over time. Everyone loses if their life insurance premiums are too high to pay long-term, and the policy lapses.

Term Life Insurance

Term life insurance is ideal for covering significant temporary financial responsibilities because the coverage is affordable and finite. Your term options range from 10-40 years.

When choosing life insurance, pick a term length that equals your longest financial obligation. This varies from person to person and includes things like your mortgage loan, the number of years until you retire, or years until your youngest child is financially independent.

It’s common for people to buy $250,000, $500,000, or even millions of dollars of term life insurance. If you die unexpectedly, you want your policy to ensure your family can pay for your funeral and debt left behind and also keep their standard of living.

Permanent Life Insurance

Permanent life insurance, if needed, is typically purchased in lower face amounts because of the high price tag. Using it to cover all of your life insurance needs would be far too expensive.

We recommend buying a more comprehensive term life insurance policy to cover all your big-ticket responsibilities and supplement it with a smaller permanent policy to cover any end-of-life expenses.

For example, you could buy a $500,000 30-year term life insurance policy at age 30 for approximately $30 per month to replace your income should you die unexpectedly during your working years. And then supplement it with a $50,000 whole life insurance policy that costs approximately $60 per month to ensure you leave your loved ones some money for end-of-life costs, no matter when you die.

Learning how to choose the best life insurance policy and knowing how much you need can be overwhelming. Quotacy’s agents do not work on commission and can help you with a needs assessment if you don’t know where to start. If you prefer to do it yourself, try our free life insurance needs calculator.