How To Arrange Life Insurance (for less)

John, a 35-year-old father, has two young kids: Emma, who is 5, and Noah, who is 3.

John provides for the family, and if something were to happen to him, they would face financial hardship.

He is wondering how he should arrange life cover?

Let’s look at what would happen if John passed away..

Immediate Needs:

The family would need money to cover funeral expenses and continue paying bills, like the mortgage.

Living Costs:

Emma and Noah need money for food, clothing, and WiFi.

Education:

Noah and Emma will likely need money for their education, particularly for college.

As a result, John needs a significant amount of life insurance now to ensure that his family’s financial needs are met if he passes away unexpectedly.

Fast forward twenty years, John is 55, and his kids are adults.

Emma has a job, and Noah is starting his career.

The family’s mortgage is paid off, and John and his wife are preparing for retirement.

At this point, John’s need for life insurance is greatly reduced because:

Fewer Immediate Needs:

The mortgage is no longer a concern, and immediate expenses are lower.

Independent Children:

Emma and Noah are self-sufficient, so John’s life insurance doesn’t need to cover their living or educational costs.

Retirement:

John and his wife have prepared for retirement, ensuring they have funds for the future.

So how should he arrange life cover?

He has two options

1) Level term life insurance

2) Decreasing term life insurance

John, like all of us, needs more life insurance when the kids are young and dependent,

This need reduces as our kids grow up and become financially independent.

So why do most people buy a level-term life insurance policy that will pay the same amount now as it will in 25 years?

Don’t you need more cover now and less in the future?

Is there a better way to arrange life cover?

What’s the Best Way to Buy Life Insurance?

Let’s say you’ve worked out that you need cover of €500,000 over 25 years to care of your family should you leave us unexpectedly.

If you die tomorrow, your family will receive €500,000.

Should you head off in 5 years, your family will receive €500,000

In 24 years, 11 months, and 30 days…your family will also receive €500,000

Does it make sense for your family to get the same payout in 25 years as they would today?

Or is there an alternative?

Of course there is!

Should You Buy Reducing Life Insurance Instead of Level-Term?

A quick crash course on the two types of life insurance available:

a) Level Term Life Insurance

This is your run-of-the-mill life insurance.

You die during the term, and it pays out the agreed lump sum.

So if you take out €500,000 over a 25-year term and you die within those 25 years, it pays out €500k to your family.

Simple enough, right?

b) Decreasing Term Life Insurance

This is a life insurance policy where coverage reduces over time.

By the way, if you choose to assign it to a bank for a mortgage, it becomes what is better known as Mortgage Protection.

But what few people know is that you can buy reducing term life insurance and use it as personal life cover (even if you’re not getting a mortgage)

Using our example above but buying €750,000 reducing term life insurance over 25 years:

If you die tomorrow, your family will receive €750,000

If you pass in 5 years, your family will get around €600,000 because your cover would have reduced over time.

If you survive for 24 years, 11 months, and 30 days, your family receives around €17.52 (nothing basically)

So reducing term life insurance pays out more when your family need it most – when the kids are young.

Because, in the future, when they’re financially independent, they don’t need a huge payout.

Therefore, arranging life insurance on a decreasing basis better meets your needs.

It protects your family when they are most vulnerable

And the real beauty is…

IT COSTS LESS THAN TERM LIFE INSURANCE

Case Study

Evan thought a €500,000 15-year life insurance policy would be best for his situation.

Hi Nick, I used your price comparison wizard. Given my assets & pension cover, etc., I would like to arrange life insurance for €500,000 for 15 years (while we still have kids at home). Both 46, full health etc. It quoted €100 per month. Let me know any other key points to consider. Thanks, Evan

But did Evan need level-term life insurance, or would reducing life insurance work just as well?

Let’s find out:

Using decreasing cover has two significant advantages

You get more cover.

It’s cheaper

In the end, bought €500,000, but on a reducing basis.

He then used the €41 per month savings to buy an income protection policy, which he initially thought was outside his budget!

What are the Pros and Cons of Reducing Life Insurance?

Pros

You can get more coverage for the same price

Or you can buy the same amount over a longer term for the same price

Cons

The payout is small in the last few years of your policy

If you add serious illness cover, it can only be on an accelerated basis, so this cover also reduces over time.

Anything Else I Need to know?

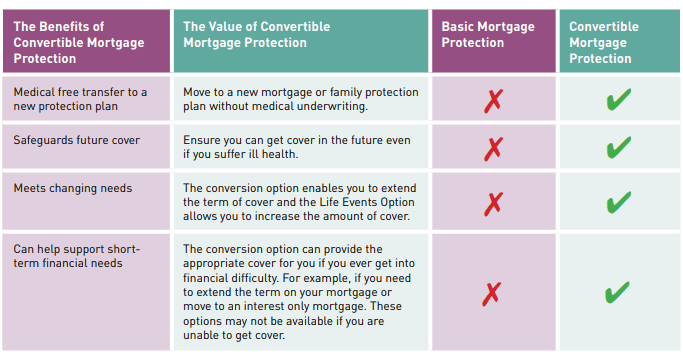

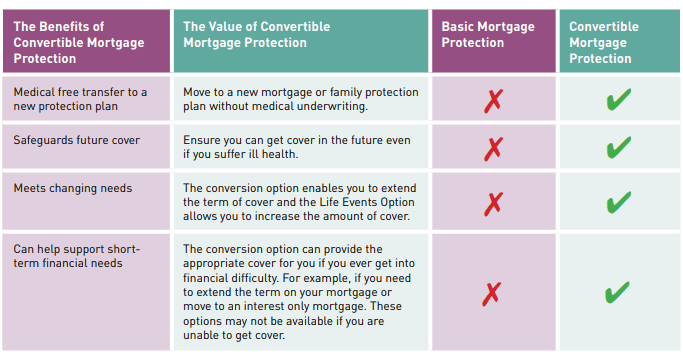

When I first wrote this blog, way back, there was no conversion option available for reducing life insurance policies, so you couldn’t extend your policy in the future.

Since then, Zurich Life, Royal London, Irish Life and New Ireland have all added a conversion option to their reducing life insurance policies.

The conversion option is magic (not as magic as that tractor that turned into a field, but magic nonetheless)

You can convert your reducing life insurance into level-term life insurance in the future without answering medical questions.

Consider it a safety net if you change your mind and prefer level-term life insurance.

Can You Buy Life Insurance That Pays Out Monthly (not as a lump sum)?

Yes, you can, and I discuss that in great detail here:

What is Monthly Income Life Insurance?

Over to you…

I know this blog is a bit complicated, so I’m sorry if I have melted your head.

But if you complete this life insurance questionnaire, I can do the thinking for you and send you a personalised recommendation.

![]()

![]()

Or, if you’d like a quick chat to discuss, please schedule a time here.

Talk soon

Nick

Editor’s Note: We first published this blog in 2017 and have regularly updated it since