How Much Money Do You Need to Retire in Canada? | A Detailed Analysis

Background: What Drives Financial Concerns Around Retirement?

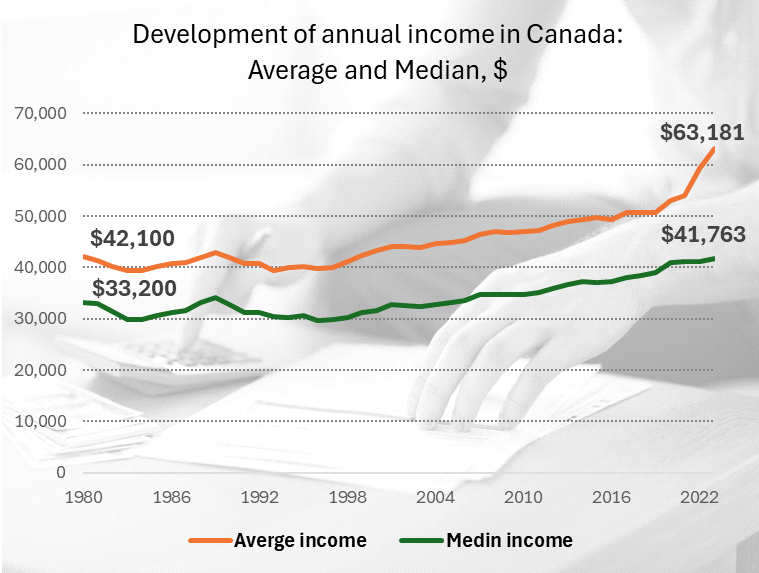

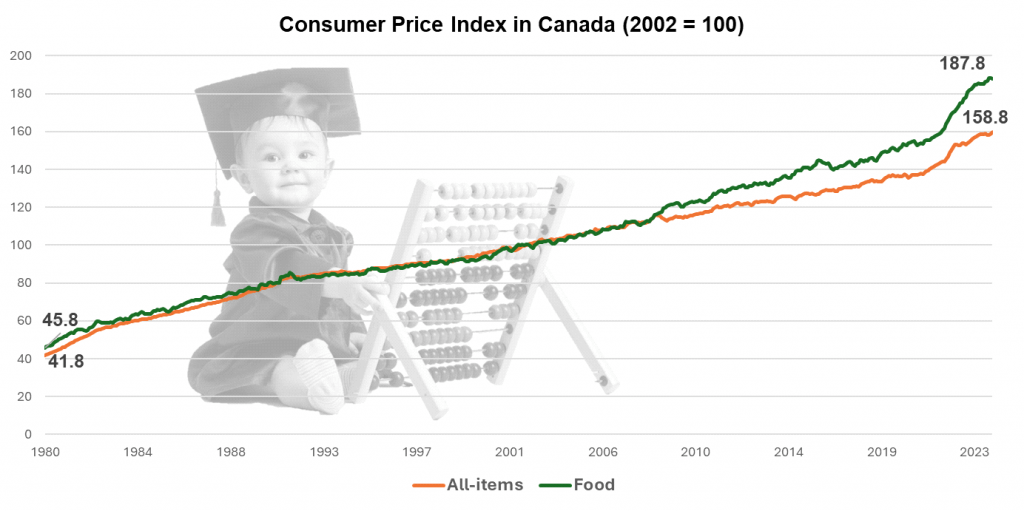

Despite soaring costs in Canada, especially on the real estate side, the incomes of Canadians have not grown fast enough to keep pace with the increased cost of living. Both average and median incomes have not climbed as quickly as the consumer price index (CPI).

This means, the average salary grew only by 50% and the median salary grew only by 26% between 1980 and 2022, which results in minimal growth year-over-year. However, when we look at the development of the CPI, it climbed far faster than salaries; growing almost 400% between 1980 and 2023.

To put this in perspective, when a loaf of bread at Loblaws costs $3.99, as it averages now at Loblaws in 2024, it would have cost so much in the previous years:

198019902000201020202024$1.12 $1.87 $2.29 $2.69 $3.49 $3.99

It means getting less for a similar amount of money, given that salaries have not increased at the same speed.

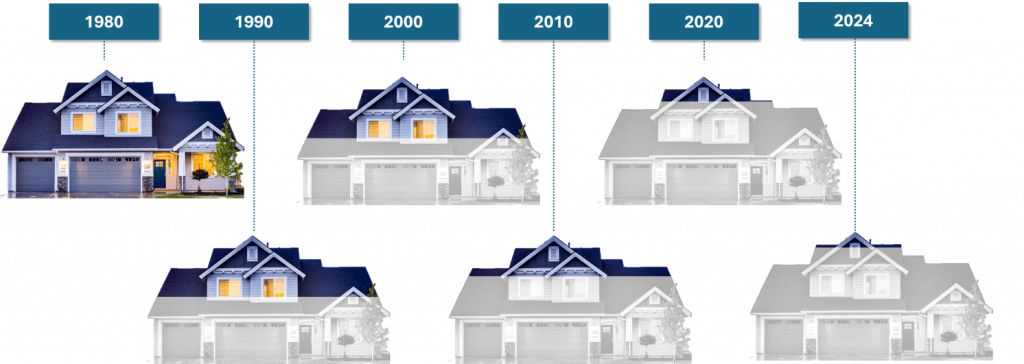

If we look at real estate prices, this development becomes even more drastic, especially in cities like Toronto and Vancouver. For example, in 1980 the average price of a Toronto property was $75,694. In 1990 – $255,000, in 2000 – $243,255. In 2010 it was $431,262 and in 2020 it was $939,636. In 2023 costs soared further to $1,126,591.

At the same time, life expectancy in Canada increased from 75.1 years to 82.96 in 2023. This overall statistic, though, is watered down by a number of factors, including those who have a diminished health expectancy due to health pre-conditions. What stands out is, currently 5 out of 10 Canadians aged 20 today are expected to reach age 90, and 1 out of 10 is expected to live to 100 years of age.

It is no wonder why Canadians are asking themselves if they will be able to afford a decent retirement in an environment where they live longer than ever, but salaries do not climb as quickly as consumer goods prices and real estate costs.

How is This Retirement Article Different?

There are numerous articles written on the topic of retirement and how much money you need. Most of them converge towards a simple “you need 70% of your pre-retirement income,” statement, which is a preferred way for financial advisors to plan but it does not take into account specifics of particular situations such as if you rent or own a house, if you wish to gravitate towards a simple or more luxurious lifestyle, etc.

There are several themes we will cover in this article. First, we discuss probable scenarios and for each of them, and we share a ballpark of how much money you need. Next, we will talk about the money you need if you want to retire at a particular age or at a particular salary. Finally, we dive into insurance products such as whole life insurance, universal life insurance, term life insurance, critical illness insurance that will help you plan your retirement better.

Our Approach

So, let’s start by stepping away from the standard 70% approach and instead develop an approximate schedule of payments that you can expect to pay across different categories such as house, transportation, food, hobbies, and vacations.

For our exercise, we use the example of somebody who is about to retire at the age of 64. Average life expectancy in Canada is currently 84 years but that is a dangerous number to plan for as this variability is fairly high; you don’t want to run out of money by that age. We use 94 as our upper reference number, meaning that if you retire at 64, you should be prepared to financially cover 30 years of your life at the style you are considering.

We added more scenarios based on two major factors:

Having a mortgage versus a house that is paid off, as this is a big cost driver.The type of retirement you are gravitating towards – standard versus luxurious. Within luxurious retirement we considered several vacations throughout the year, having a more expensive car, and spending more on groceries.

A few other assumptions we factored in:

This calculation does not include any jobs or side hustles you could be pursuing to augment your cash flow after retirement.We do not consider any savings that you might have accumulated (e.g. RRSP, TFSAs, etc.). If you have saved $1M throughout your pre-retirement years, you need $1M less once you are retired.We do not consider additional investments as you would need to consider both the additional income stream from these investments and also the taxes associated with them.If you have an additional stream of income through a pension/annuity, that would also change the equation in your favour.We do account for inflation using 2.5% as an annual inflation marker.We do not consider any additional value that might be locked in your property that you could access in different ways, e.g. HELOC, reverse mortgage, or downsizing or selling your property.We do not include in the calculation any government benefits that could have been accumulated over time such as Canada Pension Plan (CPP) or Old Age Security (OAS) pension.

Scenario 1: Single Person Household

First, we look at the scenario of retirement savings for a single person both with and without a mortgage. For that, we refer to an average mortgage ($469,000) and assume a term of 20 years.

The range that is provided refers to retirement funds required for living until the ages of 84 and 94.

In addition to that, we differentiate between moderate and luxurious retirement living where we double expenses in some categories (highlighted in red in the table below).

Cost categoriesDwelling• Mortgage

• House maintenance & other fees (e.g. garbage)

• Home insurance

• Property taxesUtilities• Cable

• Internet

• Hydro

• Gas/HeatingTransportation• Gas

• Insurance

• Car maintenance

• Car change (every 15 years)Food• GroceriesHealthcare• Basic healthcare expensesApparel• Clothing

• ShoesEntertainment

Single Person Household Without a Mortgage

If you do not have a mortgage to pay when you retire, that sets you up for far lower retirement costs. The main dwelling-related costs that you will be responsible for are:

property taxesmaintenance costsadditional fees (like garbage fees)home insurance

In this case, your estimated retirement budget could look as follows:

Single Person Household with a Mortgage

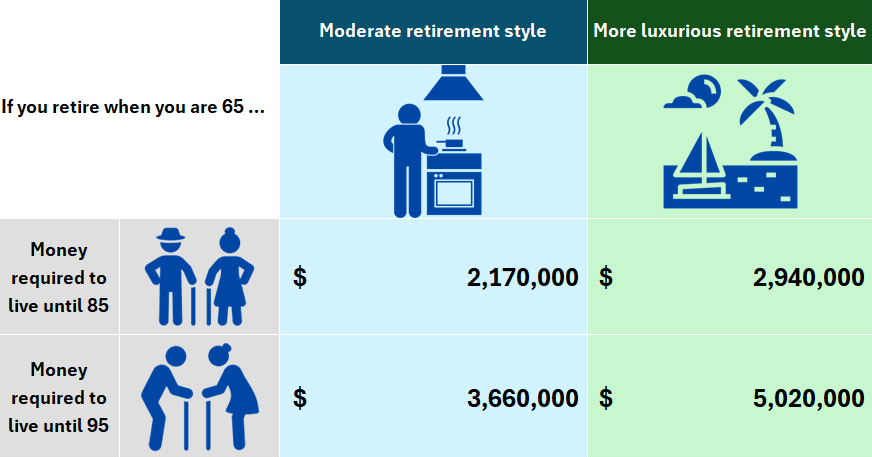

Should you have a considerable mortgage when you are retiring, you need to carry additional costs. In this case, you are adding an average of $2,500/month to your retirement budget. Your estimated retirement budget could look as follows: between $2.2M and $2.9M for moderate and luxurious retirement styles when you plan until the age of 85, and between $3.7M and $5.0M for moderate and luxurious retirement styles when you plan until the age of 95.

It makes sense to mention that the financial needs of somebody who is planning to stay a renter are somewhat similar as this person will not be paying off a mortgage but will spend a considerable amount of money in rental costs. Rental costs of ~$4,000/month will result in numbers similar to the ones above.

A person with a partially paid mortgage might have additional sources of cash such as unlocking value in an already paid-off portion of the property (HELOC, reverse mortgage, full property sale, etc.).

Scenario 2: Two-person Household

In this scenario, we look at retirement funds required for a household of two people around retirement age. We assume that at this stage there are no child-related expenses as the children have already grown up and are completely independent.

We stick with the same mortgage, knowing that these costs are spread across two people.

At the same time, some costs like apparel, vacations, etc., are doubled (as noted in the table below in red) whereas others like food are increased by 75% (see the table below in blue), realizing that there are some savings when living together.

Please note that this is only an approximation.

Cost categoriesDwelling• Mortgage

• House maintenance & other fees (e.g. garbage)

• Home insurance

• Property taxesUtilities• Cable

• Internet

• Hydro

• Gas/HeatingTransportation• Car maintenance

• Car change (every 15 years)

• Gas

• Car InsuranceFood• GroceriesHealthcare• Basic healthcare expensesApparel• Clothing

• ShoesEntertainment• Hobbies

• Vacations

• Going out

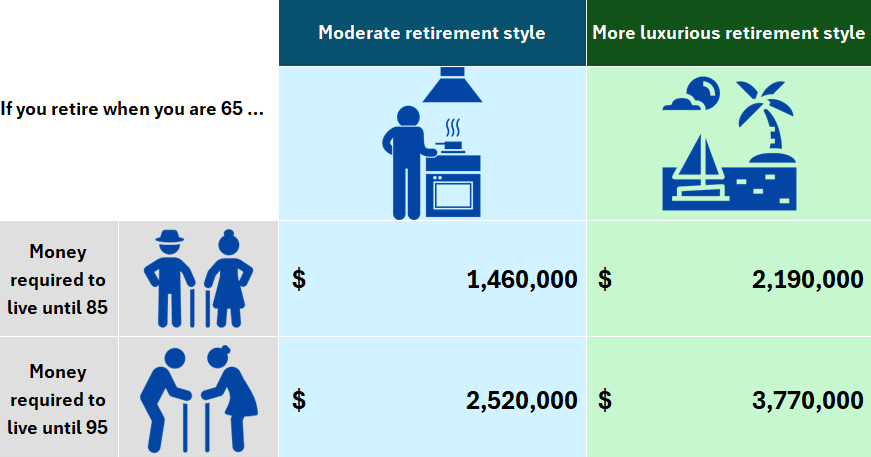

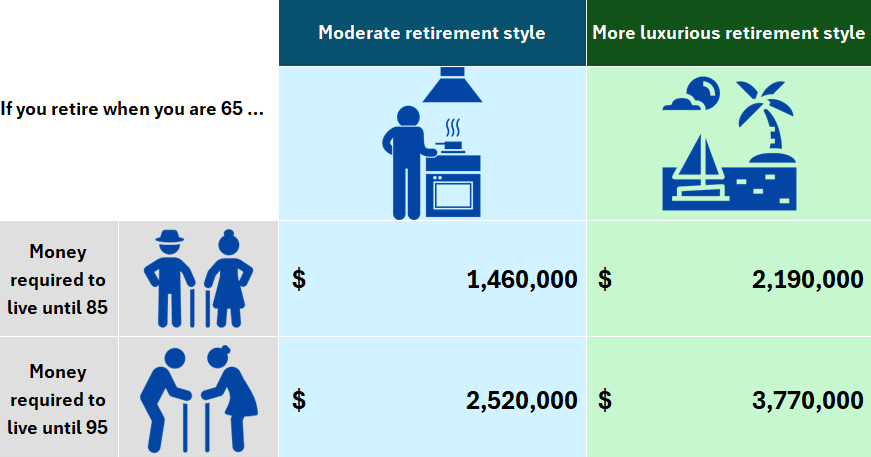

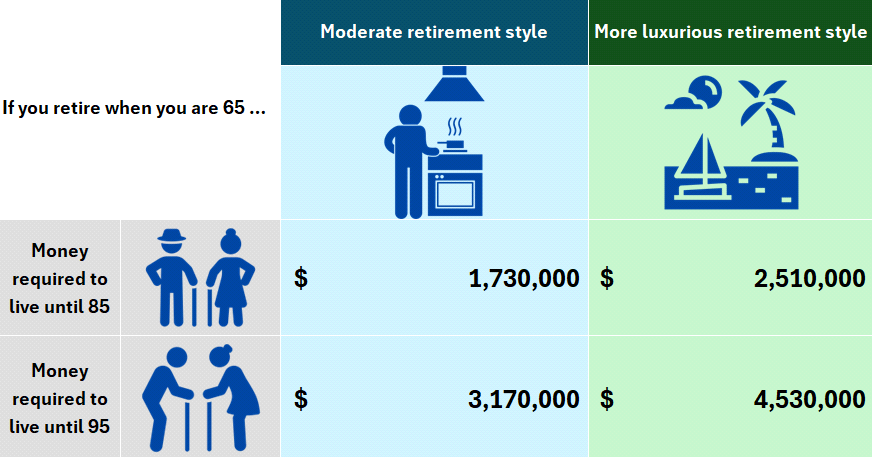

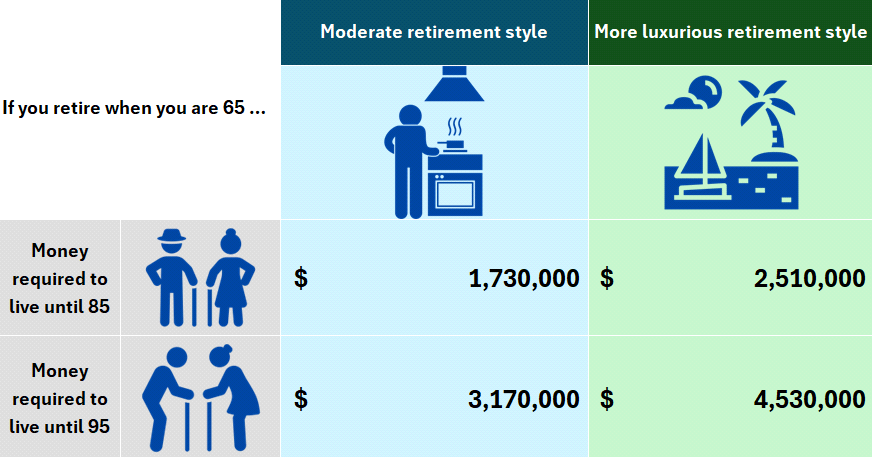

Two-person Household Without a Mortgage

If your household does not have a mortgage to pay, that sets you up for far lower retirement costs. The main dwelling-related costs that you will be on the hook for are property taxes, maintenance costs, additional fees (like garbage fees), and home insurance.

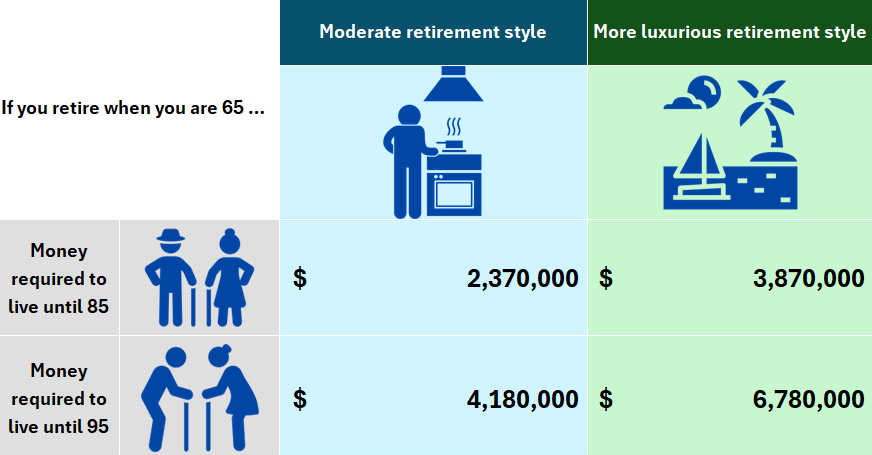

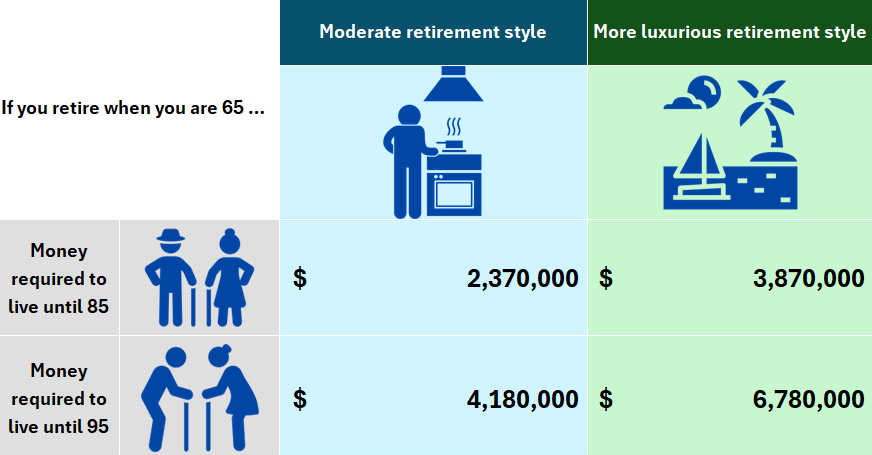

In this case, your estimated retirement budget could look as follows:

The numbers above are per household, meaning that if both partners or spouses are contributing to the household, each of them could contribute from $1.2M (money required to live in a moderate fashion until the age of 85) to $3.4M (money required to live in a luxurious fashion until the age of 95).

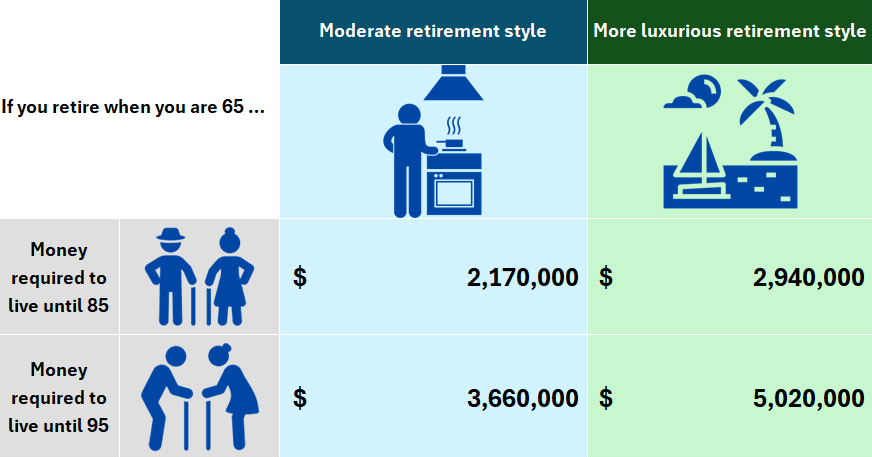

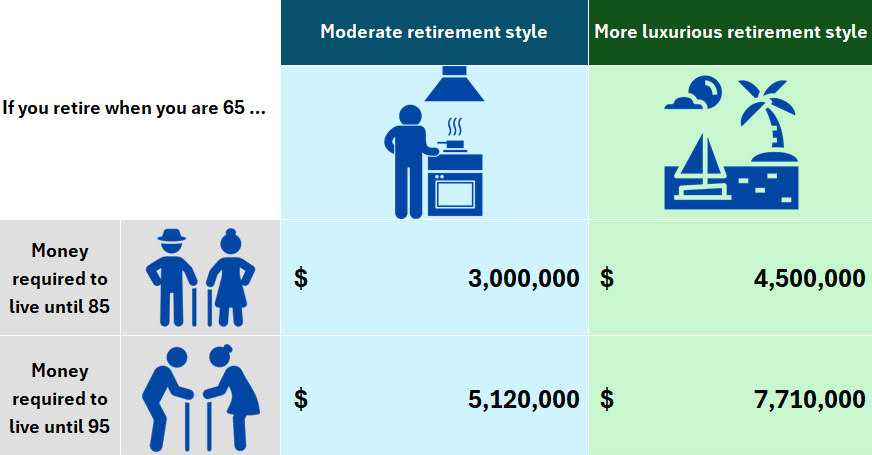

Two-person Household with a Mortgage

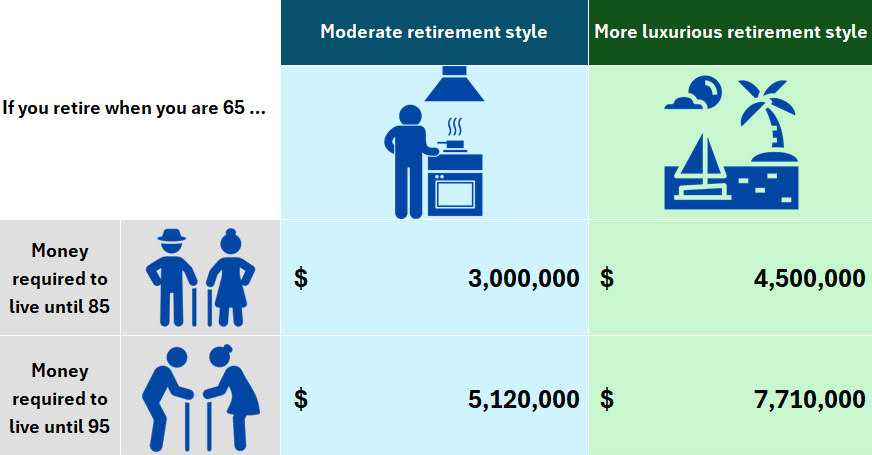

If you still have a lot to pay off on your mortgage when you are retiring, you need to carry additional costs. In this case, you are adding on an average of $2,500/month to your retirement budget.

Your estimated retirement budget will be between $3.0M and $4.5M for moderate and luxurious retirement styles to reach age 85 in comfort, and between $5.1M and $7.7M for moderate and luxurious retirement styles when you plan to live until the age of 95.

Scenario 3: Single Person Household with a Serious Medical Condition

As people get older, their health tends to deteriorate. It comes as no surprise that there might be additional costs associated with maintaining a good standard of living for those who experience serious medical conditions.

The key difference in this scenario as compared to the first one (a single person) is the medical condition of a retiree that requires him/her to spend additional funds on health-related care.

We account for this by adding additional homecare expenses, basically somebody who helps with everyday tasks like a nurse or a personal support worker. That adds around $4,000/month to the budget.

For our exercise, we consider that the full amount is paid out of pocket (private care option), without any government support. Note that the government may offer some additional financial support depending on your case.

Single Person Household with a Serious Medical Condition and Without a Mortgage

No mortgage also means lower costs for seniors with medical conditions, if they can stay in their own dwelling. The main dwelling-related costs that you will be on a hook for are property taxes, maintenance costs, general fees (HOA, garbage, utilities), and home insurance.

A typical budget in this scenario can look like this:

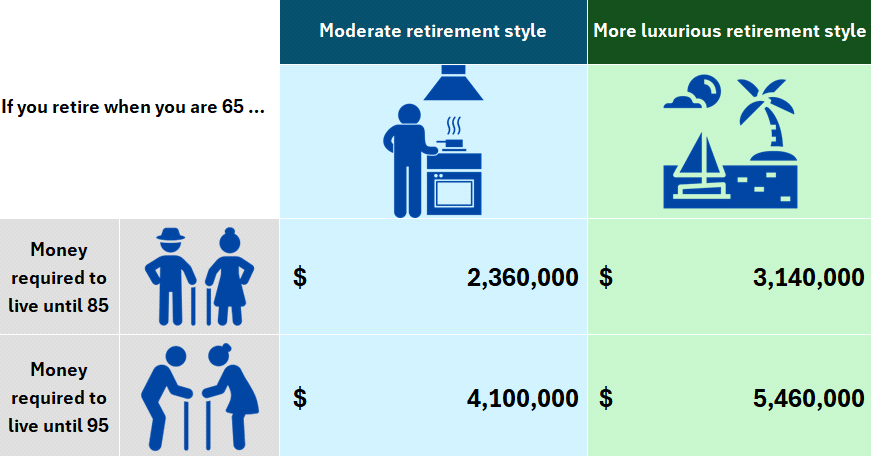

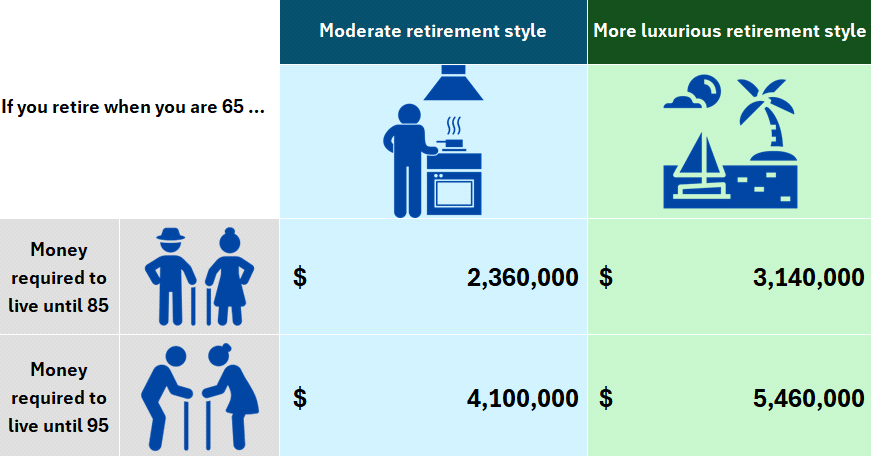

Single Person Household with a Serious Medical Condition with a Mortgage

Should you have a considerable mortgage when you are retiring, you need to carry additional costs. In this case, you are adding an average of $2,500/month to your retirement budget on top of all your other expenses.

Your estimated retirement budget could be between $2.4M and $3.1M for moderate and luxurious retirement styles respectively when you plan until the age of 85 and between $4.1M and $5.5M for moderate and luxurious retirement styles respectively if you live to the age of 95.

How Much Money Do I Need to Retire at a Particular Age?

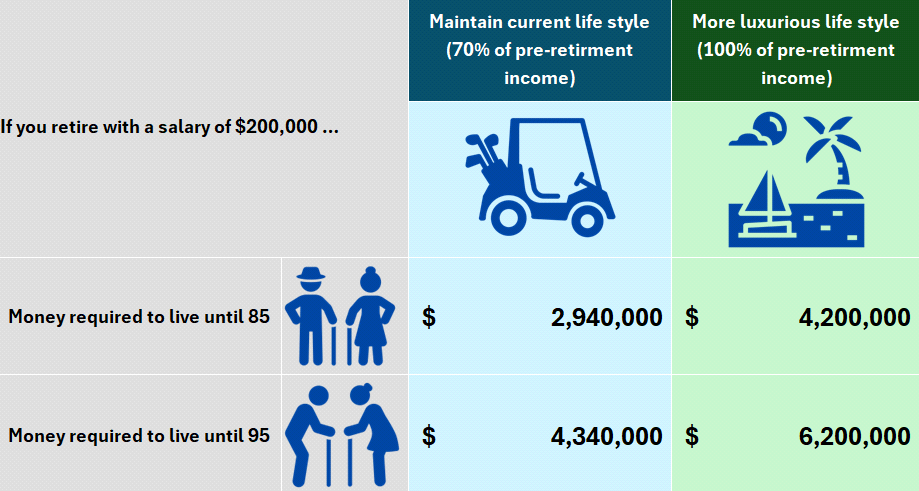

To answer this question, let’s consider a simplified approach considering that if you want to maintain your current lifestyle you need to plan for 70% of your pre-retirement salary for each year of your life. Should you spend your retirement in a more luxurious way, dedicating yourself to hobbies you have always dreamed of plus allowing yourself a few vacation trips a year, you’d better plan for your full pre-retirement income (100%) for each year of your life in retirement. The idea is that an additional 30% of expenses can be saved from not having work expenses (less needed for transportation, clothing, etc.). These funds can be diverted to hobbies, additional vacations, and other items of interest.

Since salaries vary greatly; we take a few select data points from 2023:

Median Canadian Salary: $41,763Average Canadian Salary: $63,181

In addition to that, we also look at the numbers when a salary is around $80,000 and $120,000 per year.

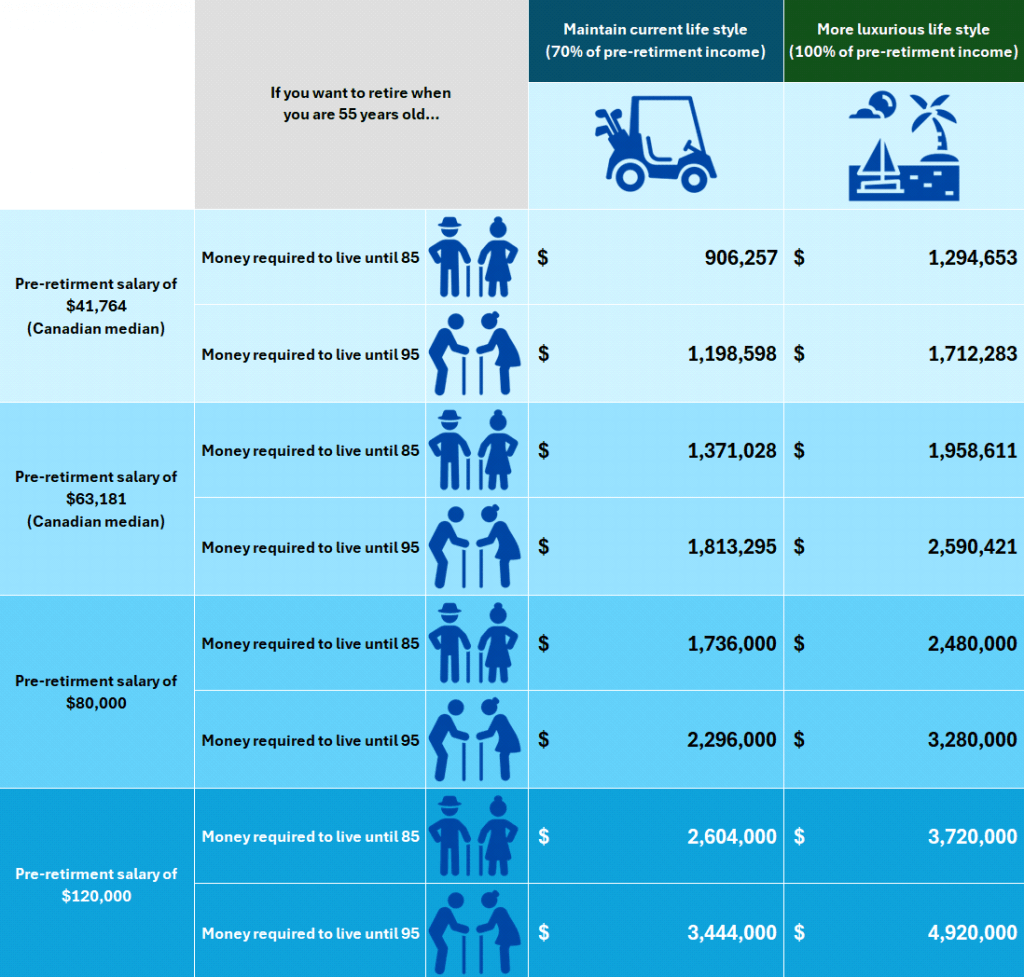

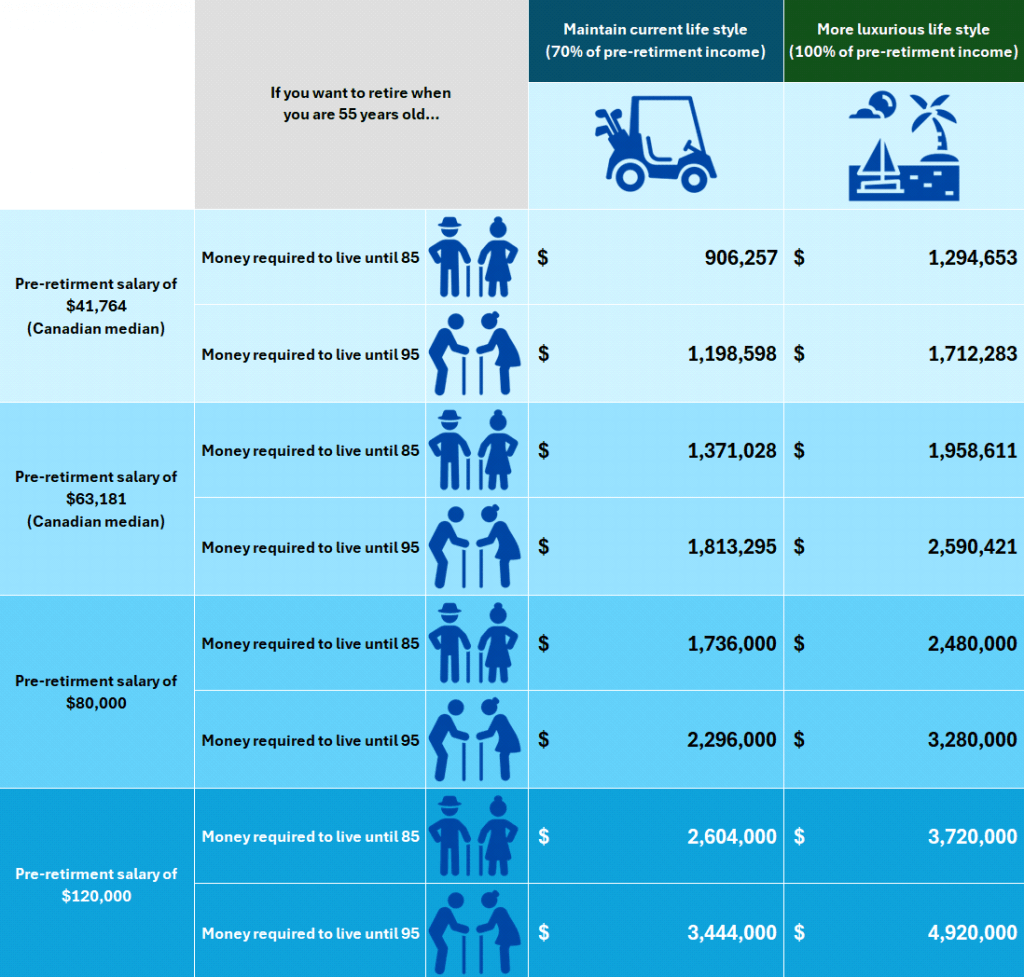

How Much Money Do I Need to Retire at Age 55?

To retire at the age of 55 while having a salary just shy of $42,000 (again considering the Canadian median income of $41,763), you would need approximately $0.9M to comfortably reach the age of 85 and $1.3M to reach 95. However, to retire on full pre-retirement income, you need approximately $1.2M to reach 85 and $1.7M to reach 95. Note that if your pre-retirement income is higher, you should plan for higher retirement funds, according to the table below.

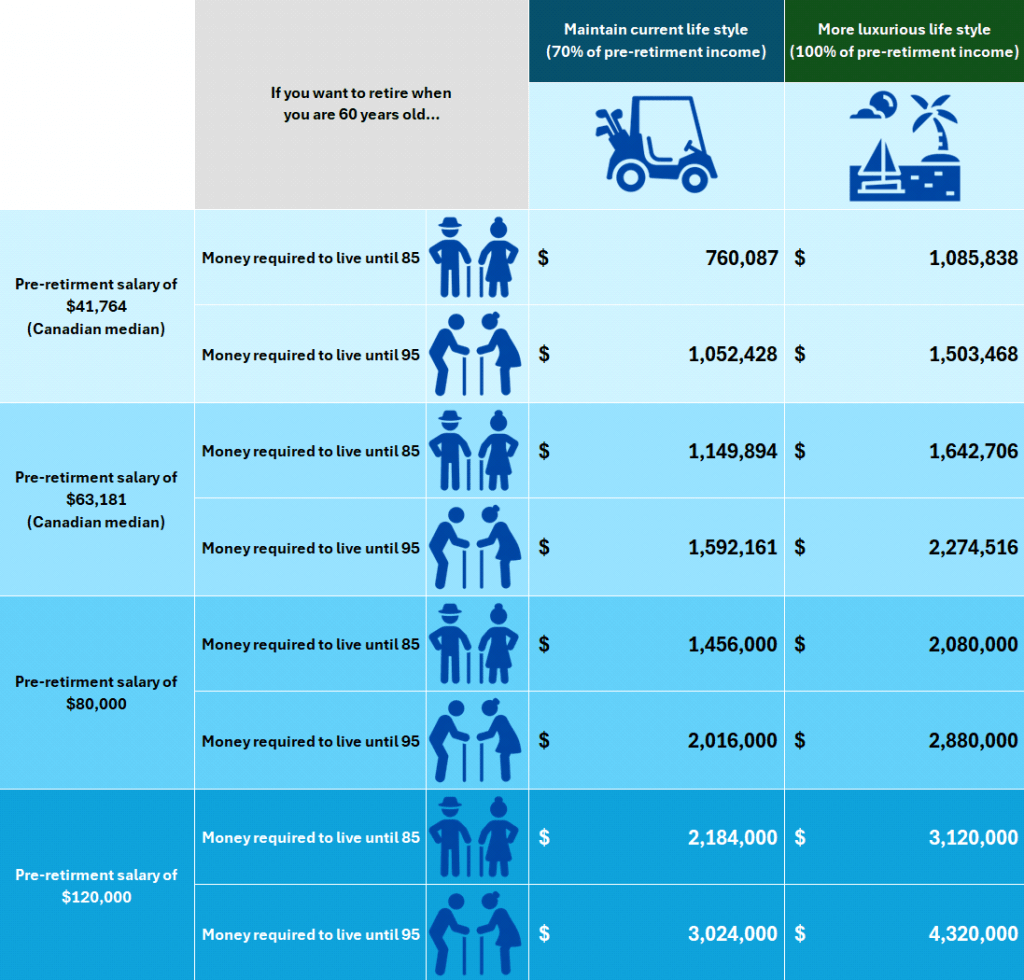

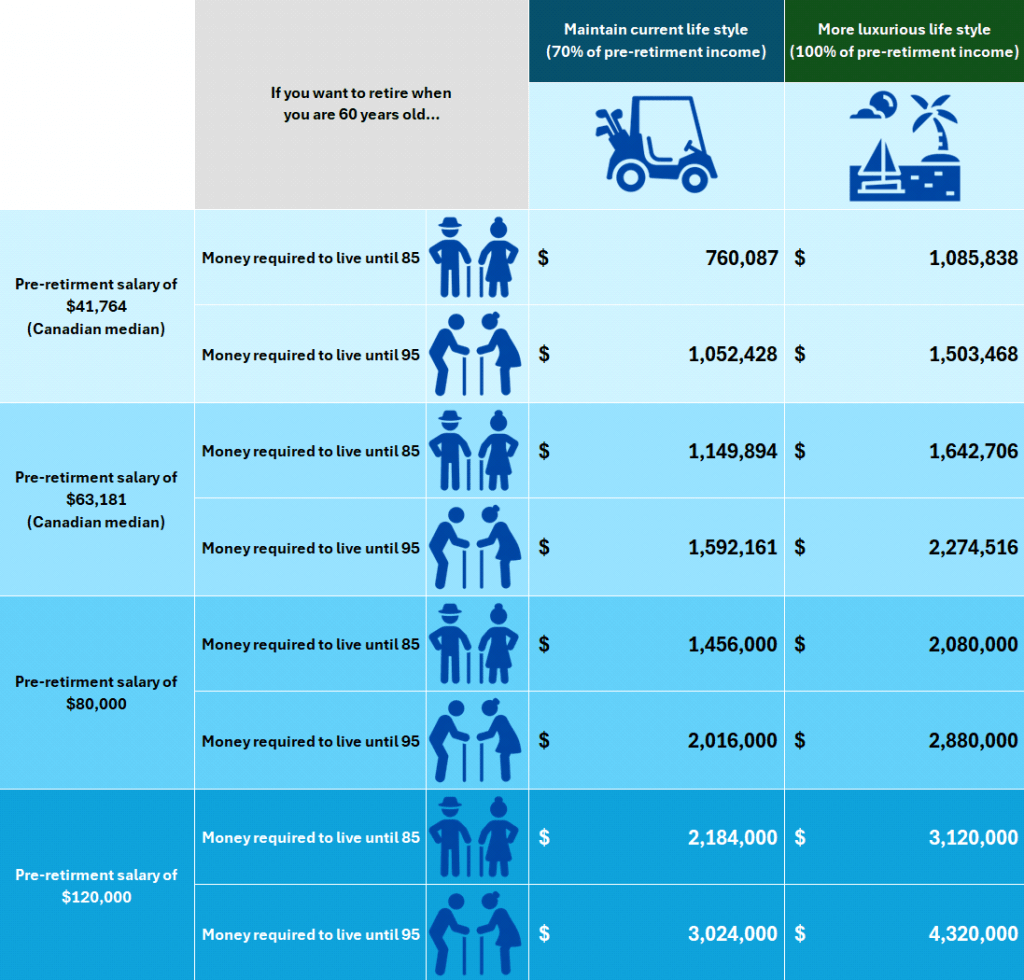

How Much Money Do I Need to Retire at Age 60?

At age 60, while having a salary just shy of the median at $42,000, you would need approximately $0.8M to retire at 85 and $1.1M to retire at 95.

If you plan to rely on your full pre-retirement income, plan for approximately $1.1M for age 85 and $1.5M for age 95.

Should your pre-retirement income be higher, let’s say $120,000, you would need significantly higher pre-retirement funds. If you decide to maintain your current lifestyle (while planning for 70% of your pre-retirement income), you’d need $2.2M and $3.0M to live until 85 and 95 accordingly, or $3.1M and $4.3M to live until 85 and 95 accordingly.

If your pre-retirement income is higher, then you should plan for higher retirement funds, according to the table below.

How Much Money Do You Need to Retire with a Particular Annual Income?

Let’s look at a simplified approach considering maintaining your current lifestyle. Here, you need to plan for 70% of your pre-retirement salary for each year of your life. Should you spend your retirement living in luxury, plan for your full pre-retirement income for each year of your life in retirement.

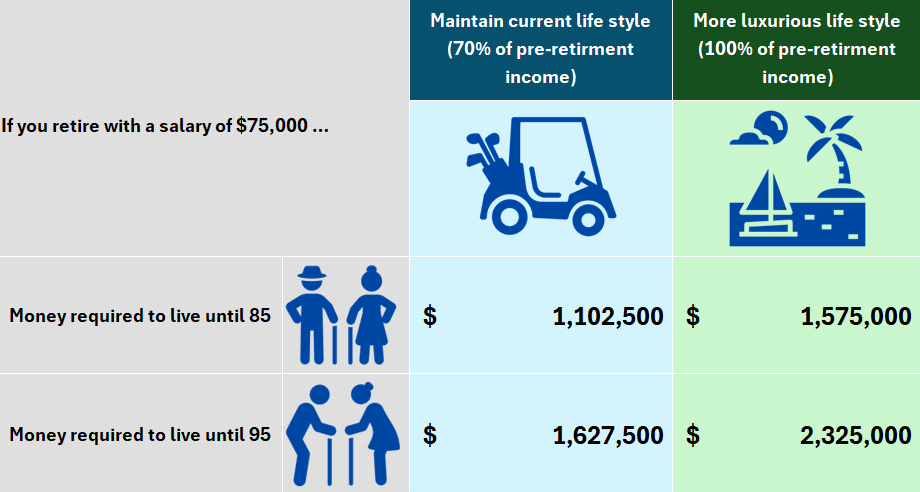

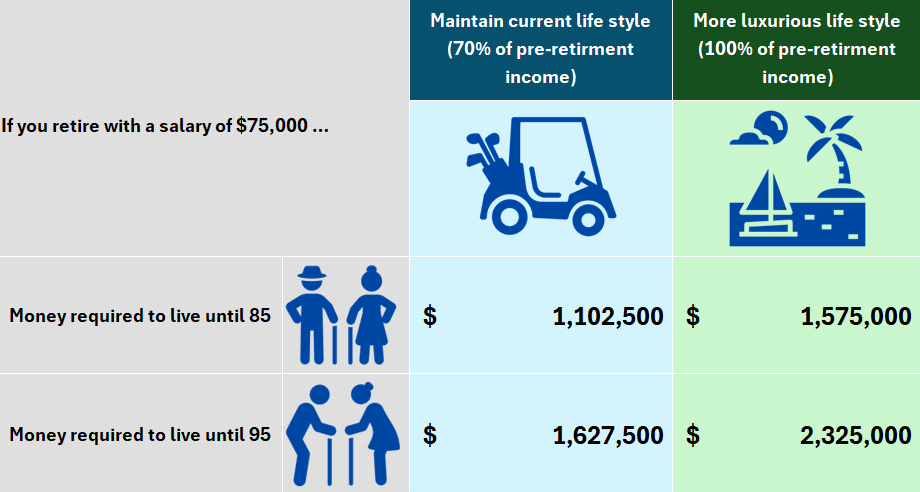

How Much Money Do You Need to Retire With $75,000 a Year Income?

To retire at 65 while having a salary of $75,000, you need approximately $1.1M if you live until the age of 85 and $1.6M if you live until the age of 95. For a full pre-retirement income, you would need approximately $1.6M to comfortably get to 85 and $2.3M to make it to 95 while maintaining your current lifestyle.

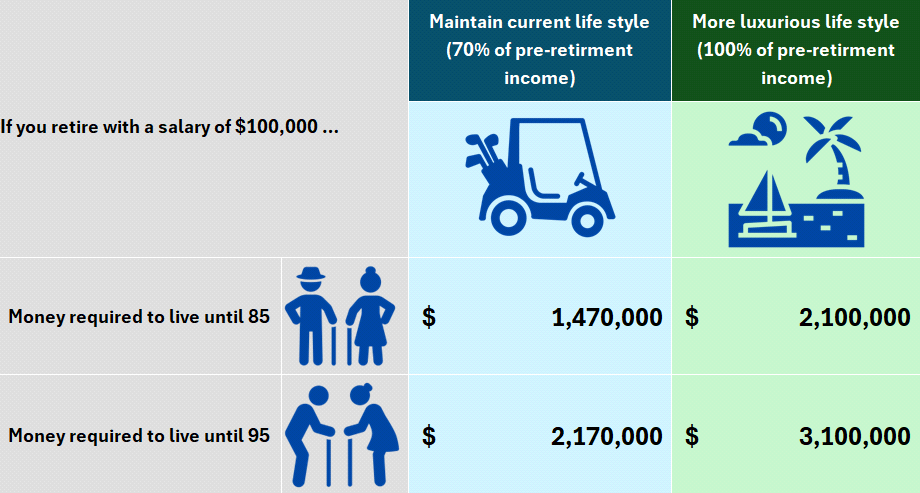

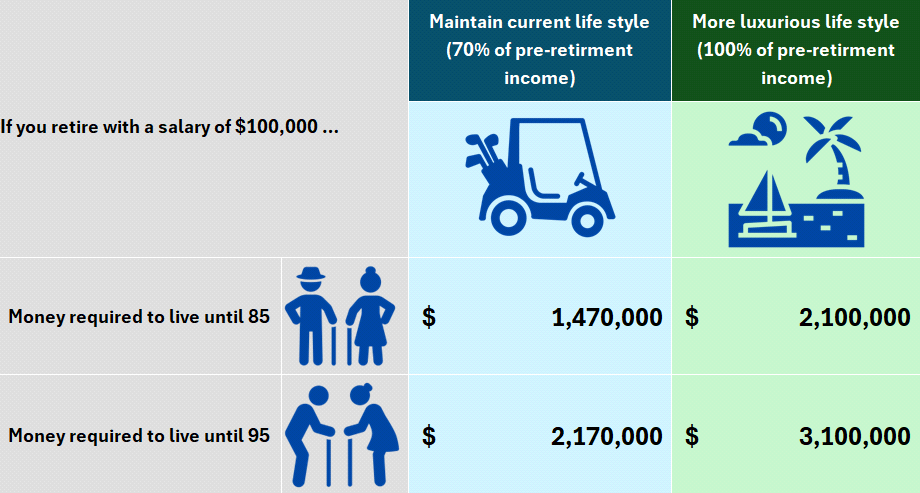

How Much Money Do You Need to Retire With $100,000 a Year Income?

To retire at 65 while having a salary of $100,000, you need approximately $1.5M if you plan to live until the age of 85 and $2.1M if you plan to live until the age of 95. Should you decide to live retirement in luxury and rely on a full pre-retirement income, you need approximately $2.2M to reach the age of 85 and $3.1M to reach 95 in comfort.

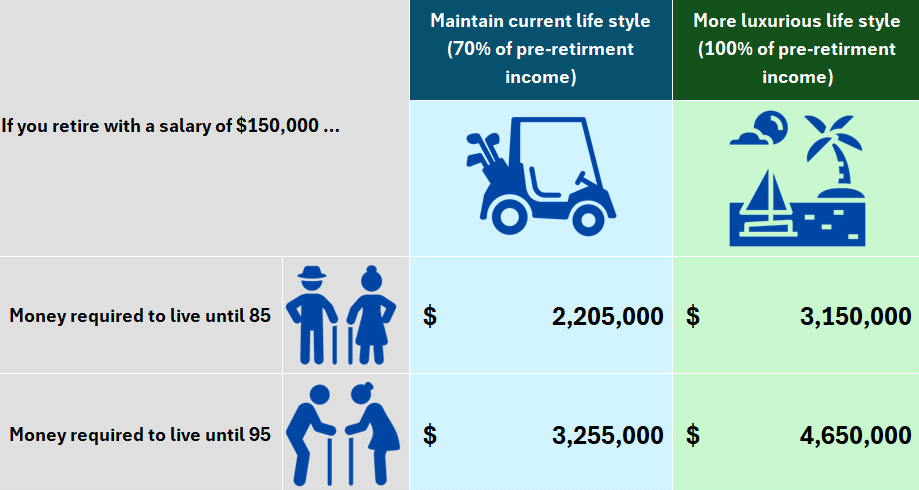

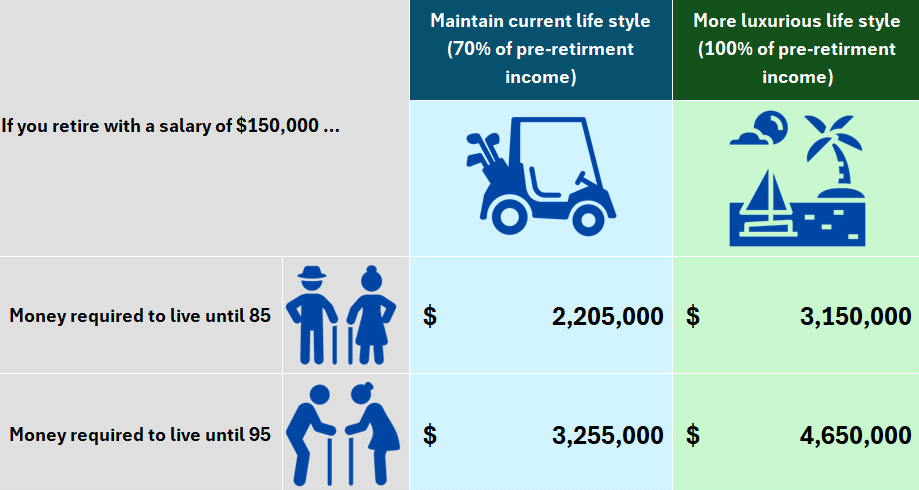

How Much Money Do You Need to Retire With $150,000 a Year Income?

To retire at 65 while having a salary of $150,000, plan for $2.2M for age 85 and $3.2M for age 95. To rely on your full pre-retirement income, you need approximately $3.3M to reach age 85 comfortably and $4.7M to reach 95.

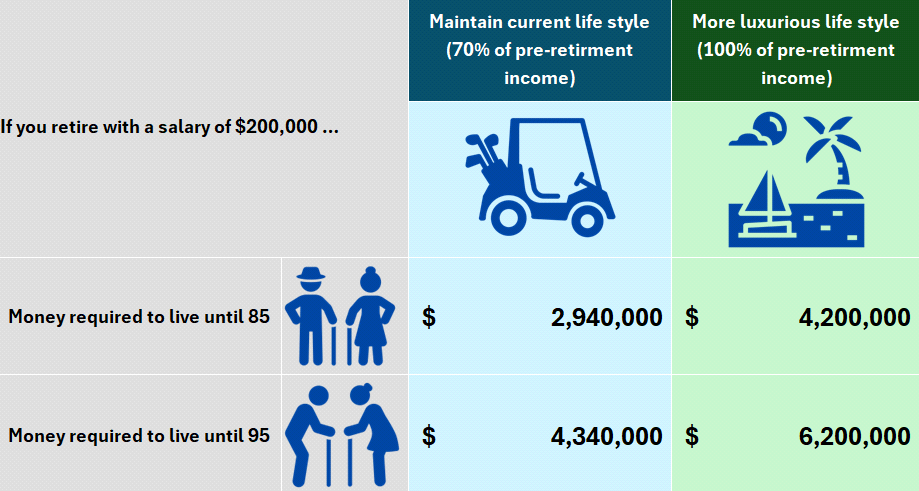

How Much Money Do You Need to Retire With $200,000 A Year Income?

To retire at 65 on a salary of $200,000, aim for around $2.9M for age 85 and $4.2M for age 95. If you need your full pre-retirement income you need approximately $4.3M if you plan to live until the age of 85 and $6.2M if you plan to live until the age of 95.

What Financial and Insurance Products Can Help with Retirement Planning?

Both investment and insurance products play a role when planning for enough financial coverage for retirement.

Typical Financial / Investment products playing a role in the retirementTypical Insurance products playing a role in the retirement• Mutual funds

• ETFs

• RRSPs

• TSFAs

• Segregated funds• Low costs term insurance for various purposes e.g. final expenses, mortgage coverage, etc.

• Whole life Insurance universal life Insurance

• Critical Illness Insurance

People need to invest according to their age and ultimate needs. Those with longer time horizons can and should take on more risk to ensure achieving their goals. They should also take advantage of making scheduled periodic deposits to their investments to take advantage of volatility in the market.

Mutual funds are a great way to take advantage of professional management and ETFs can provide a solution for those that are looking for lower costs.

Also, typical financial products like RRSPs and TFSAs have their role in saving/augmenting your funds while leveraging tax opportunities.

As clients get older and want to protect their investments, they can look to segregated funds, which have guarantees built in along with other benefits like bypassing probate by being able to name a beneficiary on non-registered holdings.

It is advisable to work with a financial advisor who understands your current situation, long-term plans, and has your best interest at heart.

On the insurance side, it is important to look at both need and cash flow.

Some popular solutions with younger families are lower-cost term insurance solutions to cover expenses (final expenses, mortgage, education, etc.) and income replacement in case of the death of one partner.

Those a little older would be looking at permanent insurance like whole life insurance or universal life insurance to ensure loved ones are taken care of as the chance of illness is greater. Lastly, you can look at critical illness insurance and disability insurance. Critical illness is becoming more popular because the chance of falling ill with some sort of life altering illness is greater than ever, especially as we are living longer.

Some more advanced insurance strategies, like infinite banking, leverage permanent insurance policies like one’s own mini bank that you can borrow against instead of paying higher lending rates to financial institutions.

Our advisors are very well versed in all insurance products to assist you with financial and retirement planning. LSM Insurance (a division of Hub Financial) works with more insurance companies than most brokerages. We look forward to finding out more about your situation and helping you plan for your retirement.