How Much Does Real Estate Business Insurance Cost?

Running your own real estate business isn’t all designer handbags and stilettos. Let’s face it, in spite of what Netflix might want us to believe, it’s very rarely that glamorous. Instead of selling sunsets, most realtors and brokerages are focused on selling properties. In fact, that’s what makes real estate business insurance so important.

In a world where there are more realtors than houses to sell, time is money. That’s why we want to make sure you spend it wisely. Whether you’re looking to open your own real estate office or one with some partners, here’s how to make sure you’re properly set up with real estate business insurance — and what it’ll cost you.

Who Needs Real Estate Business Insurance?

If you work as a solo realtor or own a brokerage you should have insurance coverage. Truly any kind of real estate professional who works with clients and digitally stores private client information should have the proper protection in place in case of unfortunate circumstances. You should also seek coverage if your business has a physical location, work vehicle, or employees who work for you either remotely or in an office setting.

What Kind of Insurance Do Real Estate Agents Need?

Buying insurance can be like buying a home. You want to get the coverage you need at the best price and not end up with a three-car garage when you only have one car and no desire to start a band in your downtime.

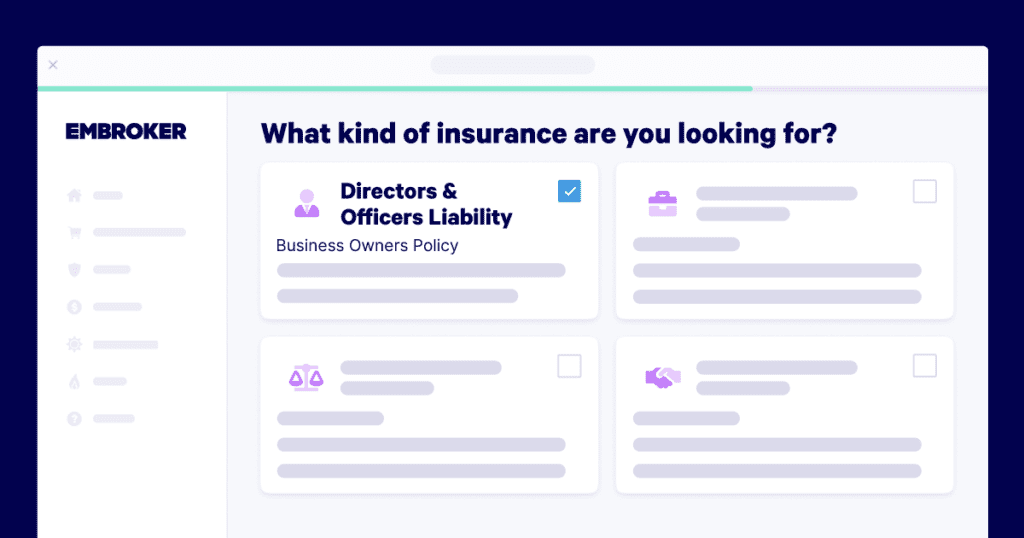

Insurance plans can be overwhelming, and if you’re not conscientious you could end up paying for more than you need. On the flip side, you don’t want to compromise and end up paying for a plan that won’t come through for you when you need it. When it comes to real estate business insurance, here’s what realtors really need to focus on:

Professional Liability: Unlike General Liability, Professional Liability insurance or Errors and Omissions (E&O), will keep you and your company protected from things like civil lawsuits for client claims of negligence, common mistakes, omissions, or misrepresentation.

Cyber Risk: A Cyber insurance policy will help cover you in the case of a cyber-related security breach or similar events. As a realtor, you deal with people’s financial and personal information and can benefit from protection against lawsuits that may be a result of a system breach.

Business Owners Policy: This coverage typically includes Commercial Property Insurance, Business Interruption Insurance and General Liability Insurance together as one bundle.

Commercial Property Insurance is a must-have plan for realtors or brokers who work out of a physical location. That said, solo operators may want to acquire it as well, especially if they consider a portion of their home to be a workspace.

Business Interruption Insurance will help protect you against monetary losses due to periods of suspended operations when a covered event, such as a fire, occurs and causes physical property damage.

General Liability will cover things like third-party slip-and-fall injuries, legal fees and defense costs, medical payments, and reputational harm.

Common Types of Claims

Realtors have come to expect the unexpected when making deals — gold-plated toilets, backyard bomb shelters, and carpeted ceilings make the list of some of the weirdest things realtors have encountered. The same can be said for the business side of what you do. No one plans on getting sued, but it’s best to be prepared.

In all seriousness though, no matter your best efforts, things can indeed go wrong in real estate and the right coverage can save the day. If you don’t have insurance and your business is unable to come up with the funds to pay for damages that occur — not to mention the legal fees that come along with them — you could in fact find yourself in a position where you are forced to make some tough decisions about your firm.

Clients who are dissatisfied with your professional services may sue you and your business. If they claim that you have misrepresented the home they intend to buy, or eventually bought, they may have a case against you. While you may not have all the information about the home yourself, it’s ultimately you and your firm who are responsible for handling this claim. In these cases your Professional Liability coverage can help.

While on the job, accidents and injuries can happen to you, your clients or agents who work under you. A General Liability or Workers Compensation policy may cover these types of incidents

General Liability covers most circumstances occurring within your place of business (your firm’s building, for example) such as slips and falls. Worker’s Compensation, on the other hand, will cover your employees while they are out on the job, such as an accident while commuting, icy steps at a home you’re showing, and more.

While slightly different, having both policies is a great way to hedge your liability bets, and ensure that you’re covered financially.

How Much Does Real Estate Business Insurance Cost?

Real estate professionals can expect to spend as little as $20 per month or as much as $200 per month. Truth be told, there are certain characteristics of your business that will impact how little or how much you spend. Take a look:

The size of your business: Having more employees can put your business at greater risk. A small business will most likely be considered a lower-risk business than a brokerage of 50 people or more.

Your annual revenue: Like the above, the more money your business makes, the more likely you may become a target for cyberattacks or the like. This can impact the cost of your cyber insurance, or other liability coverages that are impacted by the amount of money your firm brings in.

The location of your business: Realtors in NYC or California may find that their coverage costs are higher than those in rural areas that may bring in less revenue.

The amount and sensitivity of the data your firm holds: Given that your kind of business does store sensitive data like Social Security numbers, financial records, dates of birth, and other highly personal information, you may be considered a higher-risk industry and may need to pay more because of it.

Keeping the Cost of Real Estate Business Insurance Down

Generally, if you have been in business for some time, remaining claim-free or having a low-claim history will help with your insurance coverage costs. Additionally, proper prevention and management for things like cyber threats and having a security consultant on call, can help minimize risks and in return help you save on coverage.

But, there are also things realtors and firms can do to keep real estate business insurance costs down.

Purchase Insurance Programs

Purchasing a package of policies tailored to your needs can reduce the cost of those policies by reducing overall liability. Be sure to ask your insurance provider about packages or programs that could benefit your real estate firm. However, insurance programs are important to consider, regardless of real estate business insurance costs.

Pay in Advance

Paying your insurance premiums in advance can bring significant savings if you have the funds available. Most insurers offer discounts if you pay your annual real estate business insurance costs upfront rather than month-to-month.

Invest in Risk Management

Investing in risk management practices is hands down one of the best ways to reduce insurance premiums. Insurance is all about protecting your business from risks. So, the more risks your business faces, the more you will pay for coverage. If you need help figuring out where to start with risk management for your real estate business, ask your insurance provider about areas to focus on.

Only Buy What You Need

Many insurance options are available, but take the time to consider what your real estate firm actually needs. Having unnecessary coverage that doesn’t benefit your business just means unnecessary spending.

Raise Your Deductibles

Raising your deductible can lower your upfront real estate business insurance costs. But, increasing your deductible comes with the trade-off of having higher expenses to cover if a claim is filed. So, it’s a risky move that shouldn’t be your first option for lowering your insurance costs. If you choose to pay a higher deductible, make sure you don’t select a deductible you won’t be able to pay if something happens.

Review Your Policies Annually

Truthfully, reviewing your coverage every year is something everyone should make a point of doing. As your business changes, your insurance needs will change along with it. Keeping your insurance provider informed about those changes can go a long way in helping you keep your estate insurance costs down.