How much do health insurance agents make on average?

How much do health insurance agents make on average? | Insurance Business America

Guides

How much do health insurance agents make on average?

How much do health insurance agents make? Do they earn more than agents in other insurance lines? Read on and find out the answers to these questions

Health insurance agents can make a positive impact on people’s lives by helping them find the policy that best suits their healthcare needs – something that makes the job truly rewarding. But is it worth the pay?

In this article, Insurance Business answers the question, “How much do health insurance agents make?” We will give you a breakdown of the different salary ranges and state-by-state wages, as well as compare the profession’s earning potential with other types of insurance agents. Read on as we give you a rundown of everything you need to know on how much income health insurance agents make.

Employment websites provide different wage estimates for health insurance agents, but the general salary projection ranges between $46,000 and $55,000. How much health insurance agents make can vary significantly, depending on a range of factors. These include:

Their experience level

The type of policy they sell

Where the plans are sold

Commission rates

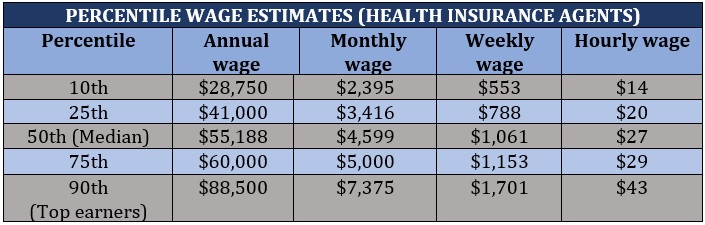

The table below reveals the percentile wage estimates for health insurance agents across the US, according to data gathered online.

Based on the analysis, most health insurance agents in the country earn average salaries around $41,000 to $88,500 annually, or between the 25th and 75th percentiles. Earnings above or below this salary range are considered outliers.

A health insurance agent’s earning potential can likewise be influenced by the number of policies they sell. You can find out how much health insurance agents make per policy in this article.

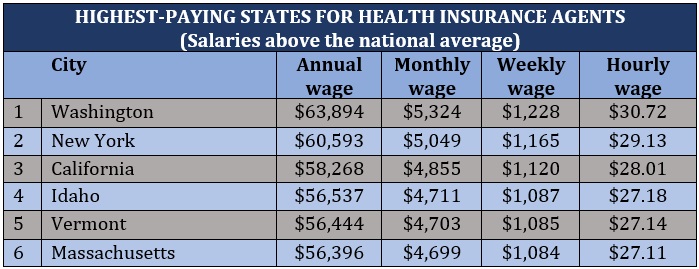

Because each state has different requirements for healthcare coverage and varying rules on how health insurance is sold, how much a health insurance agent makes also differs depending on where the policies are sold. Overall, there are six states where average salaries are above the national average. These are:

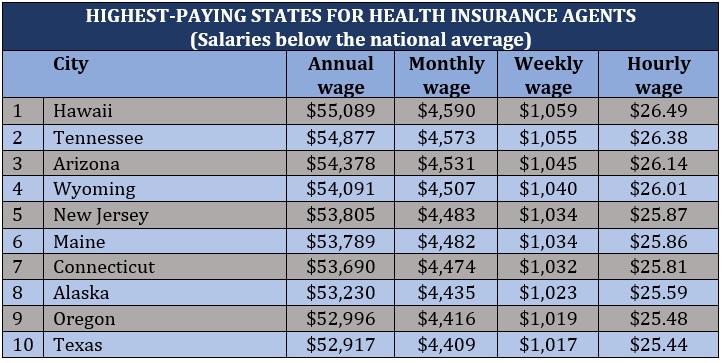

Meanwhile, these are the next 10 highest-paying states, where annual salaries are just below the country’s average.

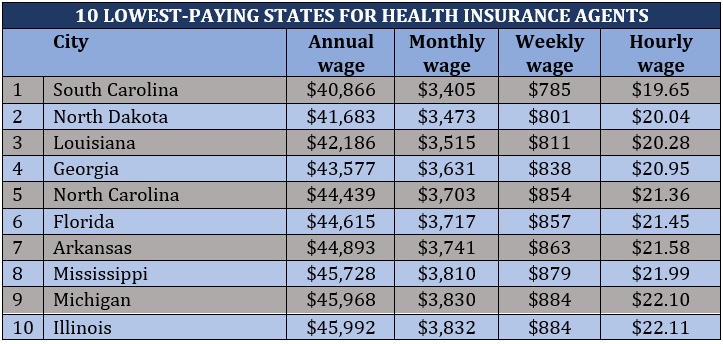

At the other end of the spectrum are the lowest-paying states for health insurance agents ranked below.

Do health insurance agents earn more than agents in other insurance lines? The table below, which shows the median salaries of the different types of insurance agents across the US, provides the answer.

How much do health insurance agents make vs. agents in other insurance lines

INSURANCE AGENT SALARY COMPARISON BY BUSINESS LINE

Business line

Annual wage

Monthly wage

Weekly wage

Hourly wage

Health

$55,188

$4,599

$1,061

$27

Life

$62,552

$5,213

$1,203

$30

Car

$50,408

$4,200

$969

$24

The type of policy health insurance agents sell also has a major impact on their earnings. Agents often offer customers plans that can be accessible in the health insurance marketplace, although they can also recommend options available from private health insurers.

The commission rates vary depending on the health insurance provider they are working with, but the general range is from 5% to 10% of a policy’s premiums for the first year. The rates typically go down once a plan has been renewed.

Health insurance agents specializing in group policies, meanwhile, earn slightly lower commissions ranging from between 3% and 6% of the total premiums. Since group plans are often purchased by businesses for their employees, health insurance agents can make up to four- or even five-figure earnings per company, depending on the number of staff.

If you want to get an idea of how much insurance agents make, our comprehensive guide can help.

Health insurance agents sell policies on behalf of insurance providers. Captive health insurance agents work exclusively for an insurance company, while independent agents can offer health plans from multiple insurers.

These licensed professionals are responsible for explaining the key features and benefits of the different health policies from their partner carriers to clients, helping them find the coverage that matches their needs.

This duty is similar to that of an insurance broker. The main difference is agents represent insurance companies while brokers are required to act in the best interest of the insurance buyers. If you want to learn more about what this type of industry professional does, check out our comprehensive guide on how to become an insurance broker.

Health insurance has become an essential form of coverage for many Americans because of the high cost of medical care and treatment across the country. Health insurance agents play a vital role in helping individuals and families access affordable health insurance plans that fit their needs.

The most successful health insurance agents possess a combination of hard and soft skills that enable them to assist insurance buyers in getting the best possible coverage. Here are some of the top skills and attributes health insurance agents need to thrive and grow professionally:

Customer service: As the role requires regular interaction with clients, health insurance agents must have the necessary people skills to provide excellent customer service. This allows them to build and maintain partnerships with clients.

Problem-solving skills: Navigating the country’s complex healthcare system can be an overwhelming endeavor. This often requires agents to come up with creative and innovative solutions to help clients find a suitable health insurance plan for their unique needs.

Communication skills: The ability to convey important information in a way that is easy for clients to understand is a crucial skill to have.

Time management: Health insurance agents need to be able to juggle multiple tasks and still provide quality service to clients. This requires having the foresight to prioritize tasks and complete projects efficiently.

Negotiation skills: There are times when patients may have a different view on the type of coverage they need, resulting in disagreements with their agents. Having solid negotiating skills allows health insurance agents to manage the situation carefully and find a middle ground that benefits both parties.

Numeracy: Strong mathematical skills are crucial to be successful in the field as insurance agents deal with numbers all the time.

Organization: A good health insurance agent knows how to keep their records accurate and organized, especially because they deal with many clients.

Self-motivation: Insurance agents must possess an intrinsic desire to perform to the best of their ability.

The answer to this question depends on an agent’s situation and goals. While branching out to sell life insurance may help increase a health insurance agent’s earning potential, this also entails having to meet a separate set of licensing requirements. There aren’t really any huge drawbacks to selling insurance for both lines.

What are the top health insurance companies in the US?

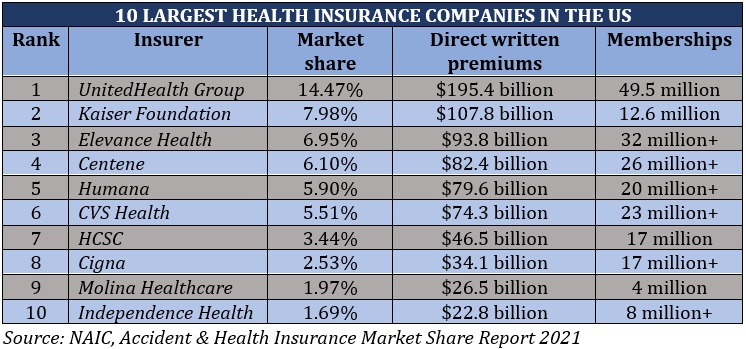

Another major benefit of being a health insurance agent is the opportunity to partner with the industry’s biggest names. According to the National Association of Insurance Commissioner’s (NAIC) latest accident and health insurance market share report, the 10 largest health insurance companies in the US control more than half, or 57%, of the overall market.

These insurers provide basic health insurance policies to individuals, families, and businesses, including Medicaid and Medicare plans, long-term care insurance, dental insurance, and vision care benefits.

The table below ranks the top 10 health insurance providers in the country based on NAIC’s most recent figures.

Our list of the top insurance websites for insurance jobs is the best place to start if you’re looking for job opportunities for health insurance agents. A quick search on these sites can yield hundreds, if not thousands, of job postings, which you can filter to match your skills and qualifications.

Some of these listings are from renowned industry names that offer not just great benefits and compensation package but also a positive workplace culture that enables health insurance agents to thrive and grow professionally. Jumpstart your health insurance career right now by clicking on the link above.

Were you surprised to find out how much insurance agents make? Do you think being a health insurance agent is a rewarding career? Share your thoughts in the comments section below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!