How much Central Coast residents pay in monthly bills – KSBY San Luis Obispo News

The Central Coast certainly is paradise and living here the dream of many, but it also comes at a cost. KSBY took a deeper look at new research showing how much people here pay in monthly bills compared to other areas and what you can do if those bills are hurting your wallet.

Sergio Ahumada is one of many drawn to the beauty of the Central Coast. He used to visit for vacations and fell in love with the area. His then-wife and kids packed up their bags and left Los Angeles 8 years ago.

“I didn’t really realize how much it would be to live here,” he said.

But soon after the couple separated, he realized living in paradise comes with a hefty price. He works full time but has little money saved.

“The first thing you want to pay is rent, of course, car payments, and then you have food. Your kids want stuff,” Ahumada said.

Unable to find an apartment he can afford, he became homeless – a struggle many Californians face.

CALIFORNIA HOUSEHOLD BILLS

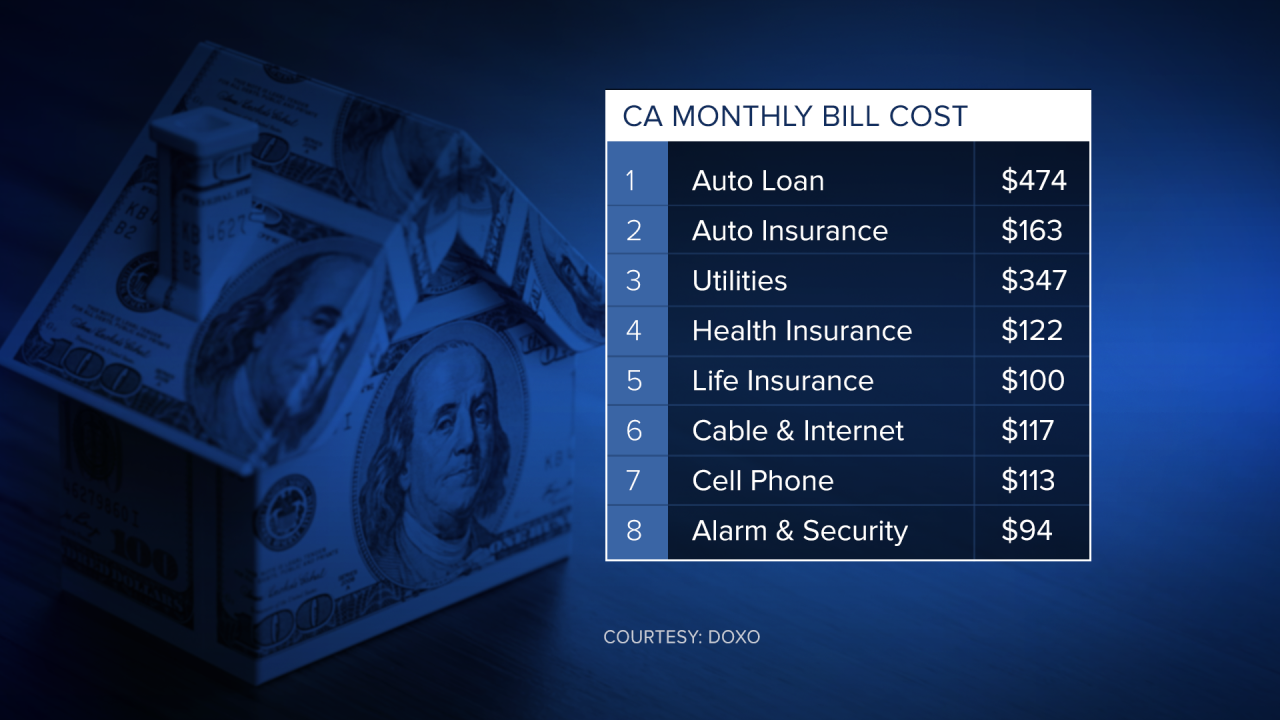

doxo, a company offering bill paying services, released statistics showing how much Americans pay in monthly bills. That includes the cost of mortgage or rent, auto insurance, auto loans, utilities, health insurance, life insurance, cable and internet, mobile phone, and home security.

California is ranked as the second most expensive state for household bills with residents paying $2,649 per month. The national average is $2,003.

KSBY

Liz Powell is the Director of doxo Insights.

“Majority of the expenses in California are due to mortgage and rent,” Powell said.

According to doxo’s data, the average mortgage in California is $2,234 and average rent is $1,570. For other categories included in doxo’s report, households in California pay the following on average:

KSBY

For San Luis Obispo County, doxo’s data shows residents pay less than the state average in mortgage except for homeowners in San Luis Obispo – $2,424, and Arroyo Grande – $2,351.

Those in SLO county pay more in health and life insurance and cable and internet but pay roughly the same as the state average in rent, auto loans, car insurance, utilities, cell phones, and alarm and security.

“New York, on the east coast, their utilities are really going to be expensive because that’s usually tied to weather. San Luis Obispo is mild,” Powell said.

For Santa Barbara County, people who live in Santa Barbara, Goleta, and Carpinteria pay hundreds of dollars more than the state average in mortgage and rent.

Housing costs are cheapest in Santa Maria and Lompoc where mortgages and rent are less than the California average.

Overall, Santa Barbara County residents have higher auto loans and cable and internet bills than the other parts of the state but pay less or roughly the same as the state average for car insurance, utilities, health and life insurance, cell phones, and alarm and security.

HOUSING AND AFFORDABILITY

Janna Nichols of the 5Cities Homeless Coalition says housing and affordability issues aren’t new to the Central Coast.

“There’s an old adage that you shouldn’t spend more than a third of your income on rent and utilities, etc.”

The National Low Income Housing Coalition’s 2021 report says to afford a two-bedroom apartment without paying more than 30% of your income on housing, you need to make $66,600 a year in SLO County and about $94,960 annually in Santa Barbara County.

KSBY: NLIHC 2021 Report

“We have a long-term challenge here in our county that people are going to wrestle with. More housing is key to that,” Nichols said.

The 5Cities Homeless Coalition was able to help Sergio Ahumada get his own apartment. But even if you don’t qualify for rental or housing assistance, Nichols says reach out. They can still help or direct you to other resources.

“We want to work with them to see if we could affect their income. We work to see if we can assist them with a better job or improve their skill set.”

For homeowners who’ve fallen behind on their mortgage payments, California launched a new COVID relief program in January that pays up to $80,000 in mortgage, property tax and insurance.

There are multiple state and local programs that can help with gas, utility, phone, and internet bills:

There are also the California Lifeline discounts that could lower the cost of your phone or internet bills. Powell says you should also try and negotiate with your service provider for a discount. You may be surprised.

“Just taking this (data) and saying, this is the average here, I should be paying less, I think it could be pretty helpful,” Powell said.

To save money on car insurance, experts suggest shopping around, trying usage-based insurance, or changing your limits or deductible.

If your finances have been affected by COVID-19, your auto loan lender may offer payment or debt relief.