How liability car insurance can protect you

How liability car insurance can protect you | Insurance Business America

Guides

How liability car insurance can protect you

Liability car insurance is often the most important type of auto coverage. Find out what kind of protection it provides in this guide

Almost all states require drivers to carry liability car insurance. This is often the most important form of coverage, protecting you financially against any accident that you’re legally responsible – or liable – for.

But just like other types of auto policies, there are several aspects to liability coverage that you must understand to get the level of protection that you need.

In this article, Insurance Business explains how this crucial form of coverage works. We will give you a walkthrough of what liability car insurance covers and what it doesn’t. We will also discuss how much coverage is required and compare this with how much coverage you actually need.

If you’re currently working out an ideal amount that can give you adequate protection, this guide can help you make an informed decision. Read on and find out how you can make the most out of your liability car insurance.

Liability car insurance is often considered the foundation of any auto policy. Each state requires motorists to have some level of liability coverage before they are allowed on US roads. Even in states where car insurance is not mandatory, it is compulsory for drivers to take out liability protection if they opt to carry auto insurance.

As the name suggests, liability car insurance provides financial protection if you have been found legally responsible for an accident that leads to another person’s injury, death, or property damage. Coverage also applies when others are driving your vehicle.

Liability policies compensate third parties. Coverage can include:

Hospital bills and other medical expenses

Lost income

Funeral and burial costs

Repair costs of damaged property

Legal and settlement fees

Auto liability insurance doesn’t come with a deductible. Your insurer covers the full cost of the liability claim up to the limits of your policy and pays the person who has filed the claim against you.

Liability car insurance provides two types of coverage:

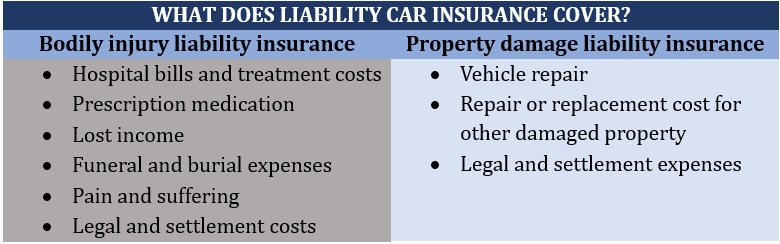

1. Bodily injury liability coverage

Also referred to as BI coverage, bodily injury liability insurance covers the medical costs resulting from the injuries another person suffers because of an accident you caused. Some policies pay for lost income if the third party is unable to work and funeral and burial expenses if they die from their injuries.

Bodily injury liability policies also cover legal expenses if you’re sued due to the accident. These include settlement costs.

Additionally, you will often see the term “pain and suffering” under BI coverage in your policy document. In car insurance parlance, pain and suffering constitutes all physical, mental, and emotional trauma the injured party experiences because of the accident. These include emotional anguish and physical pain.

Bodily injury liability insurance is mandatory in almost all states, except Florida. New Hampshire and Virginia, where car insurance is not compulsory, require motorists to take out BI coverage if they choose to purchase auto insurance.

Florida has a unique insurance situation. If you want to know how car insurance works in the state and which insurers offer the best coverage, our guide to Florida car insurance can help.

2. Property damage liability insurance

Property damage liability insurance is required in all states if you get car insurance. Also called PD coverage, this type of liability car insurance compensates third parties for the damage and losses they incurred because of an at-fault accident.

A PD policy pays the cost to repair or replace another person’s vehicle and other property. And like BI coverage, it also covers the legal expenses arising from a lawsuit, as well as any settlement costs.

The table below sums up what liability car insurance typically covers:

Liability car insurance covers only third parties involved in an accident you caused. This means it doesn’t pay for the injuries and property damage that you and your passengers sustain.

To be protected against these types of losses, you will need to take out other forms of coverage. Here’s a summary of what a liability car policy excludes and what type of coverage you can purchase to be financially protected:

Bodily injuries that you and your passengers suffer

Personal injury protection insurance or PIP is typically required in no-fault states. It covers everything included in a BI policy but applies to you and your passengers. Coverage includes medical expenses, lost wages, and funeral costs. PIP is also referred to medical payments insurance or MedPay in most states.

Damage your vehicle sustains

There are two types of policies you need to keep your vehicle fully protected:

Collision coverage: This pays out the cost to repair or replace your car if it collides with another vehicle or object, rolls over, and sustains damage from a pothole.

Comprehensive coverage: This covers loss or damage caused by a non-collision accident. This includes theft, vandalism, falling objects, and natural disasters.

Both collision and comprehensive car insurance are optional. They also don’t cover mechanical failure and normal wear and tear.

Hit-and-run accidents

If you find yourself in a hit-and-run situation, your uninsured motorist coverage may be able to help. It can cover losses and damages if the at-fault driver doesn’t have car insurance. Also called UM coverage, this is often bundled with an underinsured motorist policy, which covers the gap if the at-fault party’s insurance isn’t enough to cover the costs.

Stolen items from your vehicle

While your car insurance may protect you against vehicle theft, most policies don’t cover items stolen from inside your vehicle. Some homeowners’ and renters’ insurance policies provide coverage for such incidents.

Each state imposes its own minimum coverage limits for liability car insurance. We’ve compiled these requirements in the table below. The table also contains the links to each state’s motor vehicle department’s auto insurance requirements webpage. You can click on these links if you want to learn more about the minimum mandatory coverages in your state.

Minimum mandatory liability car insurance limits – state-by-state breakdown

As you may have noticed, minimum liability coverage limits are shown as a series of three numbers. These figures represent the following:

Bodily injury liability limit per person: This is the maximum amount your policy will pay for injuries to a single person after an at-fault accident.

Bodily injury liability limit per accident: This is the maximum amount your policy will pay for injuries to everyone hurt in an at-fault accident.

Property damage liability limit per accident: This is the maximum amount your policy will pay for the overall property damage that you caused.

All figures are in thousands of dollars, so a policy with a 10/25/5 liability coverage limit means:

$10,000 in bodily injury liability coverage per person

$25,000 in bodily injury liability coverage per accident

$5,000 in property damage liability coverage per accident

You can find your policy liability coverage limits in the declaration page of your policy document. However, some policies offer a combined single limit. This is often a larger amount that covers both bodily injury and property damage. If you see just a single number in your policy document, this means that your policy has a combined liability coverage limit.

Most insurance companies recommend getting coverage that’s enough to cover your net worth. This is the value of all your assets and investments, minus your debts.

While states implement minimum mandatory liability limits, this may not be enough to cover the injuries and property damage that you caused in an accident. Often, you will need to take out coverage beyond what your state requires. Bear in mind that you are responsible for paying out any expenses that exceed your liability coverage limits.

Minor fender-benders may not cost much, but sometimes it takes just one major accident to completely disrupt your financial security. A single accident can run up to hundreds of thousands of dollars, so it pays to have sufficient protection.

Liability car insurance is often the most expensive portion of your car insurance. A policy that carries minimum state-mandated coverage costs about $680 annually. This figure is based on the various price comparison and insurer websites Insurance Business checked out.

The amount you pay, however, may be significantly lower or higher than this number as insurers typically use a range of factors to determine your premiums. Some of the variables that have a huge impact on your premiums include:

Your driving record, including traffic violations and involvement in accidents

Your claims history

Your policy’s coverage limits

The type of vehicle you drive

Where you live

Your credit rating, except in California, Hawaii, Massachusetts, and Michigan

Your age also has a major effect on your insurance rates. Typically, the younger you are, the higher the amount you pay for coverage – insurers view younger motorists as riskier to insure. However, there are still ways for young drivers to get cheap car insurance.

Car insurance is a highly individualized form of coverage. That’s why it is often difficult to find a policy that can cater to every need.

To find the liability car insurance policy that matches your needs, the first step is to determine how much coverage you require. You can do this by calculating the value of your personal assets. Ideally, your liability coverage limits must be enough to shield your assets from potential lawsuits. You should also consider your ability to meet any financial responsibilities that may arise after an accident.

Liability car insurance is just one of the many crucial elements of your car insurance policy. To be fully protected, you may also need to take out other types of coverage. These include state-mandated requirements such as personal injury protection and uninsured motorist coverage, as well as optional policies like collision and comprehensive car insurance.

Car insurance is not as straightforward as it seems. There are many layers to this vital form of coverage that you need to understand for you to get the protection that you need. If you want to dig deeper into how car insurance works, our guide can prove useful.

Do you think getting liability car insurance that exceeds minimum state requirements is worth it? Is liability coverage enough to give you the necessary protection? We’d love to see your thoughts in the comments section below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!