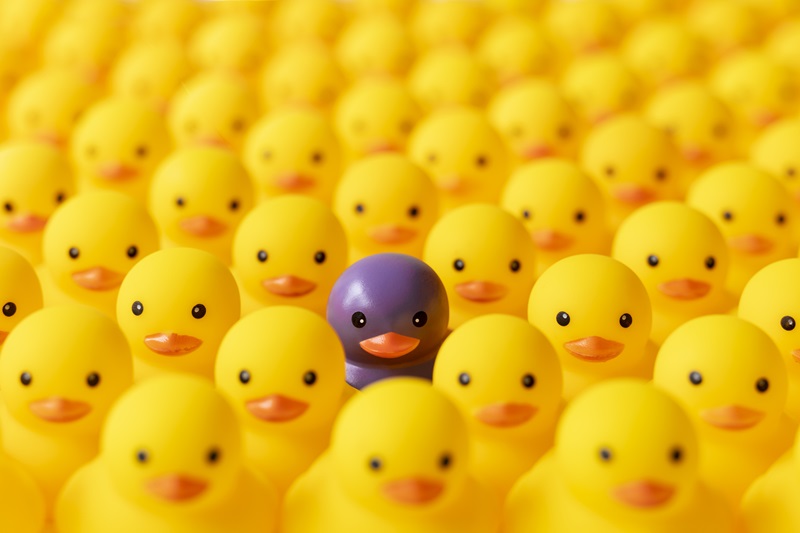

How insurtechs can stand out in a crowded P&C market

Market dynamics are making it tougher for start-up insurtechs to find willing insurance company partners, and some say digital specialization is the key for insurtechs to make their way into the squeezed P&C industry.

“Focus on specific differentiation,” advises Marcus Daniels, founding partner and CEO of Highline Beta, a hybrid corporate venture studio that builds and funds new ventures (such as insurtechs) from inception. “This is naturally critical given how many seed-stage insurtech startups are creating a noisy environment.”

Daniels was interviewed in a Q&A Mondaq blog authored by Janelle Weed of Torys LLP.

“[Insurtech] founders should aim to engage [insurance] executives in areas where their biggest pain points exist and find ways to remove friction for these executives so that they can get to pilot,” Daniels said in the Q&A with Weed. “For example, climate and cyber risks have been top of mind for insurance executives, so founders who are building products that can deal with these pain points should know their audience and clearly showcase to them how they can help.”

During the hard market over the past years, restoring profitability has been top of mind for insurance company executives. That means cutting down operating expenses as a means to shave percentage points off their combined ratios (a measure of insurance company profitability).

Hypothetically, there can be a digital and cultural mismatch between insurance companies and insurtechs. Although insurance companies are interested in advancing their digital capabilities, they are still working their way through legacy systems, and moving data into the cloud. In contrast, insurtechs are not encumbered by previous technologies and can start new ventures from scratch.

Some of these dynamics are cited as the reason why insurance companies are now less likely to acquire insurtechs as a means to advance their digital capabilities quickly through mergers and acquisitions.

“One of the things happening in the insurance industry, especially with the larger insurance companies, whenever they wanted to launch a new product, they would go and acquire [insurtechs],” Piyush Srivastava, a panellist at the Reuters Future of Insurance Canada 2023 conference, said in November. “There was quite a lot of M&A activity that was happening in the last 15 to 20 years.”

Srivastava is partner and head of North America’s industry advisory group at Tata Consultancy Services.

“That model is changing,” Srivastava continued. “What’s really happening in the industry is that there’s [an insurance] company working within an ecosystem of data providers that are specialized companies. If [an insurtech] has got a product, [an insurance company can] basically buy its pricing, services, and — maybe through API connectivity — it can [enhance] its old products, and [the insurance company] can actually sell this [enhanced] product to market.

“So, rather than building that, how can [the insurance company go to market with a new product] by partnering with other [insurtech] companies, getting their data and services, and offering a wider range of products and services? I think that’s the direction the market is moving.”

However, given the insurer’s intent to trim operating expenses, including costs associated with third-party contracts — and given the rapidly expanding number of start-ups — insurtechs are finding themselves competing for attention in a crowded market.

To crack into this tough market, Daniels suggests consideration of five partnership opportunities for insurtechs. Look at crafting digital solutions related to insurance companies’ digital infrastructure, distribution, climate, artificial intelligence, and cyber.

Feature image courtesy of iStock.com/enviromantic