How Does the Help to Buy Scheme Work in 2022?

The Irish property market is mental.

Prices have skyrocketed to the moon, and there are no signs of them falling back to earth.

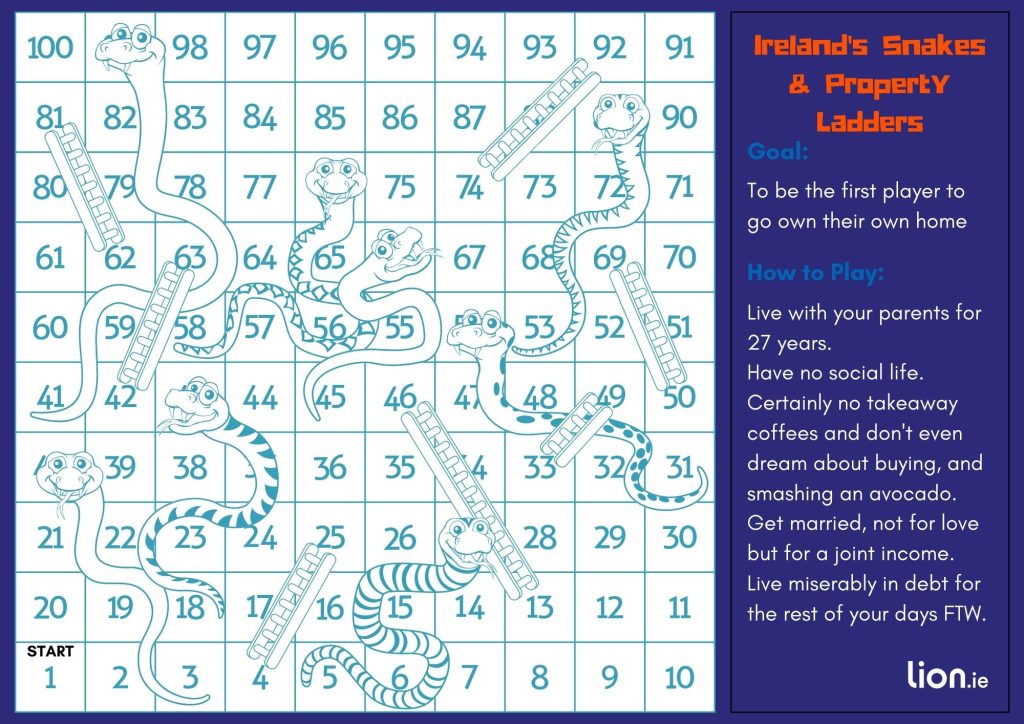

So heaven help anyone considering taking a step onto that property ladder.

Oh, you are, are you?

In that case, I bet you’re feeling pretty darn overwhelmed and wondering if you’ll ever get a foot on that ladder or if you’ll spend your time sliding down slippery snakes.

I feel for you you.

I truly do.

We bought back in 20008, yep, pretty much the day before the arse fell out of the property market but look, we didn’t buy as an investment so the price of the house is irrelevant, we bought a home that we have lived in happily ever since.

It’s sick (sick as in shit, not as in awesome) that you need a deposit of €52,500 if you want to buy your first home.

But before you throw it all in the bin and build a fort in your Ma’s garden, there are a few government schemes out there that you may be able to avail of.

The Help To Buy Scheme is a popular one that has proved crucial to many first-time property buyers:

What is the Help To Buy Scheme?

Simply put, this gem of a scheme gives first-time buyers a refund of some of the income tax and DIRT (Deposit Income Retention Tax) that they have been paying in Ireland over the last four years.

/ rant begins

Or less simply put, it’s a harebrained scheme that the Government is using as a sop to first-time buyers instead of dealing with the crisis by building more houses.

/ rant ends

Of course, to get your mitts on any cash from the HTB scheme, there are conditions to satisfy, the big ones being:

You must be a First-time Buyer

You have to buy a new build or a self-build

The latter is a bit of a crappy condition as most new builds are far pricier than a house built in the ’70s

What do I Need to Qualify for the HTB Scheme?

OK, you so have cleared the first hurdles.

Smooth!

Now let’s get deep into the nitty-gritty and determine whether this scheme is right for you.

More obstacles:

You must have never owned a home in the Republic of Ireland before (even with someone else)

Your desired home must cost less than 500,000 smackeroos.

Your mortgage must be at least 70% of the house value to qualify, e.g. the house is €300,000, so your mortgage must be at least €210,000

You must be tax compliant.

The developer must be on the Approved List of Qualifying Contractors

You must live in your prospective home for a minimum of 5 years after purchase

How much money can you get from Help to Buy?

If you were to replace a boat piece by piece, is it the same boat?

I do not know the answer to either question.

But I know the amount of HTB Benjamins you can get depends on the years you’ve worked over the last four and how much Income Tax and DIRT you have paid.

Remember, the Government hasn’t gone all Willy Wonka here, handing out Golden tickets and everlasting gobstoppers.

It’s just refunding what you have already paid.

So they’ve gone with three distinct ways of working how much cash they’re willing to hand back, and they go like this.

A maximum of €30,000 (regardless of the number of buyers)

10% of the purchase price of your new home or the completion value of your self-build

The total amount of Income Tax and DIRT you have paid over the last four years.

So how do they decide which one to go with for you?

Go on, have a guess.

You would be right on the money if you said whichever one gives you the smallest amount.

And this can be a real kicker if you haven’t worked every hour God sent in the last four years and paid a fair whack of Income Tax and DIRT.

It’s pretty clear how to make the most of the HTB scheme:

Don’t apply until you have worked and paid taxes for the full four years before applying, or the Help To Buy Scheme might not be that helpful.

If you have paid a boatload of tax, how does the HTB scheme work in practice?

OK, let’s say you spot a new build for €310,000 (good luck trying to find one of these in Dublin).

In the last four years, you have paid €50,000 in income tax or DIRT.

So you will qualify for the maximum of €30,000, leaving you with a mortgage of €280,000.

Can you use the HTB money as your deposit?

Yes, but of course, the banks will look more favourably on your mortgage application if you can prove you’re saving a bit and not living paycheque to paycheque.

Can you use savings in addition to the Help to Buy scheme?

Yep, using the same figures as above, let’s say you also have savings of €30,000 to put toward the house.

Now you need a smaller mortgage of €250,000.

What happens if you qualify for the Help to Buy scheme?

Now, if you qualify and find you’re entitled to get a healthy rebate, you’re probably wondering how do you get this money.

If you’ve bought a new build, you won’t see a single cent as it will all go straight into your contractor’s pocket.

Self-builders, however, will have it deposited into their bank accounts.

I’m self-employed. Can I qualify for the HTB Scheme?

When researching this article, I fully expected there to be some sort of exclusion or limitation for the self-employed because the Government think all self-employed people are gazillionaires, paying zero in tax and living it large on their offshore islands.

For once, though, being self-employed won’t affect your eligibility under the HTB Scheme.

As long as you are fully tax compliant, you can join the party (what do you mean you pay zero in tax?)

So all annual tax returns need to be filed on time, with no underpayments, and it might make sense to get yourself an accountant to sign off on your tax certificates too.

So keep everything above board, and you, my self employed friend, will be ready to rock.

How do you actually apply for the Help to Buy scheme?

Applications for the HTB are pretty easy, and if you’re tax compliant, you will qualify.

The holy trinity of your HTB application are the:

application stage

claim stage

verification stage

We’re not going to worry about the last two just yet.

For now, you just want to get your name in the hat, and you can do this all online using the Revenue Online Service (ROS)

Once approved, you’ll get an application number, a summary of the maximum amount you can claim, and an access code. Keep these handy as you’ll need them for your bank when you apply for a mortgage.

So I’ve applied, been approved, and have my claim amount. What happens next?

Assuming you have your mortgage Approval in Principle, it’s time to go house hunting!

Go hustle.

OK, HTB money, mortgage, what else do I need to consider when buying a house?

Legal fees

Valuation fee

Home insurance

Mortgage protection (life insurance) – Check out our First Time Buyer Mortgage Protection Guide.

Over to you

I’ll be honest with you, I learnt a bit myself researching that blog, so I hope you found it useful too.

If you need help on the mortgage protection insurance side of things, please complete this questionnaire, and I’ll be right back with a no-obligation recommendation and some indicative quotes that you can add to your house-buying budget.

Thanks for reading,

Nick.