How builder’s risk insurance protects your construction business

How builder’s risk insurance protects your construction business | Insurance Business Canada

Guides

How builder’s risk insurance protects your construction business

Builder’s risk insurance is an essential part of a construction project. Find out how this type of coverage benefits construction companies in Canada

Let’s say your construction company was hired to work on a large-scale project. During the construction phase, a massive fire broke out resulting in extensive damage to the property, materials, and equipment. An investigation revealed that the losses easily reached hundreds of thousands of dollars. Without coverage, you’re on the hook for the cost of repairs.

The situation shows how important it is for construction businesses to have builder’s risk insurance.

In this guide, Insurance Business will explain how this type of insurance works and how it can protect your business. We will also give you a checklist of what to look for when choosing the right policy. Read on and find out the answers to the most common questions about builder’s risk coverage.

Construction projects are exposed to a wide range of risks. From natural calamities to man-made hazards, disasters often strike unexpectedly. Builder’s risk insurance protects property owners and construction companies against financial losses resulting from these incidents.

The policy pays for the cost to repair or rebuild the damaged structure and replace lost materials and equipment. This helps ensure that the construction project goes as planned without major financial setbacks and delays.

Coverage kicks in when the first shovel hits the ground and lasts until the project is completed. This is why the policy is also called course of construction insurance.

If your business is involved in the construction of residential and commercial establishments, builder’s risk insurance is important. Homeowners doing major renovations and expansions can also benefit from this type of coverage.

There are no laws in Canada requiring construction companies to take out a builder’s risk policy. Most clients, however, choose to only work with businesses that carry insurance.

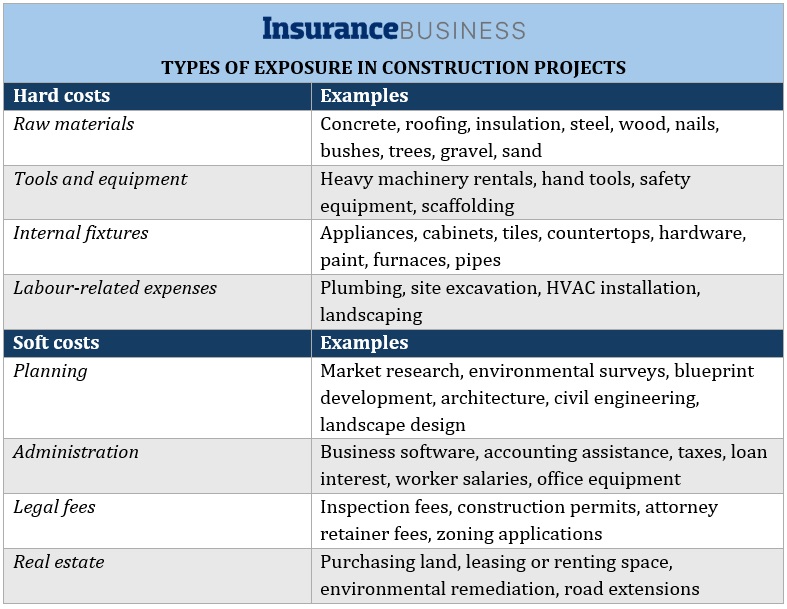

Builder’s risk insurance covers two types of exposures:

1. Hard costs

Hard costs come from tangible assets associated with a construction project. These include the physical structure, materials, supplies, and labour-related expenses. Compared to soft costs, hard costs are easier to determine because they are used to make visible improvements.

In its most basic form, builder’s risk insurance is designed to cover only hard costs.

2. Soft costs

When a disaster happens, losses and damage onsite can result in project delays that can lead to additional expenses. These are considered soft costs. These include architectural and design fees, loan interests, and advertising and PR expenses. Mostly, soft costs wouldn’t have been incurred if there were no delays in the construction project.

Here are some examples of hard and soft costs in a construction project:

A builder’s risk policy reimburses the hard and soft costs incurred if the loss or damage is caused by covered events, including:

theft

vandalism

fire

explosions

hurricanes

named storms

hail

civil riots

Standard policies don’t usually cover overland flooding and earthquakes, although you can add these events by purchasing an endorsement. Water damage is often covered only up to a specified limit. Some insurance providers will also allow you to include coverage for pollution clean-up, molding, sewer backup, and business interruption.

Increasing your policy’s level of coverage has a corresponding effect on your premiums.

Builder’s risk insurance doesn’t cover every exposure. Some instances that the policy excludes are:

faulty workmanship

employee theft

normal wear and tear

corrosion and rust-related damage

mechanical breakdown

acts of war and terrorism

clean up costs due to pollution

loss or damage occurring before or after construction

contractual fines and penalties

general liability

If you’re searching for coverage for these incidents, it may be better if you look at other types of construction insurance. This guide on insurance for contractors will give you a rundown of the different types of coverage your construction business needs.

To give you an idea of how builder’s risk insurance can benefit construction companies in Canada, we will give you a few scenarios:

1. Fire damage

Scenario: Your construction business is working on a huge shopping complex worth millions of dollars. During construction, faulty electrical wiring causes a massive fire resulting in extensive damage to the property, materials, and equipment. Worse, the incident has delayed the project’s completion.

What builder’s risk insurance covers: Your policy can help pay for the costs of the fire damage. These include repair and reconstruction of the affected areas and purchasing of new materials and equipment. Your insurance, however, may not reimburse the costs to replace and re-install the faulty electrical system that caused the fire.

2. Structural damage due to weather-related event

Scenario: Your construction company is building a commercial establishment in a prominent suburban location. With the project nearing completion, a severe storm rips through the area. This caused major structural damage to the building and delayed the project’s progress.

What builder’s risk insurance covers: Your policy will cover the cost of repair, debris removal, and replacement of lost and damaged equipment. The exact cost, however, will depend on the limits specified on your policy document.

3. Stolen materials and equipment

Scenario: You leave some materials and tools in a locked storage onsite overnight, thinking it would be secure. You come back the next day to find out that the construction site has been broken into, and the essential supplies have been stolen. Without these supplies, the project will be delayed.

What builder’s risk insurance covers: Construction sites are among the favourite targets of thieves because of the expensive materials and equipment often stored in them. Fortunately, your builder’s risk policy covers the cost of replacing the stolen property to ensure that the project can proceed without further interruptions. But there’s a condition: the property must have been stored in a secure location at the job site.

4. Vandalism

Scenario: You’re restoring an abandoned house in a popular tourist location so it can be used as a vacation rental. One night, the property was broken into and vandalized, causing significant damage to the property.

What builder’s risk insurance covers: Your policy will pay for the cost to repair the damage. If there are materials and equipment that were stolen, these will also be covered up to the policy’s limit.

Find out the current trends on Canada’s construction insurance market straight from the experts in this episode of Insurance Business TV.

Depending on the agreement, either the project owner or the construction company can get builder’s risk insurance. This is why it’s important that you confirm who will be responsible for purchasing coverage when finalizing the details of the construction contract.

Regardless of who took out insurance, coverage can be extended to everyone who is involved in the project. This can be done through an additional insured endorsement. Those who can be added as named insureds include:

general contractor

subcontractors

architects, engineers, and consultants

lenders or loan providers

property investors

real estate developers

Homeowners renovating or expanding their properties can also benefit from getting builder’s risk insurance. Being the rightful owners of the property, they will be responsible for shouldering the cost of any damage without proper coverage.

Construction companies and property owners can expect to pay anywhere from 1% to 4% of the overall project costs for builder’s risk coverage. This means that the premiums for contractors working on a $500,000 residential project will be significantly lower than those constructing a $5 million commercial complex.

For these examples, the premiums can range from $5,000 to $20,000 and $50,000 to $200,000, respectively.

Apart from the total cost of the project, there are several factors that can influence premiums. These include:

where the property is located

duration of the project

property’s market value

level of coverage required

limits of the policy

past insurance claims

Premiums for builder’s risk insurance, however, are calculated differently than other types of insurance policies. Unlike home and auto policies, in which the costs are calculated per year, construction insurance premiums are based on the expected completion of the project.

Each construction project comes with its unique share of risks. Because of this, there is no one-size-fits-all builder’s risk insurance policy that can cater to every need. To find the right coverage that matches your business’ needs, there are several factors you need to consider:

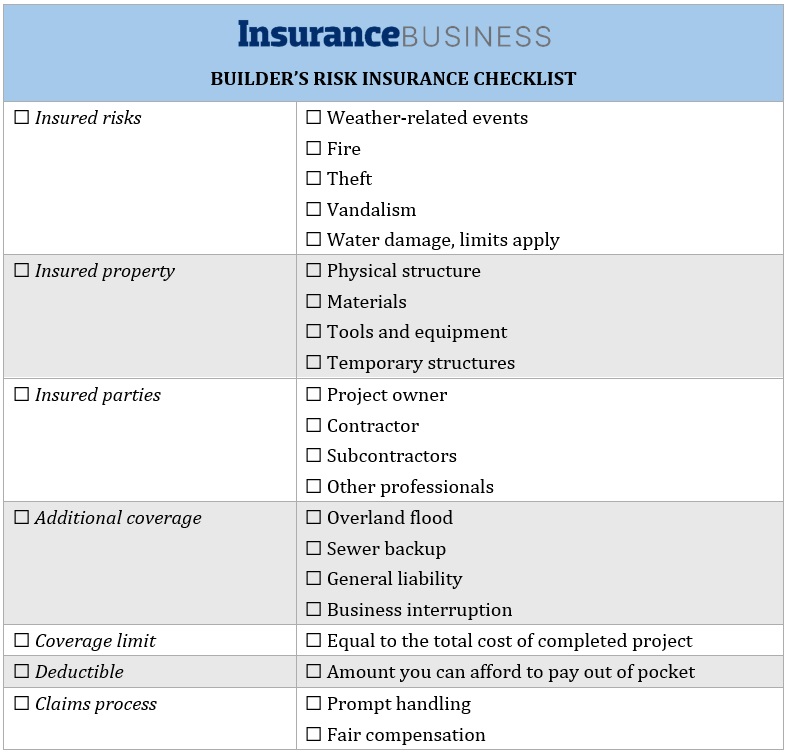

Insured risks: Standard policies cover loss or damage caused by severe weather, fire, theft, and vandalism. Water damage is also covered up to a certain limit. Additional coverage is often needed for flood and earthquake damage, general liability, and business interruption.

Insured property: Builder’s risk insurance covers the building and anything that will become a permanent part of the structure. Coverage extends to materials, fixtures, equipment, and temporary structures needed to complete the project.

Insured parties: Builder’s risk coverage can be purchased by the construction company or project owner. Most policies allow the policyholder to add named insureds. These can include subcontractors, engineers, architects, developers, and consultants.

Policy exclusions: Some risks and situations are not covered. These include faulty workmanship, normal wear and tear, employee theft, and negligence. You may need other types of business insurance to get coverage.

Coverage limits: This is the maximum amount the insurer will reimburse you for the covered losses. The figure must be enough to cover the estimated value of the completed project.

Deductibles: This is the amount that the policyholder must pay before the insurer picks up the tab. A higher deductible will result in lower premiums because of the lesser risks the insurer will be taking. The amount must be something that you can afford to pay out of pocket.

Claims process: Go with an insurer who has a reputation for responding to claims promptly and fairly.

Here’s a checklist of what you need to consider to find the policy that best suits your needs. You can download the file and print it for easy access.

Another important factor that you should consider is the insurer’s reputation. If you’re looking for a builder’s risk insurance provider that offers top-notch coverage, our Best in Insurance Special Reports page is the place to visit. Here, we only feature insurance companies and professionals who are vetted by our panel of experts as respected and reliable industry leaders.

Do you think getting builder’s risk insurance is important for construction businesses? Have you experienced the benefits of having coverage? Feel free to share your story in the comments.

Keep up with the latest news and events

Join our mailing list, it’s free!