Homeowners and Renters Pick Insurance with Convenience and Price Breaks

Published on

April 27, 2023

If we want to know where P&C insurance is heading (and what homeowners and renters are expecting), we need only look at what is happening within our homes and rental spaces. Homes are beginning to have minds of their own.

The light switch is a good place to start. Most of us mindlessly turn switches on and off as we enter and leave rooms. However, switch technology has been evolving. Motion-detecting switches are now commonplace. If you install one, you only need to enter a room for the light to come on. If there is no motion in the room for a set period of time, the light goes off. It’s responsive, economical and it saves energy.

Step up a notch and you can install a voice-activated light switch that allows you to control your lights via voice through Google Assistant, Apple Homekit, Amazon Alexa, etc. It is Ring-enabled as well, so you can step up security by turning on your lights when motion is detected through motion sensors or cameras. Your switch has now become part of a smart network that can link dozens of related devices. It’s now possible to answer the front door with your refrigerator, let your thermostat set the temperature based on occupancy, and lock your doors from anywhere.

The smart possibilities are endless, but they prove that there is high value in automation and convenience. Flipping a switch was never that hard, but the old switch wasn’t acting on behalf of your safety or energy bills – or increasingly “green views”. The switch never cared about what you were doing. It didn’t know your needs.

The personalized home or apartment

To say the smart home has a mind of its own may be cliche. It might be more precise to say that your home or apartment has a bit of your mind in it. It allows itself to be customized to the way you live your life.

Traditional insurance is much like that traditional light switch. It works. It does the job and is reliable. Insurance’s traditional products have always been pivotal in creating peace of mind for consumers. But dealing with new and expanding risks, market dynamics, and evolving needs — as well as the new expectations of insurance buyers — means that insurers must develop new ideas and approaches that account for many more aspects of living – including risk avoidance and mitigation.

Insurers need next-level automation, deeper personalization, and products that are integrated into the lifestyles and mindset of younger generations. In Majesco’s recent thought-leadership report, Enriching Customer Value, Digital Engagement, Financial Security and Loyalty by Rethinking Insurance, we consider customer trends with a look at how insurers can respond.

Solving for profitability and customer value at the same time

Today’s insurers are being asked to learn more about their customers. They need a more holistic understanding of their customers’ view of security; one that goes beyond traditional risk products and channels.

There is a way for insurers to ensure that their learning and listening impacts the bottom line. They must work both ends of the consumer equation, Convenience + Value = Sales, but they must include personalization in the formula. When Majesco looked at customer preference and data, we found three high-level needs:

Personalized pricing and underwriting with more effective use of data

Value-added services that complement risk products

Convenient channel options at the point of need or the point of purchase for related items.

It’s time for insurers to think in terms of smart insurance — the kind that digitally-immerses customers in a holistic financial ecosystem.

Filling the new insurance gaps

Today, we are seeing increasing environmental, societal, and technological risks that have the potential to intersect and significantly disrupt people’s lives. Increased extreme weather events and natural disasters have an unprecedented and increasingly significant impact as well as societal risk with increasing crime.

Right now, there is a growing protection gap in homeowners and renters coverage by consumers. One of the reasons is simply economic. Customers lack enough coverage due to the rapid rise in home prices over the last few years (from 15% to over 30% on average) and the inflation in the value of materials to repair or build. In November 2021, it was reported that the median price of single-family existing homes rose in 99% of the 183 markets tracked by the National Association of Realtors in the third quarter, with double-digit price increases seen in 78% of the markets.[i]

Together, this highlights a growing increase in risk, and growing protection needs that result in increased premium costs for homeowners and renters insurance, making personalized pricing and value-added services that can help eliminate or reduce risk increasingly valuable to the consumer.

Is the customer ready for data-based pricing?

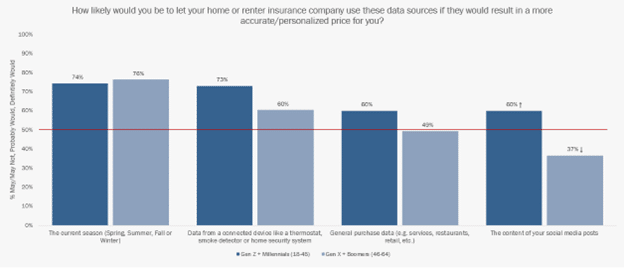

Now is the perfect time for insurers to capitalize on new sources of data for better underwriting and pricing. According to Majesco’s consumer survey results, Gen Z and Millennials are very comfortable using data from multiple new, non-traditional sources for personalized pricing. Interestingly, Gen X and Boomers are equally interested in homeowner/renter personalized options, reflected in the small gaps of 23% or less as shown in Figure 1.

Gen X and Boomers also show interest in using data from connected devices and general purchase data for pricing. Using content from social media posts falls significantly in popularity for Gen X and Boomers but remains surprisingly strong for Gen Z and Millennials. In particular, Gen X and Boomers like the seasonally adjusted pricing, potentially reflective of their living in other locations during different seasons.

Figure 1: Interest in new data sources for homeowners/renters’ insurance pricing

Smart home devices show strong interest in both generations. According to NerdWallet, smart-home devices can help prevent water damage, fire, or theft. Their research found that consumers could get up to a 13% discount depending on the device and where they lived. Interestingly, some insurers like Farmers and Lemonade also offer savings for smart locks, while Amica and Farmers give discounts for motion sensors.[ii]

Regardless, insurers offering a smart home insurance discount and more personalized pricing using advanced analytics like property intelligence, could help consumers reduce home or rental insurance premiums. This addresses their financial top-of-mind issue and engenders loyalty through an insurance partnership that anticipates their needs, keeping them safe and secure.

Value-added services can save the customer time and money while reducing claims

Resilience is essential to living in a world filled with risk. Risk resilience focuses on the ability to avoid or minimize risk, decreasing the impact of recovery. Value-added services are valuable tools insurers can offer to help their customers increase their risk resilience.

Leveraging technology such as IoT devices, smart watches, loss control assessments, and value-added services not only assesses and monitors risk, but proactively responds to it to avoid or minimize damage with mitigation services and actions. From concierge services to monitoring water hazards, to helping to live healthy lifestyles, leading insurers are shifting to risk resilience strategies that not only drive better business outcomes but also great customer loyalty. And consumers are very interested in these value-added services.

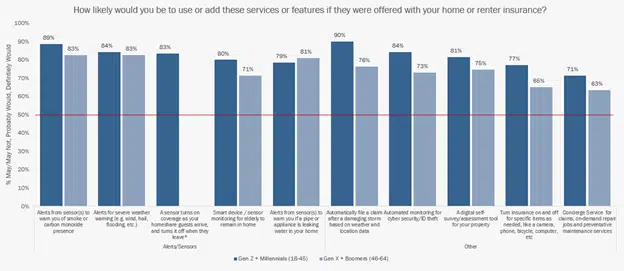

Some of the insurance’s best bets happen when all generations are aligned in their thinking. For example, there is great alignment between the generational segments on value-added services in homeowner/renter insurance as reflected in Figure 2. The average gap between the generational segments is just 7% (excluding sensor-based activation of homeshare insurance, which did not have any Gen X and Boomer respondents), compared to 24% in life/health/voluntary benefits and 16% in auto insurance. Both generational groups are well above the 50% threshold, highlighting the overwhelmingly strong interest.

Alerts and monitoring devices/services like smoke/CO and water leak sensors, home monitoring for elderly family members, and severe weather alerts, promote safety and provide peace of mind, and have among the highest levels of interest for both generations. In particular, the monitoring of elderly family members leverages sensor technology to help keep them in their homes rather than a nursing or assisted living facility – helping to manage financial top-of-mind issues.

Ease of automatic claims FNOLs based on weather and location data, automated cyber security monitoring, and digital property self-assessment tools all provide self-service capabilities increasingly demanded by customers. Likewise, on-demand single-item insurance and concierge services for repairs and preventative maintenance are also of high interest.

Figure 2: Interest in value-added services with homeowners/renters insurance

The breadth and strong interest in these value-added services offer insurers an opportunity to deepen customer relationships while creating potential new revenue streams to offset the interest in personalized pricing.

Expanding channel options ensures the broadest possible reach to decrease the protection gap

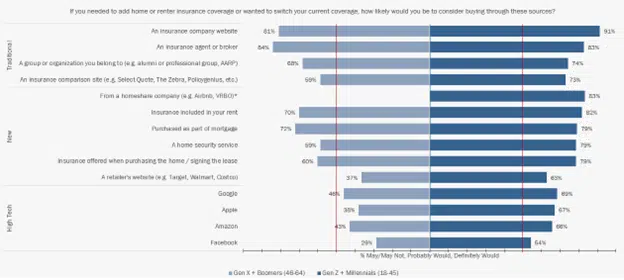

Traditional channels remain the preferred method for purchasing homeowner/renter insurance. However, insurance company websites lead agents/brokers by 8 percentage points with Gen Z and Millennials, likely driven by the higher percentage of renters in the younger generation segment and the simplicity of renters insurance as compared to homeowner insurance as reflected in Figure 3. Lemonade is an example of leveraging this dynamic with digital, online buying capabilities.

Embedded options show a strong interest of 60%-82% for both generation segments, such as insurance included in the rent or mortgage, offered when purchasing the home or signing the lease, or even as an option offered by a home security service. Majesco’s joint research with PIMA highlighted that renters and homeowners insurance, while popular products offered by insurers, had low embedded use, reinforcing the market opportunity with the right partnerships.

Compared to the other types of insurance (auto, L&AH, etc.), Google, Amazon, and Apple get their strongest levels of interest among Gen X and Boomers for homeowners/renters insurance, at 37%-46%. Gen Z and Millennials interest are at 63%-69%, nearly double the older generation, highlighting the strong loyalty to these brands. Although not shown here, our last data point from 2021 on Amazon as a channel for homeowner/renter insurance has nearly the same levels of interest in both generation segments with 68% for Gen Z and Millennials and 43% for Gen X and Boomers.

Figure 3: Interest in channel options for homeowners/renters insurance

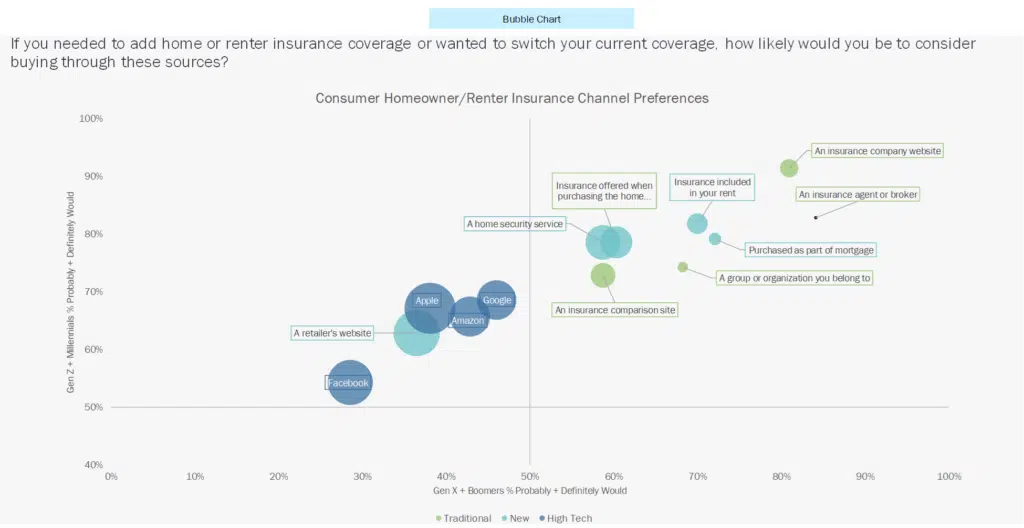

Despite the strongest showing in homeowner/renter insurance for Amazon, Google, and Apple with Gen X and Boomers, Figure 4 highlights the differences in interest levels for these channels compared to Gen Z and Millennials, reflecting the need for insurers to align the right channels with the right products for different demographic groups. In contrast, the strong interest in and alignment between the generation segments is seen with the traditional channels and embedded options in the upper right-hand corner of the chart.

Figure 3: Generational alignment on interest in channel options for homeowners/renters insurance

The strongest areas of opportunity

Looking at all the data in light of current risk trends, it’s clear that home and rental insurers are in a prime position to transition and grow. Expanding channel options in the areas where the generations align, offering value-added services that will bring convenience and speed to the process, and using data to define premiums more tightly, will give insurers a competitive edge.

When it comes to data use especially, insurers must prepare to take advantage of new data streams that are relevant to safety, security, and risk mitigation. A modern data framework will dramatically improve the overall viability of competitive pricing. Majesco’s data and analytics architecture and loss control will allow insurers to gather a more complete view of the customer and their risk while Majesco’s sales and underwriting workbench can place single policies or groups of business on the books faster.

To bring it all together — new products, new pricing, new channels — insurers should operate from a position of insurance-capable technology that allows for quick integration of all data points and up-and-coming technologies. Majesco’s P&C Intelligent Core, Loss Control, Underwriter360 and Distribution Management in the cloud will improve any insurer’s competitive position by making it future-ready. Find out more about it and Majesco’s Spring ‘23 release by tuning in to Majesco’s Revolutionizing the Insurance Industry webinar from earlier today.

To dig deeper into the minds of consumers and to connect the dots between trends and opportunities, be sure to read Enriching Customer Value, Digital Engagement, Financial Security and Loyalty by Rethinking Insurance.

[i] Bahney, Anna, “78% of US markets hit with double-digit home price increases,” CNN Business, November 10, 2021 https://edition.cnn.com/2021/11/10/homes/home-prices-increase-third-quarter-feseries/index.html

[ii] Schlichter, Sarah, “Smart-Home Devices Could Save You Money on Home Insurance,” NerdWallet, April 25, 2022, https://www.nerdwallet.com/article/insurance/smart-home-insurance-discount