Home-sharing app specifically for insurance to go national

Tens of thousands of Canadians have been forced to evacuate because of an active wildfire season, and a new home-sharing digital platform dedicated to insurance is expanding nationally to help adjusters find temporary accommodations for insureds whose homes have been damaged and need interim relocation.

Alexis Vertefeuille, president and CEO, SiniSTAR

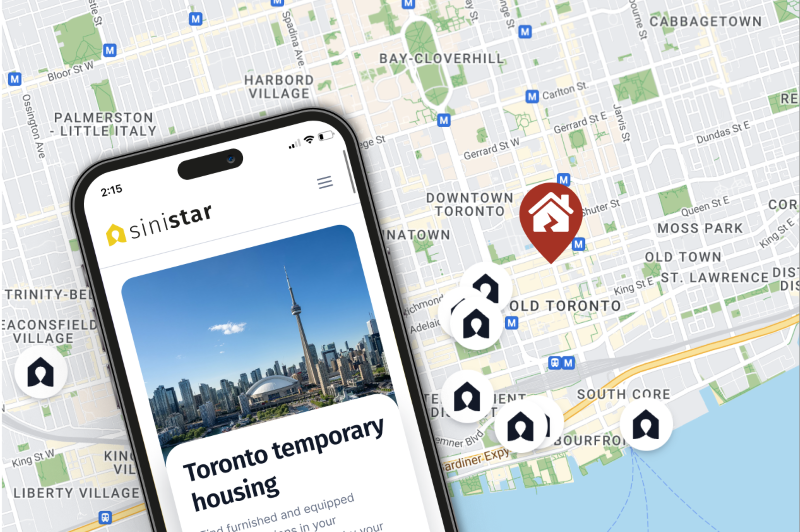

First launched in Quebec in 2016, SiniSTAR is an online marketplace platform connecting insurers and property owners. The company enables temporary housing for policyholders to be listed, found, and rented in disaster scenarios such as flood, fire, or tornadoes. Its unique bidding technology is designed to help keep claims costs down for insurers, while finding accommodations that suit the preferred needs of the policyholders.

“It’s a groundbreaking, tech-first product built for insurance companies across Canada, with multiple quotes for housing needs,” Alexis Vertefeuille, CEO and founder of SiniSTAR, told Canadian Underwriter in an interview. “We’re a bidding platform, not a reservation platform, and that’s a huge difference.

“There’s more informed legal documentation and no minimum-length contracts or extensions. We’re reducing costs for insurers, saving time for adjusters, and matching policyholders with the best temporary housing. That’s what we do, and we’re happy to create this home-sharing community across Canada.”

SiniSTAR is now expanding into western Canada and Ontario. Its proprietary technology is designed to streamline the relocation process, allowing adjusters to seek housing, request quotes from bidding property owners, sign legal documents, receive check-in instructions, and manage stay extension requests.

For example, if a wildfire were to burn down homes in a specific area in Quebec, an adjuster or displaced policyholder would access the platform and request alternate accommodation. The platform geolocates the incident, then requests quotes from all nearby hosts whose accommodations meet the adjuster’s criteria. Using a cutting-edge algorithm and AI, it filters potential accommodations based on hundreds of weighted criteria such as the number of people, distances, and bedrooms needed.

Interested hosts send quotes soon after the adjuster’s request. Throughout the process, a team of dedicated agents is available 24-7 to answer queries from adjusters and their policyholders. The adjuster always has the last word on the accommodation and must approve the insured’s final choice.

Once the choice is approved, SiniSTAR handles the signatures for the contract and assignment of a claim. The adjuster automatically receives the signed documents, and the insured’s receive check-in instructions for their temporary home.

Vertefeuille said he’s seen situations where more than 50 hosts within a kilometre of a disaster zone submitted quotes on the platform less than three hours after water damage or a house fire.

Related: What makes the Halifax wildfire so unique

The platform handles extensions for displaced policyholders. If insureds need to stay longer, with their adjusters’ agreement, they can make the request online. No minimum number of extra days is required to lengthen stays.

“For short-term rental platform users, the interface will sound familiar. But the bidding process is one-of-a-kind in the insurance space and an effective way to keep costs down,” said Vertefeuille.

“Our platform geolocates the damaged home and then lets all the hosts in the area know that someone needs housing. They then bid against each other to offer the best price to the insurance company. So that makes the price drop. But beyond cutting costs for insurers, the driving force behind the company is our desire to harness the latest technology to help displaced families find a place that feels like home.”

SiniSTAR now works with more than 33 insurance companies and has relocated thousands of policyholders in the past six years. The platform features more than 7,000 listings across Canada.

Vertefeuille, a lawyer, said he first came up with the idea of home-sharing for the insurance industry in 2016, when he helped a friend whose mother was uprooted after a home fire. The mother was living in a hotel, and Vertefeuille offered to let her rent a friend’s home. That was when he first came up with the idea of a home-sharing platform for insurance.

“This is how we use the sharing economy to help insurance companies relocate people in a kind, humane way,” he says.