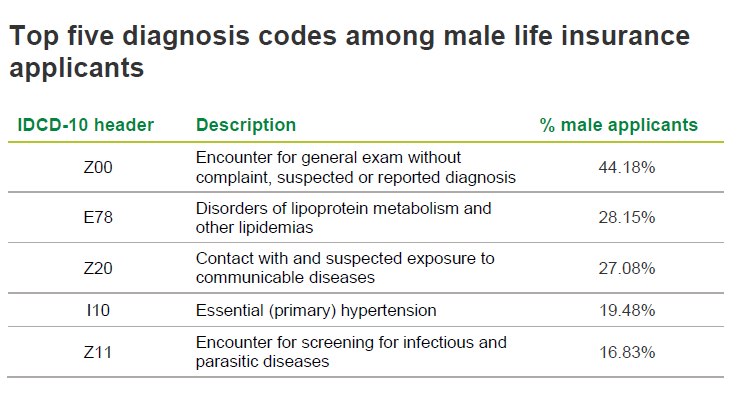

High cholesterol and COVID-19 are biggest drivers of physician visits for male life insurance applicants

LabPiQture™, ExamOne’s unique laboratory testing results database, provides deep insights into the health history of applicants. During Men’s Health Month, we’ve taken a deeper look at the conditions most commonly diagnosed in male life insurance applicants during the past year.

Source: ExamOne

Encounter for general exam without complaint, suspected or reported diagnosis

This encounter captures most general exams that are not the result of a complaint or other diagnosis. In laboratory data, this code is most commonly associated with routine checkups, and is seen commonly in both men and women. For underwriting, this can generally be considered a low-risk code and may indicate an applicant who is active in maintaining his health.

Disorders of lipoprotein metabolism and other lipidemias

Lipid metabolism disorders affect the conversion of lipids into energy, oftentimes causing harmful amounts of lipids to build up in the body. These build-ups can result in cell and tissue damage in the brain, nervous system, liver, spleen, and bone marrow. In laymen’s terms, this is the most common code for high cholesterol and is generally associated with lipid panel (total cholesterol, HDL, triglycerides, etc) results.

Contact with and suspected exposure to communicable diseases

This is an encounter diagnosis that has become more prevalent in the data since the COVID-19 pandemic and usually refers to the fact that the individual was exposed to COVID-19 and exhibits symptoms. Often this diagnosis comes with a laboratory result of a COVID-19 test whether it be positive or negative and another diagnosis of either unspecified fever or fatigue.

Essential (primary) hypertension

Hypertension, also known as high blood pressure, is one of the top 3 diagnoses for males. According to the Mayo Clinic, individuals can live with hypertension for years without any symptoms. Continuing to live with uncontrolled high blood pressure can lead to other health concerns including heart attack, stroke, heart failure, and even dementia.

Encounter for screening for infectious and parasitic diseases

Along with encounters related to exposure to COVID-19, encounters in which the individual was screened for COVID-19 were prevalent for men. There has been some confusion on how to code COVID-19 encounters, but usually this code is intended for encounters that reflect routine surveillance, without concern for exposure.

Other common diagnoses in male life insurance applicants

Insurers should also be aware of additional diagnoses among male life insurance applicants, such as the following.

(Z12) Encounter for screening for malignant neoplasms – 14.8%

(R53) Malaise and fatigue – 14.4%

(R73) Elevated blood glucose – 11.3%

(E11) Type 2 diabetes mellitus – 10.9%

(Z79) Long-term (current) drug therapy – 7.7%

Summary of the analyzed population

In our analysis of the most common diagnoses in male life insurance applicants, the mean age of a male applicant with a LabPiQture hit was 44. The mean encounter count for a hit was 5, but this conceals a substantial level of variation. The median encounter count was 3, while 29% of hits involved only a single encounter, and 1% of hits involved 30 or more unique testing events.

Laboratory insights help insurers see a clearer picture of their applicants

Through both the historical laboratory data of LabPiQture and laboratory test results, insurers can build a retrospective and current picture of their applicants. LabPiQture provides insurers with past laboratory test results related to preventive care, diagnostic information, and disease monitoring. Current laboratory testing obtained during the paramedical exam provides insights into what the applicant is living with today. The combination of data creates a very accurate perspective on an applicant’s health for underwriters to evaluate.