Health IQ Review – Life Insurance for Healthy Applicants

If you’re shopping for life insurance and you’re in excellent health – like really excellent health – you may qualify for discounted life insurance through Health IQ.

And if you meet the qualifications, you owe it to yourself to try.

Health IQ is a free service that will help those in excellent health get the lowest rates possible. But you will need to be in excellent health, live a healthy lifestyle, and be proactive in managing your health.

Not everyone will qualify, but if you do, this service may be worth checking out.

About Health IQ

Health IQ is based in Mountain View, California, and was founded in 2013.

They were designed to convince life insurance companies that people who take their health seriously deserve to be rewarded with lower insurance premiums.

The company relies on science, data generated by outside sources, and their own research to show that health-conscious people have a lower mortality rate.

It took a while, but many insurance companies have now come around.

Health IQ now partners with multiple insurance companies. The companies recognize the value of individuals’ health insurance ratings provided by the service on their website.

Health IQ is now an insurance broker, working with multiple providers.

With more than 30 life insurance companies partnering on the platform, applicants can get lower premiums by demonstrating a higher health rating.

Using Health IQ’s ratings, applicants can save up to 30% or more on their life insurance premiums.

Health IQ provides a similar service for Medicare Advantage plans and Medicare supplements. As well as car insurance and disability insurance.

We’ll be focusing on life insurance in this review.

Health IQ is not a direct insurance provider, so it is not rated by any insurance rating agencies, like A.M. Best.

But it has a Better Business Bureau rating of A+, where it has been accredited since 2016. The A+ rating is the highest rating the agency issues, on a scale of A+ to F.

Health IQ Ratings

This is the real “product” provided by Health IQ. While the insurance partners on the platform provide the policies, Health IQ provides its proprietary health rating system.

Research has shown that applicants with a high “healthIQ” correlate with a 36% reduction in early death.

Also, a 57% lower risk of heart disease and an incredible 88% risk reduction in connection with type II diabetes.

The insurance industry is coming around to the Health IQ rating system. So consumers can now get the benefit of lower insurance premiums if they have a high health IQ.

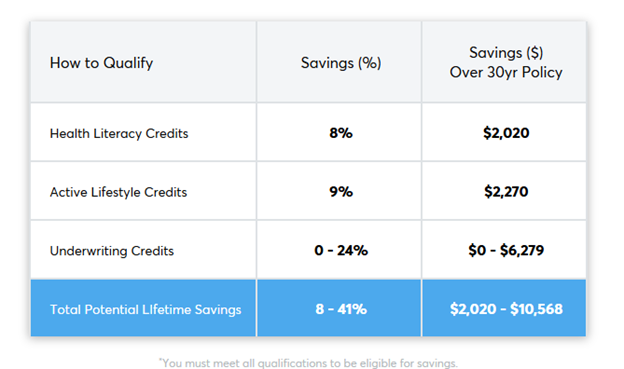

How much can you save on your premium with a high health IQ? The table below, provided by Health IQ, indicates savings ranging from 8% to 41% off regular life insurance rates.

Life Insurance Products Offered

Health IQ discusses the availability of a couple of different types of life insurance. Examples include, whole life, term life, and guaranteed issue life, which is sometimes referred to as final expense insurance.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance, which means the provider can’t cancel it as long as you make your premiums.

It will also be appealing to anyone looking to combine a savings feature with their life insurance coverage.

Whole life policies allocate a certain amount of the premium for the policy’s cash value. It builds over time and accumulates interest income.

You can borrow against the cash value while the policy is in force, or cancel the policy and take the cash.

But if you keep the policy throughout your life, your beneficiaries will be paid the stated death benefit of the policy. Plus, the accumulated cash value.

Term Life Insurance

Term life insurance is sometimes referred to as “pure life insurance”. That’s because it represents life insurance coverage only.

There is no cash accumulation feature with term life. Policies generally run for a term of five years to as long as 30 years. And many are renewable at the end of the stated term.

The main advantage of term life insurance is cost. The premium on a term life insurance policy will typically be about 10% of the premium on an equivalent amount of whole life insurance coverage.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance, or final expense life insurance, is designed for applicants who don’t qualify for traditional life insurance.

This is usually due to health considerations. But a person who can’t qualify for traditional whole life or term life may be able to get a guaranteed life policy.

The death benefit on a guaranteed issue policy is low, generally in the $25,000 to the $50,000 range as an absolute maximum.

Premiums are high on a per-thousand basis, but it is a way to get coverage if you can’t qualify for traditional policies.

In addition, guaranteed issue is a whole life policy. That means it will both provide permanent coverage, as well as cash value accumulation.

Life Insurance Riders Offered

Health IQ does not indicate which life insurance policy riders are offered by the companies participating on the platform.

But every life insurance company offers its own menu of policy riders. So which ones will be available will depend on the company you ultimately apply with.

For that reason, you may want to choose a company that offers specific riders you consider to be critical to your policy selection.

That may mean you won’t necessarily choose a company that offers the lowest base premium rate.

For that reason, you may want to explore policy offerings by three or four companies with the lowest premiums. And then choose the one that has the rider options you want for your policy.

Eligibility and Application Process

To qualify for a discount based on your health IQ, you’ll follow a multistep process on the website. The steps are as follows:

Evaluate Your Health. Here you’ll answer questions about your current health, and submit to a free medical exam.

Test Health Literacy. You’ll take a Health IQ Quiz, as well as the Healthylifestyle IQ Quiz.

Verify Lifestyle. Here you’ll indicate you’re capable of one of the following: running an eight-minute mile or an age-based equivalent, cycling more than 50 miles, or competing in a swim meet.

It’s a bit more complicated than the list above, but that’s the overview.

Completing the Health IQ Evaluation, Literacy Test, and Lifestyle Verification

To go through each of the three steps, you’ll need to complete a series of questions on the website.

You’ll be asked to provide the following information:

Your age

Gender

Height and weight

Your individual annual income

Home address

First and last name

Email address

Phone number

Indicate where you have heard of Health IQ

With all that information entered, you’ll be asked a series of optional questions.

The first will be “Will you take a 10-minute quiz in the next 30 days to save on life insurance?”

That’s followed by “Would you be willing to provide proof of your exercise to get an even greater savings?”

Next will be “Would you like to see if you qualify for volume discounts?” This is a question that asks about the coverage amount you want.

You can select $500,000 or less, $500,000 to $1.5 million – resulting in a savings of up to 26% – and $1.5 million to $3 million, with the potential to save up to 30%.

Qualifying for Discounted Rates

Once you complete those questions, you’ll be eligible for quotes. But since you haven’t verified any of the information claimed in the questionnaire, the quotes will only be for basic (non-discounted) rates.

To qualify for the advertised savings of up to 41%, you’ll be called by an agent who will help you qualify for special rate quotes.

After that, you’ll need to prove your health literacy to qualify for the savings. That will require taking a quiz.

You must complete each question on the quiz in no more than more than 60 seconds.

You’ll be asked a total of 30 questions. They deal with nutrition, dietary methods, health awareness, and the connection between certain foods and behaviors and various health conditions.

I took the test and scored 198 points out of 200. And that included getting four questions wrong. That qualified me for Elite status, which moves me toward eligibility for discounted coverage.

But there are dozens of other quizzes you can take, each offering several hundred points. You may want to do that to earn additional points to qualify for discounts on various products offered on the platform.

You’ll want to go into the “Rewards” tab, and there, you can redeem points for various health items.

Some include vitamins and supplements, exercise equipment, a juicer, eye glasses, orthotics, a smartwatch, and other items.

Getting Your Life Insurance Quote

To get life insurance quotes, you’ll need to go back to the main page, and then check “life insurance” under the “product” menu area.

This is where you’ll need to call an agent and verify your healthy lifestyle. In other words, the only way to get a quote is to reach out to a Health IQ agent.

The platform does not supply rate quotes directly.

The rest is virtually like any other type of life insurance qualification. You’ll need to supply information about your family’s health history and agree to a medical exam.

The exam will determine your cholesterol level, resting heart rate, and blood pressure.

Health IQ will look for a special rate, if applicable, among the 30 participating life insurance companies.

Some of the companies participating on the platform include Prudential, Pacific Life, Principal, Lincoln Financial Group, Ameritus, AIG, John Hancock, and Mutual of Omaha.

Pros and Cons

Pros:

Provides an opportunity for very healthy individuals to get the lowest possible premiums on their life insurance coverage.

The service is completely free to use.

Offers participation from more than 30 life insurance companies, representing some of the biggest names in the industry. You’ll not only get the discount benefit from a high health IQ, but also from the side-by-side comparison of premiums from competing companies.

You can also obtain auto, disability, and Medicare policies through Health IQ.

Lots of information and qualifications available on the platform. So it may be possible to improve your health IQ by raising your awareness of various health issues and your health-related activities.

Points accumulated can be redeemed for dozens of health-related products and services. There are plenty of quizzes to rack up additional points for a very long time.

Cons:

Health IQ is designed only for the healthiest applicants. In fact, its primarily for those in excellent health, regularly participating in extensive exercise programs. Otherwise, Health IQ is just like any other online insurance marketplace. Because it is unlikely that you’ll find any policy options any less expensive here than the others.

The application process is extensive and confusing. You’ll need to complete multiple forms and be prepared to verify specific information. They only give quotes after you contact a licensed insurance agent.

The site does contain a significant number of ads, which some may view as an intrusion.

Health IQ isn’t a direct insurance provider, so you’ll ultimately be working with an actual life insurance company.

FAQs

1. Who owns Health IQ?

The company founder and chief executive officer is Munjal Shah. The company is a corporation, incorporated in Delaware in 2015. It employs 47 people.

A search on the website Crunchbase indicates the company is funded with $136 .5 million from 13 investors.

This would indicate it’s a privately held corporation with a very small number of shareholders.

2. How does Health IQ work?

As described earlier, Health IQ works by providing information and supporting evidence confirming applicants are in above average health.

The purpose of the service is to provide a rating system that will enable the healthiest applicants to enjoy substantial insurance premium discounts.

If this describes you, you’ll go on the website and complete the steps as outlined above.

If you qualify, you’ll work with a licensed insurance agent at Health IQ to get insurance quotes from more than 30 major insurance companies.

Once you receive the quotes, you’ll be able to select a company that provides the best coverage at the lowest-cost.

One of the advantages of working with Health IQ is that it is a licensed insurance agency. That means you can call and get assistance from a licensed insurance agent.

You can contact Health IQ by phone at (888)611-0712, Monday through Friday, 8:00 AM to 8:00 PM, Eastern time. Alternatively, you can also take advantage of email at ceo@healthiq.com.

Is Health IQ Best For You?

So the main disadvantage of Health IQ is that it’s best for those in excellent health and proactive in managing their health.

Because only those applicants will qualify for the discounts the service offers.

Say you’re in less than excellent health, or you’re in excellent health and not proactive about it. Then the rate you’ll qualify for may be no better than what you will get on other online health insurance marketplaces.

Or even applying directly with individual life insurance companies.