Health insurance policyholders bear the brunt of payment arrears by authority – The Kathmandu Post

United Mission Hospital Tansen, a major health institution in Palpa district, issued a public notice on April 1 stating that it would charge patients an additional amount that exceeds the coverage of the health insurance board from April 4.

The hospital claims that the decision was taken to keep the expense of the health institution in check in order to provide quality health services to all service seekers.

The hospital administration further warned through the notice that it will close all health insurance facilities from April 19 if the unpaid due amount is not cleared by the insurance board within two weeks and health insurance coverage is adjusted on the basis of total health expenses.

“The hospital is yet to receive a huge sum of money for the health expenses of the insured people despite our repeated requests. Although health service expenses at our hospital do not run very high, the gap between our health expenses and the amount provided by the health insurance board is only widening,” reads the notice issued by Dr Rachel Karakh, the director at United Mission Hospital.

She claimed the hospital was under financial stress as the health insurance board failed to release the health expenses of the insured people on time.

“The hospital has problems releasing monthly salaries, purchasing medicines and managing administrative expenses as the government delayed providing the amount under the health insurance expenses,” said Karakh.

According to the hospital administration, the health insurance board has to pay Rs 120.7 million to the hospital for providing health services under the health insurance policy. The United Mission Hospital claimed that the hospital had to take the harsh step as the authorities concerned paid no heed to the problems it faced despite repeated requests.

“The government and the health insurance board have ignored our problems time and again. We have been compelled to take the unpleasant decision that stands to affect not just the hospital but also the service seekers,” said Jiban Bhattarai, the manager at United Mission Hospital.

Besides United Mission Hospital, several health institutions in Palpa providing services under the health insurance package have also complained of not receiving the due amount from the health insurance board. According to Palpa Hospital, Lumbini Medical College and Palpa Lions Lacoul Eye Hospital, the insurance board has yet to clear Rs 384.3 million since July last year.

Owing to the delay in receiving health insurance expenses, Lumbini Medical College has cut off the number of patients receiving health services under the insurance policy by half in the past one and a half months.

According to Krishna Prasad Parajuli, the information officer at the medical college, Lumbini Medical College used to provide health services to 500 patients on a daily basis under the health insurance policy.

“The number has decreased to 250 now as the health insurance board did not provide the amount on time,” said Parajuli, adding that the medical college has not received Rs 209 million in arrears.

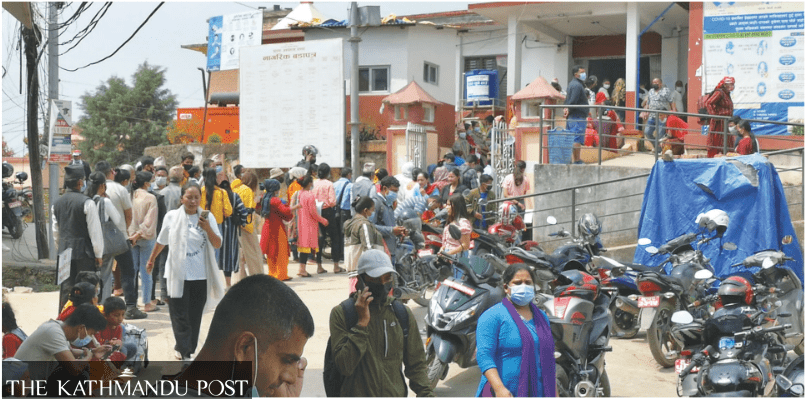

The hospitals’ move to decline patients with insurance coverage or decrease the number of such patients by half has led to inconveniences for service seekers.

Service seekers complain of having to wait for up to three days to get their turn to avail of health services under the insurance policy due to the medical institutions’ decision.

Sita Karki of Tansen Municipality, who went to Lumbini Medical College for medical concerns, says she had to wait in line from midnight to get a chance to see a doctor in the morning.

“If we don’t join the queue, we will not get treatment under our insurance policy,” said Karki.

However, it’s not only the service seekers who are facing hardships due to non-payment from the insurance board; the operation of the hospitals has also become a challenge, says Parajuli, the information officer at Lumbini Medical College.

“The medical college has been struggling to provide regular salaries to its staff, purchase medicines, repair medical tools and manage administrative expenses as it has not received health expenses from the board. The medical college purchases medicines and provides them to policy holders but we haven’t been able to do so since the health insurance board has not released the arrears,” said Parajuli.

United Mission Hospital, Palpa Hospital, Lumbini Medical College, Rampur Hospital, Tahun Primary Health Centre, Khasauli Primary Health Centre, Palpa Lions Lacoul Eye Hospital and Kaligandaki Eye Treatment Centre provide health services under the health insurance package.

Damodar Basaula, the executive director of the health insurance board, admits delays in issuing the budget under the health insurance policy but vows to release the amount by fulfilling due process. According to him, the board provided Rs 250 million to United Mission Hospital in the current fiscal year.

“The payment is released only after thoroughly checking the medical bills provided by the hospitals. Some hospitals did not submit all the necessary documents and are now blaming the board for the payment delay,” said Basaula. “The health institutions do not have the authority to not implement the health insurance programme launched by the government.”

As many as 215,000 people in Palpa are covered by health insurance. Some local units in the district have insured the Dalit and impoverished families as well.

The federal government launched the health insurance plan in 2016-17. Under this plan, a family of up to five members must pay a premium of Rs 3,500 annually to avail of health services up to Rs 100,000. A family comprising more than five members must pay Rs 700 for each additional member.